HI, just want to share and explain in detail what is call refinance property loan. This is the example show as below :

1. property market value at 500k

2. outstanding loan is 200k

3. margin of finance is 90% of the market value

so, 500k x 90%= 450k.

450k-200k=250k

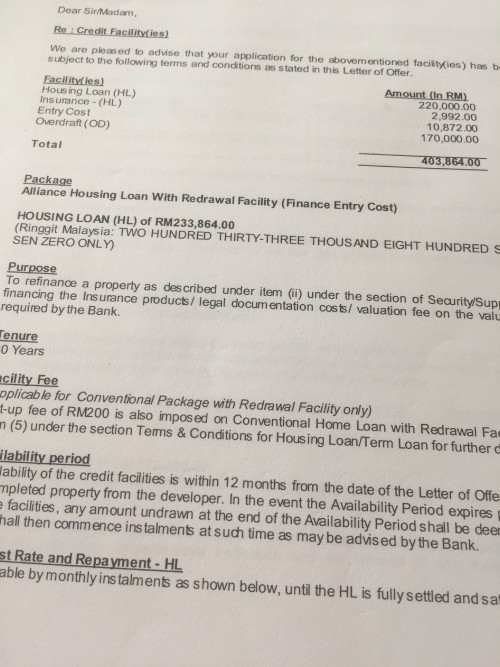

so after refinance his loan structure will be show as below :

1. housing loan : 200k

2. cash out (OD): 250K

---------------------------

Total loan : 450k

there is some reason why client wanna to refinance their property show as below :

1. standby fund for future use.

2. for education

3. to transfer the existing property ownership to other person

4.to debt consolidation existing loan into one account such as credit card, personal loan or car loan.

5.business use.

how does refinance work, refinance

Mar 26 2019, 09:40 AM, updated 2y ago

Mar 26 2019, 09:40 AM, updated 2y ago

Quote

Quote

0.0201sec

0.0201sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled