QUOTE(MUM @ Sep 30 2019, 07:41 PM)

in times of talking about 'disappointment"......

I wonder how these members adjusts....

".......LTAT has been paying out double-digit dividends to its members since 1991.

The highest amount declared was 18.25% in 1996.

Even in the midst of the stock market meltdown in 1998, LTAT managed a dividend of 13.5%.

Even in the last four of the five years since 2014 when Bursa Malaysia finished in negative territory, LTAT gave double-digit dividends between 12% and 15%.

sourced from....

Read more at https://www.thestar.com.my/business/busines...458E1AOvobVO.99

now it is only 2%......

now 2% ok lah..... can always withdraw now...

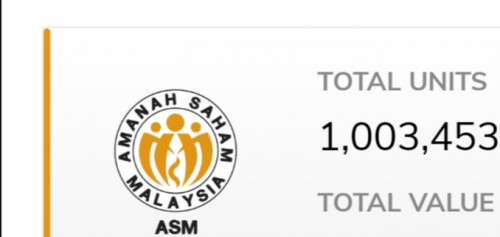

meanwhile, AS1M has always been 6% ..... if you compare CAGR between LTAT and AS1M, LTAT is so much better.

QUOTE(infested_ysy @ Sep 30 2019, 07:53 PM)

but REITs already so expensive.... enter now is a bit too late, I think.

Sep 30 2019, 10:38 PM

Sep 30 2019, 10:38 PM

Quote

Quote

0.1455sec

0.1455sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled