Wonder what do you guys do with those dividend you received?

Reinvest or buy new iPhone?

Thanks~

Dividend - What do you do with it?, Re-invest? Spend?

|

|

Aug 30 2019, 01:20 PM, updated 6y ago Aug 30 2019, 01:20 PM, updated 6y ago

Show posts by this member only | Post

#1

|

Junior Member

761 posts Joined: Dec 2006 |

Hi Guys, I am new to stock market. And I just received a quite big sum of dividend from AirAsia (although losing money in the capital investment). At the same times, I am also getting some smaller dividends from REITS.

Wonder what do you guys do with those dividend you received? Reinvest or buy new iPhone? Thanks~ |

|

|

|

|

|

Aug 30 2019, 01:29 PM Aug 30 2019, 01:29 PM

Show posts by this member only | Post

#2

|

Junior Member

387 posts Joined: Sep 2005 |

Reinvest is the way to compound benefit.

|

|

|

Aug 30 2019, 02:14 PM Aug 30 2019, 02:14 PM

Show posts by this member only | Post

#3

|

Junior Member

761 posts Joined: Dec 2006 |

QUOTE(ryanlit @ Aug 30 2019, 01:48 PM) Hahaha...If I don't need it I would not be asking right? I could have just donated it.Asking means I do care about the $$ and want to see how to grow more... Seems like our thinking logics are very diff This post has been edited by PHI_1.618: Aug 30 2019, 02:51 PM |

|

|

Aug 30 2019, 02:18 PM Aug 30 2019, 02:18 PM

Show posts by this member only | Post

#4

|

Junior Member

127 posts Joined: Feb 2011 |

reinvest.

|

|

|

Aug 30 2019, 02:48 PM Aug 30 2019, 02:48 PM

Show posts by this member only | IPv6 | Post

#5

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(PHI_1.618 @ Aug 30 2019, 02:14 PM) Hahaha...If I don't need it I would be asking right? I could have just donated it. Analyse your current situation. Asking means I do care about the $$ and want to see how to grow more... Seems like our thinking logics are very diff 1.You got your dividend but unsure what to do about it. Shouldn't you have a game plan before you bought Airasia? But since you are here now, best you set the money aside first. Not doing anything is always a good strategy. Really need to study more while you wait. Not just the stock but market strategy, game plan and most important your risk management. Wait and find a better way to reinvest your money. 2. You got your dividend but you are actually losing money. Yeah, the wrong perspective is to think Belum Jual Belum Rugi. Your current losses are real. You need to learn from this mistake.... ie never simply chase a stock for its dividends. |

|

|

Aug 30 2019, 03:00 PM Aug 30 2019, 03:00 PM

Show posts by this member only | Post

#6

|

Junior Member

761 posts Joined: Dec 2006 |

QUOTE(Boon3 @ Aug 30 2019, 02:48 PM) Analyse your current situation. Thanks for the great advice.1.You got your dividend but unsure what to do about it. Shouldn't you have a game plan before you bought Airasia? But since you are here now, best you set the money aside first. Not doing anything is always a good strategy. Really need to study more while you wait. Not just the stock but market strategy, game plan and most important your risk management. Wait and find a better way to reinvest your money. 2. You got your dividend but you are actually losing money. Yeah, the wrong perspective is to think Belum Jual Belum Rugi. Your current losses are real. You need to learn from this mistake.... ie never simply chase a stock for its dividends. I bought AA was for slightly longer term investment, cause I do see they are going through some transformation and kind of like what they put in their annual report. And I also notice their dividend yield is slightly better. I didn't know about the 90cents dividend before I bought it. So I am not actually chasing for its dividend. In fact, I was a bit caught in surprise with the dividend amount I received, hence I am not sure whether to reinvest into another share or keep it aside first. Maybe I will keep it aside and find another share to invest later... |

|

|

|

|

|

Aug 30 2019, 03:23 PM Aug 30 2019, 03:23 PM

Show posts by this member only | IPv6 | Post

#7

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(PHI_1.618 @ Aug 30 2019, 03:00 PM) Thanks for the great advice. Their annual report is so complex.... Here pusing there pusing. I bought AA was for slightly longer term investment, cause I do see they are going through some transformation and kind of like what they put in their annual report. And I also notice their dividend yield is slightly better. I didn't know about the 90cents dividend before I bought it. So I am not actually chasing for its dividend. In fact, I was a bit caught in surprise with the dividend amount I received, hence I am not sure whether to reinvest into another share or keep it aside first. Maybe I will keep it aside and find another share to invest later... The dividend is not derived from their daily operations, hence the market is pricing it much lower, they know the dividends cannot be sustained.... If this was supposed to be an investment, you need to keep yourself updated.... And the latest earnings report is so poor..... |

|

|

Aug 30 2019, 09:37 PM Aug 30 2019, 09:37 PM

Show posts by this member only | Post

#8

|

Senior Member

4,504 posts Joined: Mar 2014 |

I dump into the brokerage account for reinvestment. It may or may not go back to the same stock tho..

|

|

|

Aug 31 2019, 12:32 AM Aug 31 2019, 12:32 AM

Show posts by this member only | Post

#9

|

All Stars

24,434 posts Joined: Feb 2011 |

QUOTE(PHI_1.618 @ Aug 30 2019, 01:20 PM) Hi Guys, I am new to stock market. And I just received a quite big sum of dividend from AirAsia (although losing money in the capital investment). At the same times, I am also getting some smaller dividends from REITS. Your choice. Keep it, reinvest (not necessarily use it to buy same stock), spend it.Wonder what do you guys do with those dividend you received? Reinvest or buy new iPhone? Thanks~ |

|

|

Aug 31 2019, 09:17 AM Aug 31 2019, 09:17 AM

|

All Stars

48,589 posts Joined: Sep 2014 From: REality |

Well u can spend some & balance reinvest...

The percentage depending on u... Once awhile needed to enjoy the $$ too... But not all of it.. |

|

|

Aug 31 2019, 11:17 AM Aug 31 2019, 11:17 AM

|

Senior Member

1,917 posts Joined: Sep 2012 |

if spend them, how to compound??

|

|

|

Aug 31 2019, 07:30 PM Aug 31 2019, 07:30 PM

|

Senior Member

2,406 posts Joined: Jul 2010 From: bandar Sunway |

QUOTE(PHI_1.618 @ Aug 30 2019, 01:20 PM) Hi Guys, I am new to stock market. And I just received a quite big sum of dividend from AirAsia (although losing money in the capital investment). At the same times, I am also getting some smaller dividends from REITS. Keep in bank earn interest while waiting for new dividend stock opportunities. Same time enjoy some nice Makan with the money lolWonder what do you guys do with those dividend you received? Reinvest or buy new iPhone? Thanks~ |

|

|

Sep 1 2019, 01:39 PM Sep 1 2019, 01:39 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

spend about 10% to 20%, reinvest the rest.

if you don't spend and just invest, suddenly the stocks go down, then you'll feel like you've earned nothing!! |

|

|

|

|

|

Sep 1 2019, 02:37 PM Sep 1 2019, 02:37 PM

|

Junior Member

761 posts Joined: Dec 2006 |

seeing all the advices, I think the good option is to spend like 10%-20% and keep the rest for future reinvestment.

|

|

|

Sep 1 2019, 04:27 PM Sep 1 2019, 04:27 PM

Show posts by this member only | IPv6 | Post

#15

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(PHI_1.618 @ Sep 1 2019, 02:37 PM) seeing all the advices, I think the good option is to spend like 10%-20% and keep the rest for future reinvestment. Sorry but I strongly disagree. 1. You got some money back from an investment gone bad. Do you think it is wise to spend even 10% of it? 2. This was the money you had orinially allotted for your investment. Hence, it should remain allotted for your investments... Anyway just my 3 sen. Your money. |

|

|

Sep 1 2019, 04:39 PM Sep 1 2019, 04:39 PM

|

Junior Member

761 posts Joined: Dec 2006 |

Ok guys...I will have to spend the dividend...no choice. Reason being... my TV just gave up on me!!!! Like 2 mins before i post this comment!!

Damn.... |

|

|

Sep 1 2019, 09:50 PM Sep 1 2019, 09:50 PM

|

Junior Member

394 posts Joined: Jun 2012 From: Singapore |

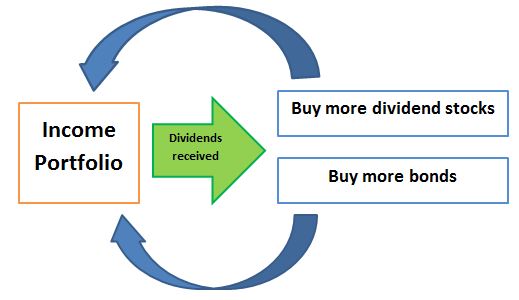

Do this over long term

|

|

|

Sep 1 2019, 10:42 PM Sep 1 2019, 10:42 PM

|

All Stars

48,589 posts Joined: Sep 2014 From: REality |

|

|

|

Sep 1 2019, 11:23 PM Sep 1 2019, 11:23 PM

|

Junior Member

761 posts Joined: Dec 2006 |

QUOTE(Dividend Warrior @ Sep 1 2019, 09:50 PM) Hahaha...good idea. Can try that if I get another big dividend...QUOTE(nexona88 @ Sep 1 2019, 10:42 PM) Lolz.. Ya man...what a pity. Damnnnn...I know the situation.. Because I faced before.. Have unexpected expenses upon receiving dividends $$... |

|

|

Sep 1 2019, 11:53 PM Sep 1 2019, 11:53 PM

|

Senior Member

4,504 posts Joined: Mar 2014 |

A long time ago, my sifu taught me that:

"Before you embark on stock market trading, you must first have at least 6 months emergency funds" * Sifus deep voice.. 😆 This post has been edited by Cubalagi: Sep 1 2019, 11:54 PM |

| Change to: |  0.0172sec 0.0172sec

0.18 0.18

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 25th December 2025 - 02:20 AM |