In a way, ASB-financing is no different than buying a house with a mortgage. Both has a collateral which backs the loan, allowing the bank to approve the loans at low interest rates (4.4%-4.85% VS personal loans and credit cards with much higher rates). The main difference is in the collaterals themselves. To buy a house, you would bleed money to:

a) buy - SPA/LA/MOT/SD/Valuation/MRTA/10%-deposit

b) maintain - damages/rental-defaults/maintenance-fees/sinking-funds/cukai-pintu/cukai-tanah/fire-insurance

c) sell - RPGT/agent-fees/charge-to-discharge

No such thing with ASB and ASB-financing. You can invest in ASB just like any other unit trust, but at the same time you have the option of taking a loan to finance the investment:

a) There are no deposits required, you can get 100% financing

b) No legal fees involved other than RM60 for endorsement and stamping fees (not stamp duty)

c) Distributions are calculated on a prorated basis, there are no "distribution defaults" like when you are renting out your properties

d) No fees nor taxes to sell, there is a ready buyer - ASB is always ready to purchase the units and return your investment value to you in cash

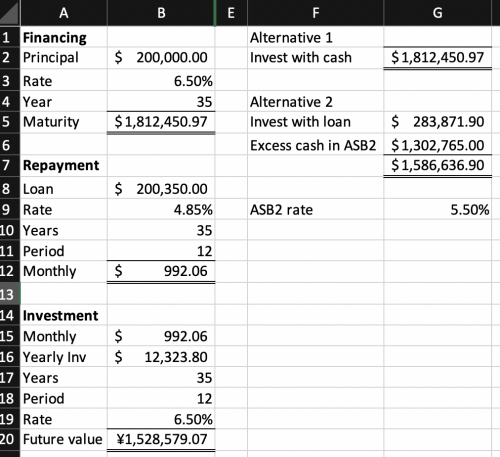

Projections and assumptions:

1. Bank interest (financing) rate of 4.85% p.a - which may change according to the bank's base-rate (BR) movement

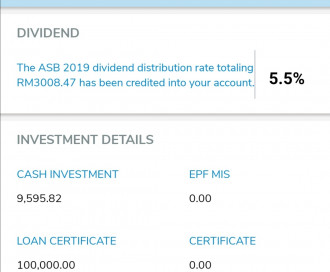

2. ASB expected returns of 6.5% p.a - which is lower than the historical lowest return of 7% a year for 2018 distribution

3. Loan and investment tenure of 35 years - maximum tenure, for 30 years old and below

4. Distributed units left in the ASB account to experience the effects of compounding

5. A small one-off insurance with the bank's panel insurance for RM350, capitalized into the financing

Total unit value after 35 years: RM1,812,450.97

» Click to show Spoiler - click again to hide... «

Total loan repayment after 35 years: RM416,665.20

» Click to show Spoiler - click again to hide... «

Bonus info. Total unit value after 35 years, but with cash-investment of the same monthly installment of RM992.06: RM1,528,086.67 . A difference of RM284,364.30 compared to investing using financing

» Click to show Spoiler - click again to hide... «

This post has been edited by wild_card_my: Dec 17 2019, 10:05 AM

May 2 2019, 02:10 PM, updated 6y ago

May 2 2019, 02:10 PM, updated 6y ago

Quote

Quote

0.2885sec

0.2885sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled