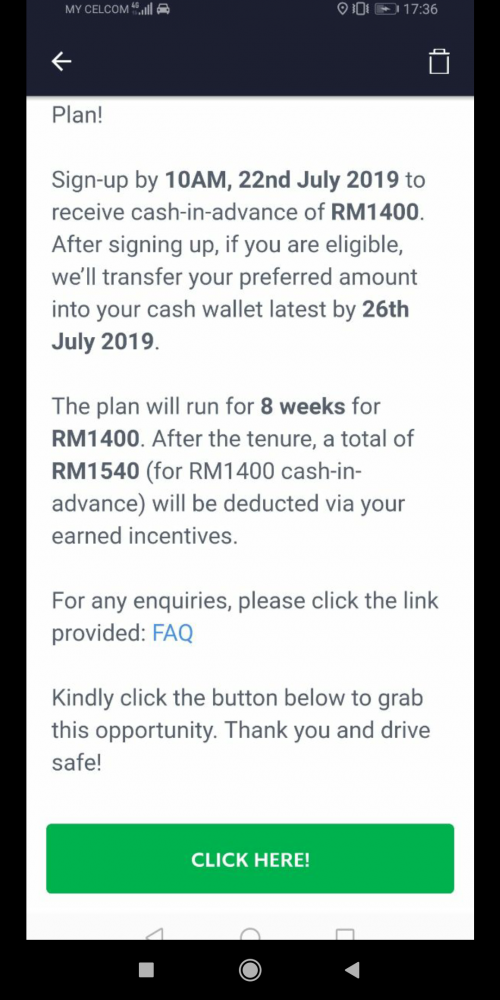

Let's take the below offer for example,

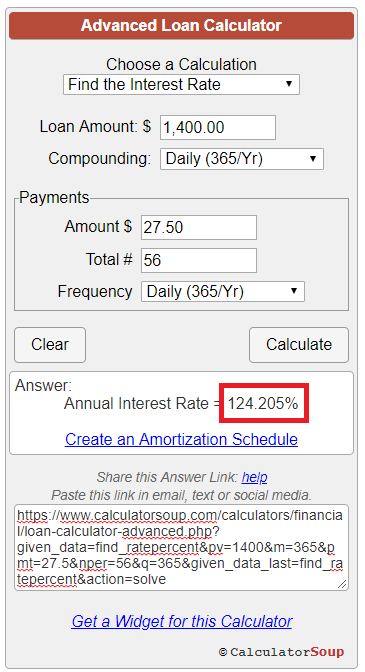

In this case, the daily repayment amount is RM27.50 for total 56 days. If I plug the number into loan amortization calculator then the actual effective interest rate is 124%!!!

Source: https://www.calculatorsoup.com/calculators/...nt&action=solve

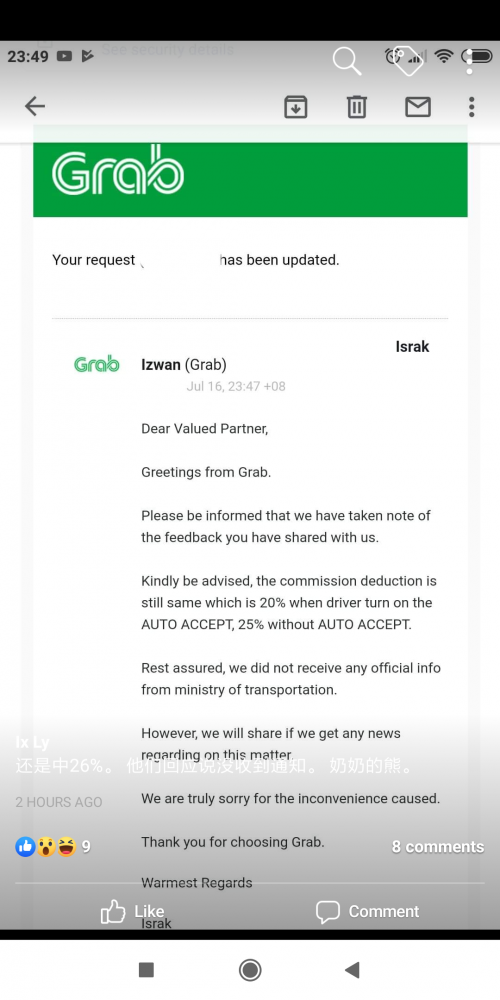

So wake up my fellow lembu, it is already pathetic to let them squeeze your driving income, please think wisely not to let them to squeeze every drop of blood out of u.

This post has been edited by S3phiroth: Jul 18 2019, 10:21 AM

Jul 18 2019, 10:19 AM, updated 7y ago

Jul 18 2019, 10:19 AM, updated 7y ago

Quote

Quote

0.0136sec

0.0136sec

1.35

1.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled