Outline ·

[ Standard ] ·

Linear+

Ubb CASH TRUST 3 years nett 6-8% pa anyone?, UBB Amanah Bhd

|

caaron

|

Oct 4 2021, 01:43 PM Oct 4 2021, 01:43 PM

|

|

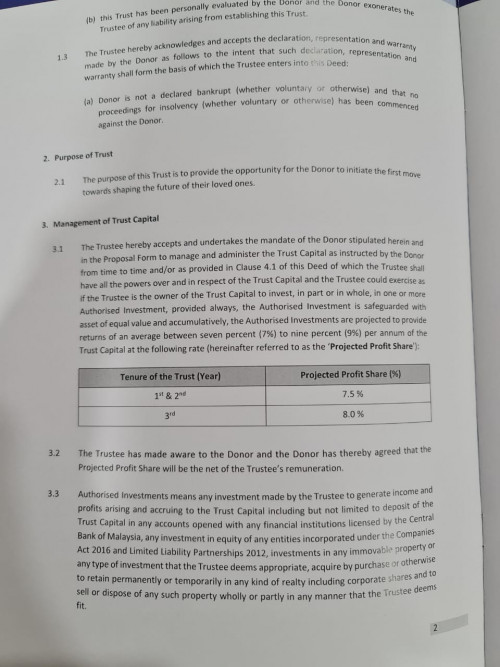

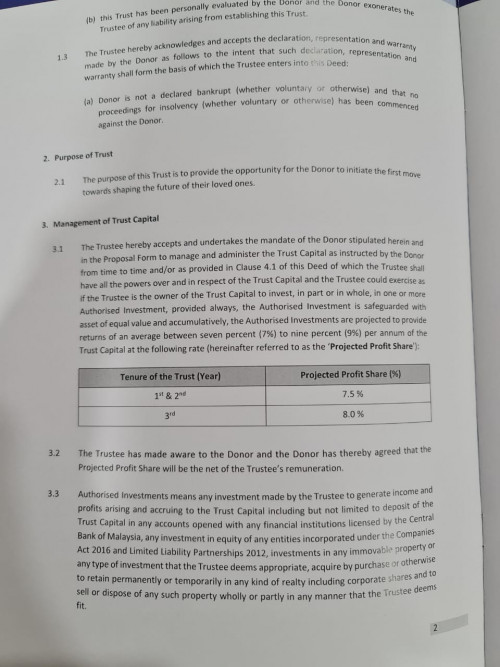

UBB Amanah's Management has decided to extend the Opportunity Trust until end of December. Again like some forumners had mentioned, many of us have already put in multiple rounds of cash trust and got our money back. The returns are nett of all fees. I myself have gotten in for a few rounds on cash trust, my clients have put in crisis trust and got their payouts recently and also put into the latest opportunity trust. I have decided to be an agent for this UBB product because so far UBB has not failed their clients. (so far) Anyhow, I think the saying goes is do not invest all your eggs in one basket. It is up to individual actually in terms of investing. But the purpose of setting up a trust is to bypass probate and the money can be distribute to beneficiary upon donor's death for emergency purposes (only applicable to cash trust) before the whole process of getting a grant of probate (normally 6 months or more). The opportunity trust brochure and the sample trust deed which mentioned projected profits for the first two years are 7.5% and 8% for the third year. If anyone is really interested to know more info can PM me.  Attached thumbnail(s) Attached thumbnail(s) Attached File(s)

Attached File(s) 5_6226753825219282083.pdf

5_6226753825219282083.pdf ( 750.32k )

Number of downloads: 148 |

|

|

|

|

|

caaron

|

Oct 6 2021, 01:38 PM Oct 6 2021, 01:38 PM

|

|

Yes. It's a grey area there as the trust you can opt for stamping by LHDN or without stamping. With stamping, they will have record of your tax no.

|

|

|

|

|

|

caaron

|

Nov 15 2021, 03:47 PM Nov 15 2021, 03:47 PM

|

|

QUOTE(fh110711 @ Nov 14 2021, 08:23 AM) To those already set up the cash/crisis/opportunity trust , mind to review the disbursement policy ? I think the objective of the trust is different between cash vs crisis/opportunity.....?? Please refer the PDF file attached. For Cash Trust, Preservation Trust, Opportunity Trust, the disbursement of returns will be done yearly. However upon death of donor, the disbursement for cash trust will be the only one disburse upon death of donor, while the rest of the trust disburse upon maturity of Trust. Attached File(s) UBB_Trust_Products_Comparison_PDF.pdf

UBB_Trust_Products_Comparison_PDF.pdf ( 92.21k )

Number of downloads: 442 |

|

|

|

|

|

caaron

|

Nov 16 2021, 04:06 PM Nov 16 2021, 04:06 PM

|

|

QUOTE(contestchris @ Nov 16 2021, 11:17 AM) How do the numbers me sense? Where are they generating the returns from????? Unlike Banks which are governed by BNM Regulation. Infact Banks are making enormous profits but unable to give those returns in FD to their clients as they follow BNM OPR rate. However UBB Amanah is a Trustee Company which isn't govern under the BNM regulation but instead governed under Trustee Act 1949. 1) Settlors/Donors set up their trusts with UBB for the benefits of beneficiaries 2) UBB performs short term loans that are approved under Trustee Act 1949 and charges interest of more than 20% per annum and must be safeguarded with assets of equal value / collateral before borrowing; as such, your money with Trustee is secured. |

|

|

|

|

|

caaron

|

Nov 16 2021, 05:21 PM Nov 16 2021, 05:21 PM

|

|

QUOTE(contestchris @ Nov 16 2021, 04:15 PM) Nothing you're saying makes sense. 1) Banks are not necessarily making enormous profits, and besides YOU can partake in the profits by buying their shares. 2) Loans with interest more than 20% p.a., how do you sleep at night "investing" your money to corporation that does this? Pls don't be so dumb. The writing is on the wall. If you check on PBBANK quarterly profit margin. It ranges 20+% to 30%. It does show that they are making good profits. |

|

|

|

|

5_6226753825219282083.pdf ( 750.32k )

Number of downloads: 148

5_6226753825219282083.pdf ( 750.32k )

Number of downloads: 148

Oct 4 2021, 01:43 PM

Oct 4 2021, 01:43 PM

Quote

Quote

0.1122sec

0.1122sec

0.25

0.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled