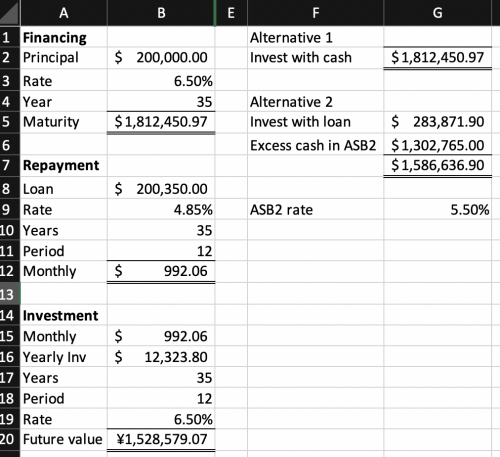

QUOTE(Nachiino Etamay @ May 2 2019, 02:14 PM)

my bank forced me to sign MRTA which almost wiped out half of first year dividends

im pretty sure there are upfront cost to this

anyways, i dont take it because its full already. but i am facing a problem now beecause ASB 2 and ASB3 also full, and need to claw for units.

can you empty your ASB and ASB2 to say, ASM and ASM2, then take 200k loan for ASB and 200k loan for ASB2?? im pretty sure there are upfront cost to this

anyways, i dont take it because its full already. but i am facing a problem now beecause ASB 2 and ASB3 also full, and need to claw for units.

would be better no?

Dec 15 2019, 08:31 AM

Dec 15 2019, 08:31 AM

Quote

Quote

0.0167sec

0.0167sec

0.18

0.18

7 queries

7 queries

GZIP Disabled

GZIP Disabled