self as a woman is at the heart of all we do.

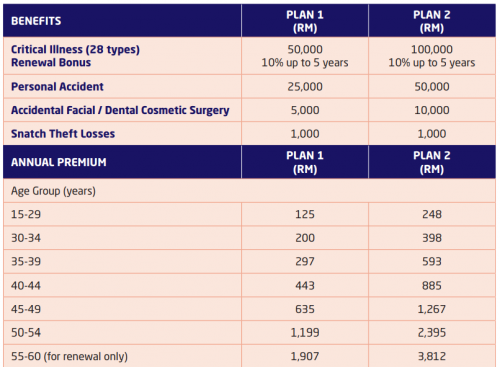

- Lump sum payment of up to RM100,000 if you are diagnosed as having a specified

critical illness and survive for at least 14 days after diagnosis.

- Covers 28 critical illnesses, each one a distinct category on its own.

- Renewal bonus of 10% of the sum insured for up to 5 years for critical illness.

- Personal Accident coverage of up to RM50,000.

- Covers cosmetic surgery for facial and dental injuries and against snatch thief or wayside robber.

- Affordable – costs as little as RM0.34 a day.

- Optional Maternity Risks and Congenital Abnormalities of New Born Babies cover.

- Quick claims settlement once relevant documents are submitted.

- Qualifies for Medical Insurance Tax Relief of RM3,000

- Pays in full in addition to any insurance policies.

3 Critical Illness (28 types)

1. Cancer

2. Stroke

3. Heart Attack

4. Coronary Artery Bypass Surgery

5. Kidney Failure

6. Parkinson’s Disease

7. Multiple Sclerosis

8. Motor Neurone Disease

9. Paralysis of Limbs

10. Terminal Illness

11. Deafness

12. Loss of Independent Existence

13. End-Stage Liver Failure

14. Loss of Limbs

15. Muscular Dystrophy

16. HIV Infection due to Blood Transfusion

17. Surgery of Aorta

18. Heart Valve Surgery

19. Major Organ / Bone Marrow Transplant

20. Blindness

21. Alzheimer’s Disease / Severe Dementia

22. Coma

23. Loss of Speech

24. Third Degree Burns

25. Encephalitis

26. Primary Pulmonary Arterial Hypertension

27. Benign Brain Tumour

28. Major Head Trauma

Renewal Bonus (subject to continuous cover)

• 10% yearly increase of the original sum insured up to a maximum of 50% if no claims are made. Renewal is not guaranteed.

Personal Accident

• Full coverage 24 hours a day, anywhere in the world.

Accidental Facial / Dental Cosmetic Surgery

• Reimbursement of medical expenses incurred for treatment or reconstructive surgery of facial and neck disfigurement or damage to sound natural teeth following injuries sustained as a result of accident.

Snatch Theft Losses

• Covers loss or damage to personal effects caused by a snatch thief or wayside robber.

******************************************

CALL / SMS / WhatsApp 019-3399039 for more info.

******************************************

May 20 2019, 06:28 PM, updated 2d ago

May 20 2019, 06:28 PM, updated 2d ago

Quote

Quote 0.0149sec

0.0149sec

0.32

0.32

5 queries

5 queries

GZIP Disabled

GZIP Disabled