QUOTE(vernontan @ Feb 28 2024, 11:54 AM)

Yup, full refund, save for the -0.01 USD "fee" Interactive Brokers (IBKR), IBKR users, welcome!

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Feb 28 2024, 01:24 PM Feb 28 2024, 01:24 PM

Return to original view | Post

#1161

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(vernontan @ Feb 28 2024, 11:54 AM) Yup, full refund, save for the -0.01 USD "fee" vernontan liked this post

|

|

|

|

|

|

Feb 28 2024, 06:29 PM Feb 28 2024, 06:29 PM

Return to original view | Post

#1162

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Having fun with WCRS function on Bloomberg to compute carry trade returns using different currency pair... Look at MYR...  MasBoleh! liked this post

|

|

|

Feb 28 2024, 06:30 PM Feb 28 2024, 06:30 PM

Return to original view | Post

#1163

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

This is using SGD as base currency.

|

|

|

Mar 3 2024, 10:31 PM Mar 3 2024, 10:31 PM

Return to original view | Post

#1164

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(diffyhelman2 @ Mar 3 2024, 09:48 PM) Hi would like to ask some clarification. Hello. I admit that's an old post... November 2022... not all info are correct... To answer your questions:1.These products are as liquid as cash balance in ibkr in terms of trade turn around? Meaning if i sell today i can use the money in my account to buy stocks soon after? Or do i have to wait for a settlement period? 2. Does the dividend accrues daily by an increase in the NaV and is paid out monthly/ quarterly when it goes ex dividend right? 3. And how did you get only 1.3% annualized? The current t bill should be around 5% and even with a 30% wht you should be getting 3.5% pa? And the dividen eventually gets refunded right? Reason is I have about a 100k and as you know the first 10k usd doesn’t earn anything while the balance currently earns 4.83%. If BiL is almost as good as cash balance while able to warm 4.8% I’ll put all that money in it while I look for stocks to buy. 1. For margin account yes, you can sell the holdings and buy stocks thereafter. I think IBKR won't charge you interests. I don't use margin account, you may check with other sifus on that dwRK Medufsaid and Ramjade. For cash account, it used to be T+2 but not sure how things will be after the T+1 settlement cycle comes into place after May 27 this year but definitely for cash account there will be delay of 1-2 days before the cash is available for you to use. 2. Yes, the NAV increases daily and is paid out monthly (start of month). BIL for example has a dividend distribution schedule as stated here: https://www.ssga.com/library-content/produc...on_Schedule.pdf 3. Yea, that's my mistake... I wasn't aware of the refund back then... over the months and years I learnt from others here... Taking into account the lost in time value of money due to the late refund my BIL ETF IRR is around 4.8x% p.a. This 4.8x% is for ALL units of BIL ETF hold, unlike IBKR's own interest scheme which excludes the first 10k USD. By the way, if your portfolio size is as big as 100k USD you should seriously consider buying US T-bills directly... it costs 5 USD per trade but given your fund size, the fees are peanuts when expressed as a percentage of the overall investment, thus you get to keep the bulk of returns... diffyhelman2 liked this post

|

|

|

Mar 3 2024, 11:24 PM Mar 3 2024, 11:24 PM

Return to original view | Post

#1165

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Wedchar2912 @ Mar 3 2024, 11:14 PM) would like to ask/confirm... buying US T-bills directly, as a not US person, there are no tax withholding right? Yea no WHT. IBKR won't mess up with Uncle Sam directly... ETF is a different story... withhold then refund... that should also include US notes and bonds right? These are infos a few months back, still pretty new. https://www.reddit.com/r/singaporefi/commen...ortfolio_whats/ https://www.reddit.com/r/tax/comments/17cr9...l_interest_for/ Wedchar2912 liked this post

|

|

|

Mar 4 2024, 09:38 AM Mar 4 2024, 09:38 AM

Return to original view | Post

#1166

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(diffyhelman2 @ Mar 4 2024, 01:51 AM) Got it. Thanks for the tip on t bills. I figure if the fund expense cost is 0.14% then for a usd5 commission i just need to make a purchase that’s greater than 5/0.0014=~$3700 to make the usd5 fee breakeven vs buying BIL. Hehe that's opportunity cost, not really breakeven per se. But yea, that's one way to compare. Another way is to look at an IRR of 4.8x% (for BIL) vs the return of a 4-week T-bill yield of 5.4% minus the 5 USD fee (assume you pay once and hold the T-bill till maturity). I use a 4-week T-bill because the duration of BIL is around 1 month too (0.08 years = 0.96 months). But BIL makes sense for small amounts and has the added convenience of automatically rolling over vs having to manually roll over every three months? Also there is not clear info can Google, but if interest rates remain constant, the secondary market price of the T bill should increase slightly everyday, approaching the face value, just like the NAV of BiL right? As for the automatically roll over part, yea, BIL ETF manager will purchase T-bills, T-notes and T-bonds with maturities of 1-3 months in the market on behalf of you whereas if you DIY you get to choose the T-bills/notes/bonds you wish to hold. If you choose a short-term one, you will have to rollover the proceeds of the previous matured issue to the next one and incur 5 USD charge every time you do so. So there is a tradeoff here you need to decide. In general, T-bills/notes/bonds which will mature in less than 12 months are very liquid, especially the very short-end ones. There is a big secondary market and you should be fine with either the 1,3 or 6 month issue. Correct. T-bills are issued at a discount to the face value. Day by day the value of a T-bill appreciates until the date of maturity when the entire principal/face value is returned to you. The maturity profile looks something like that except that since T-bills are short-term, the line should start from somewhere around $950 instead of $100ish, i.e., the curve is not that steep.  It is important to note that BIL is a portfolio of Treasury bills/notes/bonds, not just a particular issue of T-bill. You can have a look at the detailed portfolio holdings of BIL here: https://www.ssga.com/us/en/intermediary/etf...-t-bill-etf-bil This post has been edited by TOS: Mar 4 2024, 09:38 AM diffyhelman2 and lamode liked this post

|

|

|

|

|

|

Mar 4 2024, 11:49 AM Mar 4 2024, 11:49 AM

Return to original view | Post

#1167

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(diffyhelman2 @ Mar 4 2024, 11:30 AM) Actually I made a mistake, the latest SCE yields for BIL n sgov is only like 0.2% lower than the latest 1 month (maturing April) T bills. That’s surely due to the expense ratio and maybe some premium/ spread. But considering the advantages in liquidity and no need to manage roll over, Bil seems very tempting especially for amounts less than 10k. Only downside is, they withhold 30% of paid dividends for close to a year… Yup that's why using IRR is a better way to compare since the 30% WHT refund is taken care of in the cash flow calculation when the IRR is computed. In the end we care about the returns we get and we compare them. Fees can fluctuate. diffyhelman2 liked this post

|

|

|

Mar 4 2024, 10:53 PM Mar 4 2024, 10:53 PM

Return to original view | Post

#1168

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Any members here staying near Damansara/PJ area can meetup this Wednesday around 2pm ++ near TTDI MRT station for a late lunch at a nearby mall with another LYN FBIH friend. PM me for details if you are interested. This post has been edited by TOS: Mar 4 2024, 10:53 PM MasBoleh! liked this post

|

|

|

Mar 5 2024, 04:48 PM Mar 5 2024, 04:48 PM

Return to original view | Post

#1169

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

(Very) Good read on PE stuffs.

https://www.ft.com/content/55837df7-876f-42...20-02ff74970098 (Paywall ahead...) This post has been edited by TOS: Mar 5 2024, 04:52 PM |

|

|

Mar 7 2024, 01:09 AM Mar 7 2024, 01:09 AM

Return to original view | Post

#1170

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

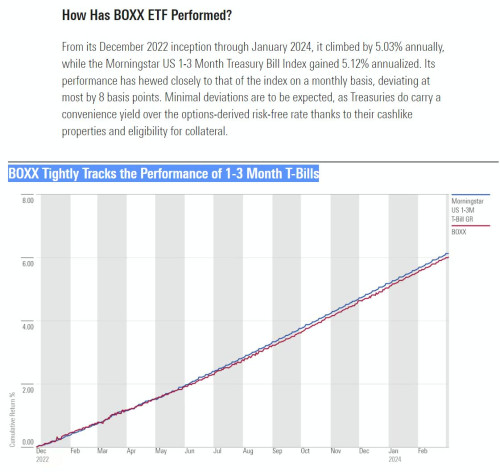

QUOTE(diffyhelman2 @ Mar 7 2024, 12:52 AM) I went with BIL. but take note, after researching more, if you do not want to have to wait for your WHT to refund (up to one year opportunity cost), the next best thing seems to be the BOXX non dividend distributing T bill ETF. Oh BOXX was discussed a few pages before. You can have a read at the posts quoted below:TER is ~0.19% up to jan 2025 https://www.morningstar.com/etfs/boxx-promi...-taxable-income  » Click to show Spoiler - click again to hide... « This post has been edited by TOS: Mar 7 2024, 09:03 AM |

|

|

Mar 7 2024, 10:56 PM Mar 7 2024, 10:56 PM

Return to original view | Post

#1171

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

For stockpickers' reference: ASM3 2023 full list of investment portfolio is now available here: https://forum.lowyat.net/index.php?showtopi...ost&p=109295172 Novo Nordisk to the moon... and NVDA runs wild. This post has been edited by TOS: Mar 7 2024, 11:17 PM MasBoleh! liked this post

|

|

|

Mar 10 2024, 10:05 PM Mar 10 2024, 10:05 PM

Return to original view | Post

#1172

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(diffyhelman2 @ Mar 10 2024, 01:25 PM) Hi i have a question. Does state street publish a list of their qualified interest income funds? For eg if i buy their etf composed of only US corporate bonds it should be a qualified interest income right? I think this is the closest I can find: https://www.ssga.com/library-content/produc...-us-en-cash.pdfBased on the original PATH act, only 4 of these are qualified for a refund: 1. original issue discount on an obligation payable within 183 days of issuance 2. interest on an obligation in registered form (other than interest on an obligation issued by an obligor in which the RIC is a 10 percent shareholder or interest that does not qualify as portfolio interest) 3. interest on deposits, and 4. interest-related dividends received from other RICs. Point 1 above is relevant for primary market-issues of 4-week, 12-week,... up to 6-month T-bills. If you hold commercial papers (original issues with less than 183 days/6 month of maturities) I suspect it may be eligible for a refund as well. Anything longer than 6-month generally will be a no. lamode liked this post

|

|

|

Mar 11 2024, 08:29 PM Mar 11 2024, 08:29 PM

Return to original view | Post

#1173

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Arrived at NTU hostel safely!

Nice meeting you guys in person. dwRK MasBoleh! Takudan Shin3Ge Quazacolt I have had a great week! Text me/PM me whenever you guys are in SG. If I happened to meet a match in Klang Valley will probably go there again... by bus... let's see. |

|

|

|

|

|

Mar 13 2024, 06:13 PM Mar 13 2024, 06:13 PM

Return to original view | Post

#1174

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 14 2024, 10:28 AM Mar 14 2024, 10:28 AM

Return to original view | Post

#1175

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(dwRK @ Mar 14 2024, 10:07 AM) thanks... do you know what is their carry trade formula and base rates they used? I guess majority of that number comes from MYR's depreciation against SGD. You short MYR (borrow MYR), then invest in a 1-year SG T-bill. 1 year later, you sell your T-bill, earn the interest (which is about the same as if you place the deposit in MYR), and you buy back MYR (settle the MYR loan plus interest which is roughly similar to SGD's loan rate), but by now MYR has depreciated about 5.3x% against SGD. sg and my have quite close rates, so 5.72% is much higher than the rate differential i was expecting... just wanna understand the numbers... https://www.investing.com/currencies/sgd-myr  Will check with Bloomberg later, maybe not today, got dance classes later this evening. This post has been edited by TOS: Mar 14 2024, 10:29 AM |

|

|

Mar 14 2024, 11:17 AM Mar 14 2024, 11:17 AM

Return to original view | Post

#1176

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.ft.com/content/fa3d201e-0e0b-46...23-c75c7312becd (use a paywall bypass plugin...)

Time to buy noodle stocks Gonna look at financial reports from Toyo Suisan and Nissin Foods. |

|

|

Mar 14 2024, 02:18 PM Mar 14 2024, 02:18 PM

Return to original view | Post

#1177

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(diffyhelman2 @ Mar 14 2024, 02:07 PM) This also applies to Swiss or japanese China etc ADR dividends right? Nope, for Swiss stocks, IBKR will withhold 35% of dividends, you need to submit a refund to Swiss Federal Tax Administration to request for the 20% refund (i.e. 15% tax treatment) by filling up Form 60. for eg I search swiss dividend tax on malaysia and get 15% witholding for individuals. so if I buy Nestle ADR I should get the 85% of the dividend amount: https://phl.hasil.gov.my/pdf/pdfam/Switzerland.pdf and China dividend withholding taxs are 10%, so if I buy BABA I should get 90% of the dividend. so far what I posted correct? https://www.estv.admin.ch/estv/en/home/inte...f/malaysia.html You may send the form to FTA once every 3 years (include past 3 years of withholding tax) and you need to visit the local LHDN/IRB office to ask for verification that you are a Malaysia tax resident. --------------------------- For Taiwanese stocks like TSMC, default withholding tax rate by IBKR is 21%, you may however claim back 8.5% (i.e. get the 12.5% tax treatment) by writing to the specific local tax office in Taiwan (e.g. Hsinchu 新竹 for TSMC or UMC) and claim back the tax from them.   certification_of_payment_samlie.pdf ( 37.52k )

Number of downloads: 4

certification_of_payment_samlie.pdf ( 37.52k )

Number of downloads: 4 Tax_Refund_Application_Form_for_Tax_Treaty_.pdf ( 147.17k )

Number of downloads: 4

Tax_Refund_Application_Form_for_Tax_Treaty_.pdf ( 147.17k )

Number of downloads: 4----------------------------- For China A- and H-shares, there will be 10% WHT automatically deducted when you receive the dividends. This post has been edited by TOS: Mar 14 2024, 02:28 PM diffyhelman2 liked this post

|

|

|

Mar 14 2024, 11:23 PM Mar 14 2024, 11:23 PM

Return to original view | Post

#1178

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(diffyhelman2 @ Mar 14 2024, 04:04 PM) Hi, I lurked around and found this old post as well. Try not to purchase Level 1 ADRs which are traded OTC like NSRGY. OTC markets are illiquid during times of crisis and may trade at a huge discount to the underlying parent share in SIX. I will advise you to buy Nestle shares on SIX/European ECNs directly on IBKR. You save the ADR dividend handling fees also. reason I am asking so many questions is because like you, I intend to purchase a swiss stock for the long term but using ADRs. in my case, Nestle ADR (NSRGY). seeing your old post, have you gone thru the wht claim process of your novartis ADR? did you have to pay any fees other than postage to send documents to Swiss tax office? and what other proof is required other than just LHDN certifying you were a malaysian tax resident? did you need to ask IBKR to furnish a special tax form? thanks for your response If you search "Swiss" in this thread you will find a lot of useful posts on reclaiming Swiss dividend taxes. https://forum.lowyat.net/index.php?act=Sear...posts&hl=&st=50 E.g. https://forum.lowyat.net/index.php?showtopi...#entry103087454 https://forum.lowyat.net/index.php?showtopi...#entry102601156 https://forum.lowyat.net/index.php?showtopi...#entry103923478 The above posts will answer your questions... ------------------------------- I sold my Novartis ADR last year after the Sandoz spin-off, and given my remaining positions in Nestle and Roche are relatively small, the reclaimed money is relatively small compared to the amount of effort I have to put in. Below is a calculation I did last year (or the year before, can't remember), to give you a sense of the magnitude of returns over the efforts put in to reclaim your Swiss tax... QUOTE Reclaimed amount: ROG = 9.3*(0.2) = 1.86 CHF NESN = 2.8*(0.2)*4 = 2.24 CHF Total = 4.1 CHF (approx 18.36 MYR) Cost: Petrol from BW house to LHDN office and back, assume 6.4L/100 km efficiency, 2.05 MYR per liter, journey to and back = 9.1 km*2 = 20 km -> fuel cost = 2.63 MYR Postage fee -> 7.20 MYR for <= 20g mail to Switzerland Total cost = 10.2 (after round up fuel cost to 3 MYR) We are not multi-billion dollar mutual funds... just poor retail investors... |

|

|

Mar 15 2024, 08:26 AM Mar 15 2024, 08:26 AM

Return to original view | Post

#1179

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(diffyhelman2 @ Mar 15 2024, 12:16 AM) wow! thanks. and very detailed writeups in the links which I will study. yes I am kinda put off investing in swiss stock especially as they only refund in CHF which is a headache (I have a DBS multi acct). only reason is due to I like nestle. investing in the malaysia nestle not the same... I suggest you to allocate the funds for NESN to an S&P 500 index fund. BRK is, in the end, still a company. No matter how diversified it is, it can't beat the S&P 500 forever. The fate of the company is tied too much to Warren Buffet alone, we are yet to see how Abel perform ... And BRK has difficulties beating the S&P 500 in the recent decade. There's not much room for alpha generation for a company the size of BRK. I guess I should just allocate the fund for nestle into more BRK B then... PS: I did not know about level 1 ADR problems....before your reply I had just purchased tencent adr which is OTC. I noticed that the commision fee was relatively higher (1.5 bp vs less than 0.8 bp for other US stocks).but I didnt notice any liquidity or large spreads when I was buying. ------------------------ In normal times OTC works but during crisis you will see a huge divergence in performance. In the worst case the market just shut down due to huge bid-ask spreads, i.e., no trades are done. These days I will advise investors to stick to the original listing venue instead of ADR except in cases like TSMC where Taiwanese markets are too restrictive to enter. Most other counters like the European ones (Nestle, Roche, Novartis, LVMH, Hermes etc.) have an active primary listing in their respective bourses back in Europe, an ADR just complicates matter and the ADR fees are like free money to the corporate banks... For the case of Tencent, you can consider the Hong Kong listed version. It's more liquid, although you do have to fork out a little more for a board lot purchase. lamode, diffyhelman2, and 1 other liked this post

|

|

|

Mar 21 2024, 05:24 PM Mar 21 2024, 05:24 PM

Return to original view | Post

#1180

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

SNB cut CHF rates in a surprising move... CHF depreciated 1% against USD as of now... QUOTE The Swiss National Bank announced a surprise cut to interest rates on Thursday, in a sign of policymakers’ confidence over falling inflation. The SNB reduced its headline rate by 25 basis points to 1.5 per cent, making it an outlier among western central banks. Others, such as the European Central Bank, are still fretful over inflation and have kept rates steady in recent decisions. The Swiss franc fell 1.2 per cent against the US dollar after the move. Swiss inflation fell to its lowest level in two and a half years in February, at 1.2 per cent. This is within the SNB’s mandated target range, helped by a weakening franc. https://www.investing.com/currencies/chf-usd MasBoleh! liked this post

|

| Change to: |  0.2576sec 0.2576sec

0.13 0.13

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 04:07 AM |