| No. | Company Name | Stock Code |

| 1 | Amway (Malaysia) Holdings Berhad | 6351 |

| 2 | Hai-O Enterprise Bhd (Now BesHom Holdings) | 7668 |

| 3 | Zhulian Corporation Berhad | 5131 |

AVON, HERBALIFE, NU SKIN

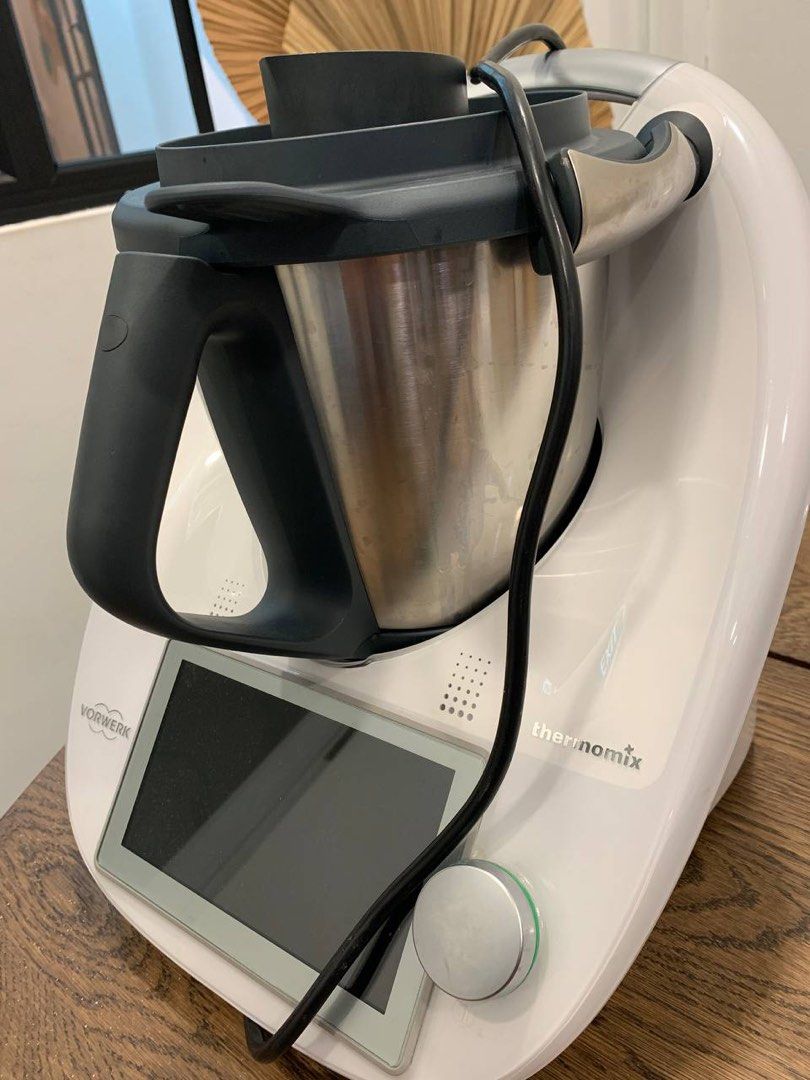

POLA ORBIS, USANA, SHAKLEE

2,3,7

16,18

Ranking in 20 list!!!!!

Avon Products Inc

4.04 USD +0.14 +3.59%

52 WEEK RANGE

1.30 - 4.08

Natura & Co Holding

28.55

Herbalife Nutrition Ltd

8 USD

Drop so much from 2021

52 WEEK RANGE

40.75

Nu Skin Enterprises Inc

21.84 USD

Natura Cosmeticos

57.61BRL

Shaklee not in 100 list,but it is listed company also

https://www.directsellingnews.com/dsn-annou...019-global-100/

Natura agrees to buy Avon, creating cosmetics powerhouse

Published 6:30 AM ET Thu, 23 May 2019

Brazil's Natura said it had reached an agreement to buy rival Avon Products via a share swap.

The deal would create the world's fourth-largest beauty company with a redoubled focus on direct sales.

Under the terms of the deal, Natura will hold 76% of the combined business with over $10 billion in annual revenue, according to a statement from the Brazilian cosmetics firm.

Brazil's Natura said on Wednesday it had reached an agreement to buy rival Avon Products via a share swap, creating the world's fourth-largest beauty company with a redoubled focus on direct sales.

Under the terms of the deal, Natura will hold 76% of the combined business with over $10 billion in annual revenue, according to a statement from the Brazilian cosmetics firm.

After Natura pushed into high-end retail shops with the acquisitions of Aesop in 2013 and The Body Shop in 2017, the takeover of its biggest rival in direct sales is a renewed bet on the company's core business of door-to-door distribution.

Brazil is Avon's biggest market, making up nearly a quarter of sales, but its business there has suffered in recent years due to a weak economy and stiff competition from Natura.

Now the 133-year-old, London-based company has agreed to a takeover offer of 0.3 Natura share for each Avon share, according to a securities filing. That values Avon's equity at around $2 billion, representing a 28% premium over its closing share price on May 21.

Shares in both companies ended over 9% higher on Wednesday as investors cheered the consolidation. Avon shares jumped 9.1% and Natura reversed early losses to end 9.4% up.

Social and economic trends in Brazil have protected the direct sales model for cosmetics, consisting of third-party "consultants" selling mainly to acquaintances, from the threat of online retail.

Natura has a commanding lead in Brazil's direct sales market, according to research group Euromonitor, which estimates a 31% market share for the company, followed by a nearly 16% share for Avon.

Natura estimated that the deal could yield between $150 million and $250 million of annual cost savings.

Many consultants already offer both Avon and Natura products, which Brasil Plural analyst Andres Estevez said could help to ease the concerns of antitrust officials.

The transaction, which is still subject to approval by Natura and Avon shareholders, as well as regulatory authorities in Brazil and other countries, is expected to be concluded by the beginning of 2020.

If the deal closes by that deadline, Natura said it would pay $530 million to investors holding Series C preferred shares in Avon, adding that it had guaranteed funding from Banco Bradesco, Citigroup, and Itau Unibanco to make the payment.

A source familiar with the negotiated terms told Reuters that investment firm Cerberus Capital Management is the Series C shareholder. In April, Cerberus sold Avon North America, which is private, to LG Household & Health Care for $125 million.

Reuters reported last week that Natura was close to striking a deal to buy Avon.

1 Amway $8.80B

Report ID 451271

2 Avon Products Inc. $5.57B

3 Herbalife $4.90B

4 Infinitus $4.50B

Lee kum kee!!!!!

Infinitus is a part of the LKK Health Products Group (LKKHPG), a member of the century-old Lee Kum Kee Group.

Founded in 1992, Infinitus embarks on a mission to advocate the premium Chinese health regimen and nurture healthier and happier lives.

5 Vorwerk $4.30B

6 Natura $3.67B

natura acquiring avon !!!!!!!!!!!!!!!!!

may 2019 news

7 Nu Skin $2.68B

8 Coway $2.5B

South Korea no.1 water purifier company ??????

9 Tupperware $2.0B

10 Young Living $1.9B

11 Oriflame Cosmetics $1.55B

12 Rodan + Fields $1.5B

13 Jeunesse 婕斯

$1.46B founded on 2009 only!!!

Industry: Consumer Products

Location: Lake Mary, Florida

Leadership : Randy Ray

Year Founded : 2009

14 Ambit Energy $1.3B

15 DXN Marketing Sdn Bhd $1.25B

16 Pola $1.24B

17 O Boticário $1.23B

18 USANA Health Sciences $1.19B

19 Belcorp $1.16B

20 Atomy $1.15B

21 Telecom Plus $1.09B

22 Yanbal International $994M

23 Market America $837M

24 PM International $834M

25 Stream $800M

26 Team National $734.5M

27 Amore Pacific $600M

28 Arbonne International $544M

29 Hinode $528M

30 Plexus $527M

31 OPTAVIA / Medifast, Inc. $501M

32 Miki $498M

33 Faberlic $463M

34 Scentsy $449M

35 Monat Global $435M

36 Younique $427M

37 For Days $385M

38 WorldVentures $377M

39 Cosway $368

40 Nature’s Sunshine $365M

41 Prüvit $325M

41 Beautycounter $325M

43 4Life Research $324.9M

44 LG Household & Healthcare $304.5M

45 Family Heritage Life $294M

46 Vivint $290M

47 Noevir $277M

48 Hy Cite Enterprises, LLC $275M

49 Pro-Partner $246M

50 Pure Romance $237M

51 Naturally Plus $236M

52 New Image Group $231M

53 proWIN International $230.2M

54 Morinda $230M

55 Menard $226.5M

55 CUTCO/Vector Marketing $226M

57 ARIIX $220M

58 SEACRET $211.5M

59 Southwestern Advantage $209M

60 LifeVantage $203M

61 Vida Divina $197M

62 KK Assuran $195M

63 Vestige Marketing $194M

64 NHT Global $192M

65 Hillary’s Blinds $185M

66 Giffarine Skyline Unity Co. $181M

67 BearCere’Ju $180M

68 Mannatech $173.5M

69 Youngevity $162M

70 Princess House $161M

71 Charle $159M

72 Diana $147M

73 Naris $137.5M

74 Maruko $130M

75 Marketing Personal $125M

76 Immunotec Research Ltd $120.5M

77 ASEA $120M

78 Color Street $119M

79 World Global Network $119M

80 Usborn Books & More $118M

81 C’BON Cosmetics $110M

82 Xyngular $109M

83 TruVision Health $106M

84 Zhulian $103M

ZHULIAN CORP BHD

5131

Last Price Today's Change

1.45

85 Nefful $101M

86 MyDailyChoice / HempWorx $100M

87 Perfectly Posh $100M

88 Energetix $94.5M

89 ZURVITA $94M

90 Arsoa Honsha $90.5M

91 Best World Int’l Ltd $88M

92 Hai-O (Sahajidah Hai-O Marketing Sdn Bhd) $87M

HAI-O ENTERPRISE BHD

7668

93 Koyo-sha $86M

94 Shinsei $79M

95 Captain Tortue $77M

96 Chandeal $72M

97 Grant E One’s $68M

98 Nikken $67.5M

99 Zinzino $67M

100 Pieroth Wein $60M

100 Medical Marijuana/Kannaway

This post has been edited by plouffle0789: Apr 16 2024, 08:51 AM

Jul 7 2019, 12:50 PM, updated 2y ago

Jul 7 2019, 12:50 PM, updated 2y ago

Quote

Quote

0.0207sec

0.0207sec

0.81

0.81

5 queries

5 queries

GZIP Disabled

GZIP Disabled