QUOTE(vincentcwc92 @ Aug 27 2019, 05:31 PM)

someone mentioned use the secure device that self generate that code....example....

https://www.pbebank.com/Personal-Banking/FA...SecureSign.aspx

This post has been edited by yklooi: Aug 27 2019, 05:37 PM

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

|

Aug 27 2019, 05:35 PM Aug 27 2019, 05:35 PM

Return to original view | Post

#1

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(vincentcwc92 @ Aug 27 2019, 05:31 PM) someone mentioned use the secure device that self generate that code....example.... https://www.pbebank.com/Personal-Banking/FA...SecureSign.aspx This post has been edited by yklooi: Aug 27 2019, 05:37 PM |

|

|

|

|

|

Aug 28 2019, 06:20 AM Aug 28 2019, 06:20 AM

Return to original view | Post

#2

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(nexona88 @ Aug 27 2019, 10:41 PM) that will be incentives enough for many investors to buy and hold and continue to buy.... what is incentive for them (PNB) to perform better? well, i guess as long as "Sold out" and the number of CAPTCHA collected daily by their system is still high....that is good enough for them to NOT take the extra Risks of investing for a better performance. and also for whatever extra they earned will also be placed in "invisible" accounts as reserves as usual those that wanted a higher returns expectation and complaining about PNB keeps lowering the dividen rates can go look for other form of investment vehicles....for i think PNB does not care as i am sure those Money Market Fund managers will be very willing to absorbs that into their MMF portfolios if those units from investors are made available to them. what else do investors like us can do if not happy about it?...... go to their AGM to complain? buy less? or sell all as a form of protest? |

|

|

Aug 31 2019, 12:09 PM Aug 31 2019, 12:09 PM

Return to original view | Post

#3

|

Senior Member

8,188 posts Joined: Apr 2013 |

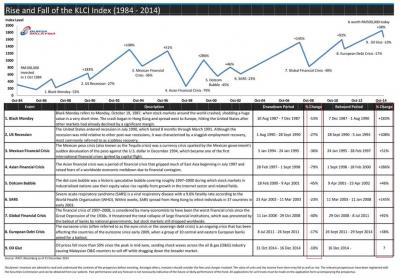

some had been telling that they are HAPPY with just 5% due to the performance of the stock market some had been telling that they are NOT Happy with just 5% due to the performance of the stock market did anyone did a tally of how related the stock market performance are to this asnb dividend rates? like see how the historical klse performed vs the dividend rate given? I just did a quick take on this KLCI performance thing..... this is not a complete representation of the results of this ASNB things for many are unknown and many other factors are not included too... hopefully this can be a better idea to start a estimation data to be a kind of supportive statement when saying "Happy/not happy/OK lah" with the given rates this site can get the data of this KLSE performance from Dec 93. (just select MAX, then move the cursor to the date required to get the start/end index value) https://finance.yahoo.com/quote/%5EKLSE?p=%5EKLSE historical ASW2 rates http://www.misterleaf.com/10346/amanah-sah...awasan-divided/ KLCI 5 & 10 Year Historical Returns https://mypf.my/2015/01/14/klci-5-10-year-h...orical-returns/ i think, if I have the money i will still put money in it as a form of diversification under the FI portion, under MYR category of my portfolio.....just like my EPF, FD and SSPN let it built and accumulate slowly but surely....but hopefully the MYR would not depreciates its buying power too much by the time i needed it. Attached thumbnail(s)

|

|

|

Aug 31 2019, 12:27 PM Aug 31 2019, 12:27 PM

Return to original view | Post

#4

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(beLIEve @ Aug 31 2019, 12:18 PM) ...... yes, I know....I think it has no much relation to how the market performance....they are just for them to manage expectation or despairyklooi I think it's very difficult to match with KLSE index. 1. part of their income is from dividend from KL counters. 2. part of their income from trading on KLSE. Win Lose or Draw should vary each year. 3. part of their income from money market - so back in the 80s-90s, interest rate also high. Unless it crashed and stayed stagnant for a number of years... for now, I will still go with the below....(+/- of course) QUOTE(moosset @ Aug 31 2019, 10:59 AM) |

|

|

Sep 6 2019, 09:36 AM Sep 6 2019, 09:36 AM

Return to original view | Post

#5

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(ytan053 @ Sep 6 2019, 08:56 AM) Just my gut feel and I could be wrong. why "think of other solution. Or get ready now" when the intention of the investors are as per below?.......... So one can still practically rely on asm fp for now until there is major changes in the future then only think of other solution. Or get ready now. QUOTE(ytan053 @ Sep 6 2019, 08:45 AM) Hence I repeatedly said , determine the objective one wants to place in amamah saham. If it's for emergency fund, temporary parking purpose, it's still an ok instrument to use, even though alternative outside can give about 5 to 7% p.a. In the near future with quite low risk but still slightly higher risk than asm. just my gut feel and I could be wrong too....If one were to invest for long horizon and think that asm is still a good instrument because of laxk of time and knowledge to look for better alternative, no wrong also. But I definitely won't go for stock as I do not know bout stock, no knowledge , no experience and no time and interest to monitor. Like u mentioned, definitely not worth taking such high risk for additional one to 2% but if the person is well versed with stock then it's their call. Stock is not bout dividend only, I look at it from the potential up and down. I.e. if give 7% dividend but drop 50% in share price, what's the point right. So asm is still good for those who doesn't want to spend time learning more bout investment, want to have peace of mind and good sleep without worrying about the market, and don't mind the hassle of catcha. It depends on how long PNB continues to play this game. Dividend of ASNB FP funds would never falls below the interest rate charged for its loans...... This post has been edited by yklooi: Sep 6 2019, 09:41 AM |

|

|

Sep 21 2019, 10:40 PM Sep 21 2019, 10:40 PM

Return to original view | Post

#6

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(vanitas @ Sep 21 2019, 06:40 PM) The term involved is AUTHORIZED seller. Agent banks are, but you are not. if sell off the available units at 5% profits....will it be sort of killed the gold egg laying goose?Think about was it legal to setup a business (assume you got 100m in FP) to sell FP fund at 5% commission? It is the same at individual scale and lower commission. 1 time profits of 5% but lose the opportunity to have risk free and yearly get 6% ROI, while searching high and low for no risk and 6% pa ROI investment vehicle QUOTE(alexanderclz @ Sep 21 2019, 09:58 PM) haha when they allow the option of transfer between unrelated ppl, it is to be expected. don't think ppl will offer their units to another person without any sort of payment for the units even without additional commission. |

|

|

|

|

|

Sep 21 2019, 11:01 PM Sep 21 2019, 11:01 PM

Return to original view | Post

#7

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Sep 21 2019, 11:05 PM Sep 21 2019, 11:05 PM

Return to original view | Post

#8

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(vanitas @ Sep 21 2019, 11:02 PM) employing people for that 5% profits?getting 1K is already not easy, the UNITS you sold are actually transferred, thus not on sale in the market This post has been edited by yklooi: Sep 21 2019, 11:05 PM |

|

|

Sep 21 2019, 11:10 PM Sep 21 2019, 11:10 PM

Return to original view | Post

#9

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(vanitas @ Sep 21 2019, 11:09 PM) Then setup a platform for buyer and seller to do the tranfer transaction, take 0.5% commission as platform fee + seller commission for himself set by seller. selling and reselling is not authorised....thus not legalThe point is it wasn't legal. transferring is not legal? |

|

|

Sep 21 2019, 11:28 PM Sep 21 2019, 11:28 PM

Return to original view | Post

#10

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(vanitas @ Sep 21 2019, 11:09 PM) Then setup a platform for buyer and seller to do the tranfer transaction, take 0.5% commission as platform fee + seller commission for himself set by seller. so the point is legal then The point is it wasn't legal. QUOTE(vanitas @ Sep 21 2019, 11:14 PM) |

|

|

Sep 21 2019, 11:30 PM Sep 21 2019, 11:30 PM

Return to original view | Post

#11

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Sep 22 2019, 12:33 AM Sep 22 2019, 12:33 AM

Return to original view | Post

#12

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(neverfap @ Sep 22 2019, 12:27 AM) Not sure how the transfer work though Transfer between ASNB funds involves two different Unit Holders of the same fund. Issit a) unit owned by A directly transfer to B account, or b) system will sell unit owned by A and then trigger account B to buy unit. Coz there's a prompt for us to input our bank account when transferring the unit and there's a message stating that the cash value of the unit that unable to transfer will be transferred to the bank account we insert? (Just saw briefly when testing out the transfer function) For instance, Unit holder A would like to transfer 100 units of ASB to ASB Account Unit holder B. For fund(s) that has/have been registered under Hibah Amanah, the provision in the Hibah Amanah’s contract applies ie the amount blocked as Hibah Amanah cannot be switched/transferred. What are the procedures to apply for transfer and switching between ASNB funds? Unit Holders are advised to fill in the following form: Borang Pemindahan dan Penukaran Unit (ASNB TS) Can the transfer and switching facility between ASNB funds be performed online through myASNB portal? Not available yet. http://www.asnb.com.my/asnbv2_5faq_EN.php This post has been edited by yklooi: Sep 22 2019, 12:34 AM |

|

|

Oct 2 2019, 07:14 PM Oct 2 2019, 07:14 PM

Return to original view | Post

#13

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(nexona88 @ Oct 2 2019, 08:39 AM) But the accumulated $$ over the years are drying up fast.... Thus u see the dividend rate keep dropping drastically... If still have alot, sure they would pay 6% 😁 KLCI really needed some big rebound.. with the funds holdings (stocks portfolios) preforming well above average... And give more dividend too.. then only we can see some positive flow... QUOTE(MUM @ Oct 2 2019, 08:50 AM) QUOTE(nexona88 @ Oct 2 2019, 09:51 AM) I read this discussion with curiosity.....will there be a trigger point where "many" would sell? will "less than FD + 1% " be the trigger? will/has ASNB use the actuarial experts to do the maths and use the phycological and behavioral science to determine the outcome, then set a base line? many had already mentioned that it will never be less than the ASB loan rate.....but will loan rate + 1% keeps to herds in line? |

|

|

|

|

|

Oct 2 2019, 09:09 PM Oct 2 2019, 09:09 PM

Return to original view | Post

#14

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Oct 4 2019, 07:26 PM Oct 4 2019, 07:26 PM

Return to original view | Post

#15

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Orchid beauty @ Oct 4 2019, 07:11 PM) you will gain 2%pa in ASM than in FD 2% of 500 is RM10 extra gain in a year RM10 in 365 days is 0.027 sen/day 0.027 sen/24 hrs = 0.0011/hr if 3hrs work to do captcha ......0.0011/hr x 3 = RM 0.0033 gain for a 3 hrs work in a year per year |

|

|

Oct 8 2019, 09:28 AM Oct 8 2019, 09:28 AM

Return to original view | Post

#16

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(nexona88 @ Oct 8 2019, 09:23 AM) I think it depends on the amount of money to be "switched"if only RM10000 then if premium is 1%, then only RM100 extra untung... for the trouble, cost of transportation and the inconveniences and the Risk that may be involved.... |

|

|

Oct 10 2019, 10:34 AM Oct 10 2019, 10:34 AM

Return to original view | Post

#17

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(mushigen @ Oct 10 2019, 10:31 AM) As more people realise it's so difficult to buy, they will not try that hard. Hence, over time, it will be easier to buy... I hope. then,as more people realise it's more easier to buy then before, they will try to buy more frequently. hence overtime, it will not be easy to buy again.....my fear. |

|

|

Oct 11 2019, 10:12 AM Oct 11 2019, 10:12 AM

Return to original view | Post

#18

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(mushigen @ Oct 10 2019, 10:51 AM) One should be more worried if he/she missed the opportunities when the time comes, if he/she did not try the captcha routines like others NOW for by the time he/she realised that there are many units available it may have been gone already |

|

|

Oct 11 2019, 10:26 AM Oct 11 2019, 10:26 AM

Return to original view | Post

#19

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Oct 12 2019, 09:15 AM Oct 12 2019, 09:15 AM

Return to original view | Post

#20

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(cscheat @ Oct 12 2019, 07:23 AM) update: every 5min, we only allowed to try 10 times (per fund) No need type Captcha already... just click same to mobile apps ................ now they just "killed" his business. |

|

Topic ClosedOptions

|

| Change to: |  0.1406sec 0.1406sec

0.62 0.62

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 04:00 AM |