QUOTE(epie @ Mar 19 2019, 03:57 PM)

it is not because of age

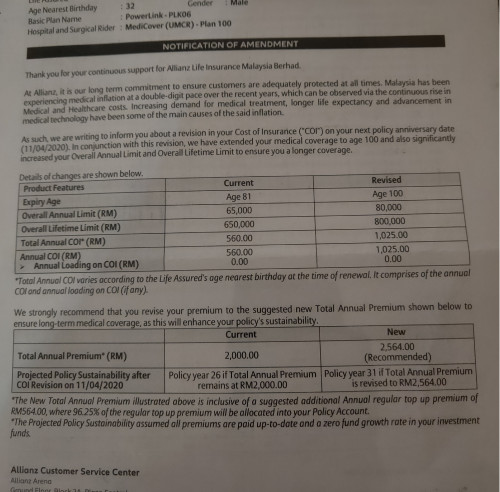

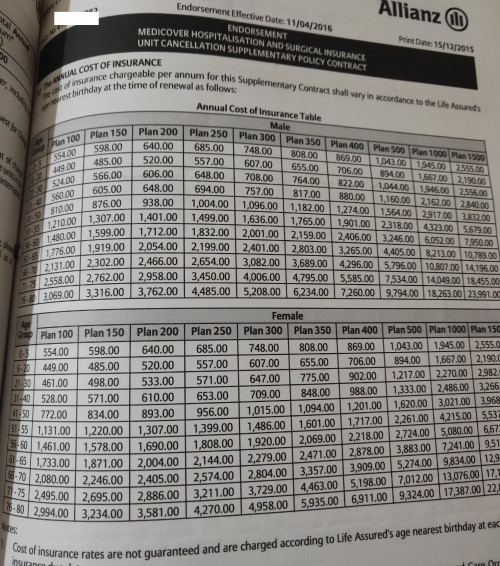

i have the premium table with me bro

yea, still the premium shown in the table is subject to change and not guaranteed.

QUOTE(j0nn @ Mar 20 2019, 06:00 PM)

Personally feel some basic insurance is still needed, eg for critical illness. Don't need to get the most "comprehensive" packages that some agents may recommend, but something is better than nothing.

Depreciation of MYR affects cost of medical insurance because cost of medical procedures increase? Medicines and equipment may be imported.

depending on individual needs and concerns.

QUOTE(tsg_7 @ Mar 16 2019, 05:28 PM)

now im waiting the reply on my brother's claim on the medical.

see what's their reply now. kinda upset now.

what's the situation?

QUOTE(jack2 @ Mar 16 2019, 09:40 PM)

» Click to show Spoiler - click again to hide... «

I think the insurance also tipu orang One.

The agents earn over 30% of the premium for few years which are part of our premium

the commission for the agency force is clearly stated in the policy contract document. anyway, there will be an adjustment regarding on what you mentioned that will be done by BNM to benefit the policyholders. prolly after this quarter or 2nd quarter.

QUOTE(peterpan888 @ Mar 17 2019, 12:24 AM)

Some insurance agent before 6 years...already quit the industry or change to another insurance company..let's say quit/changed on 3rd year....and you get referred to someone else..I assume the new guy don't get.the remaining of the commission, so face black black as they are they doing charity servicing you...

My assumptions true?

depends on the agent that serves you. very subjective.

This post has been edited by ckdenion: Mar 20 2019, 09:45 PM

Mar 20 2019, 04:20 PM

Mar 20 2019, 04:20 PM

Quote

Quote

0.0247sec

0.0247sec

0.24

0.24

6 queries

6 queries

GZIP Disabled

GZIP Disabled