In end of March 2019, my policy suppose to be matured in 1 week time, I logged in to pruaccessplus online to check my policy, and noticed the status had been changed to CEASED. I did call the customer service, and been told that my policy still in force until 1 April 2019.

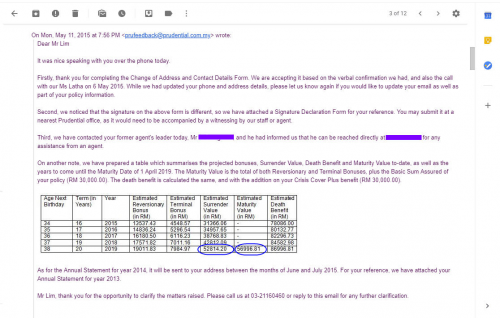

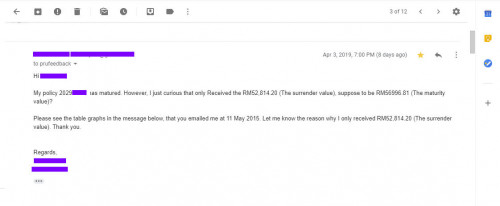

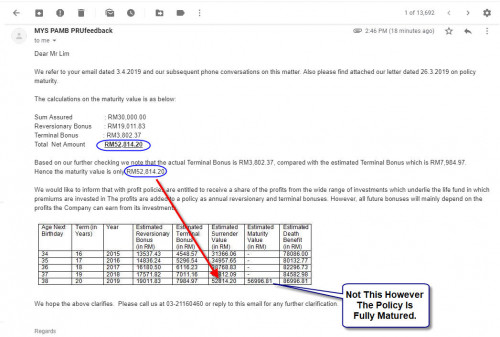

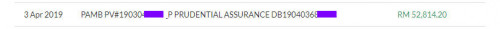

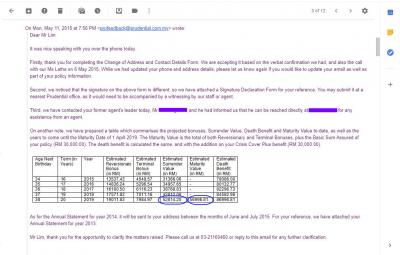

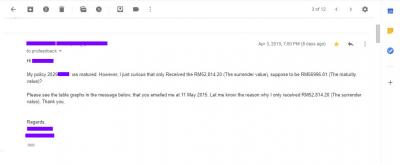

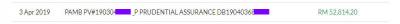

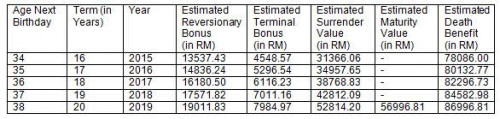

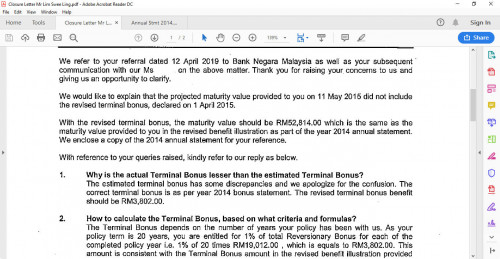

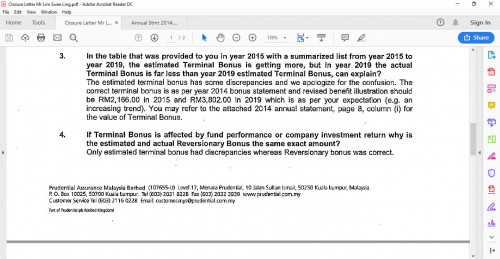

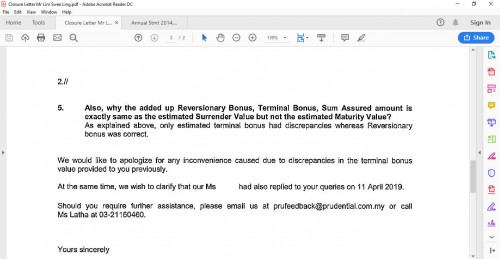

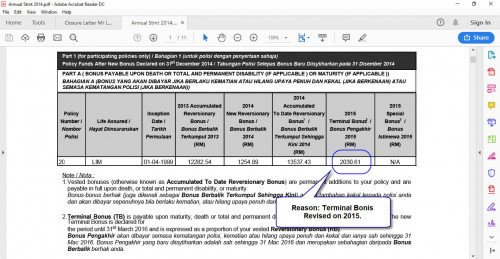

In 3 April 2019, finally received the lamp sum amount for the policy's maturity. But noticed Prudential is given me the Surrender Value instead of the Maturity value which the staff sent me the summarises table of value from year 2015 to year 2019. Then I emailed to Prudential complaint department, the other staff (beside the old staff which emailed me early in 2015 was resigned from Prudential), said (In phone and in her email reply) she cannot explain why the actual Terminal Bonus is half less than the estimated Terminal Bonus, while the actual Reversionary Bonus is exactly the same as the estimated Reversionary Bonus.

The only reason she told me is the value/ bonus depend of fund performance. But I just wondering why only the actual Terminal Bonus is huge different than the estimated Terminal Bonus, but not the Reversionary Bonus? She told me the old staff leave already, also do not know how the old staff he manage to calculate the estimated Maturity Value (In the phone call). This is was a real case scenario I faced with Prudential.

Although I was having Etiqa 10 years saving plan before, not have this issue, able to get the near estimated amount projected. Also, I was having Allianz life insurance before too, during surrender that time, able to get back what surrender value that only slightly different with estimated surrender value projected, not different half the value like Prudential's this case.

See more screenshots attached. Hope anyone or any parties got same issue like mine and share your experience here. Cheers.

I am Michael Lim

Mobile: 016-3126804

This post has been edited by sll994: Apr 11 2019, 06:02 PM

Apr 11 2019, 05:27 PM, updated 7y ago

Apr 11 2019, 05:27 PM, updated 7y ago

Quote

Quote

0.0172sec

0.0172sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled