Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

Super2047

|

Apr 17 2023, 08:47 AM Apr 17 2023, 08:47 AM

|

Getting Started

|

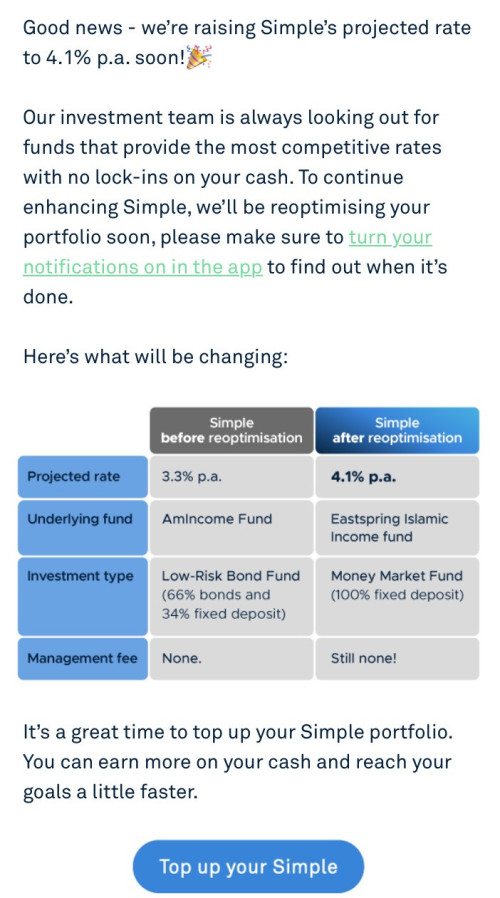

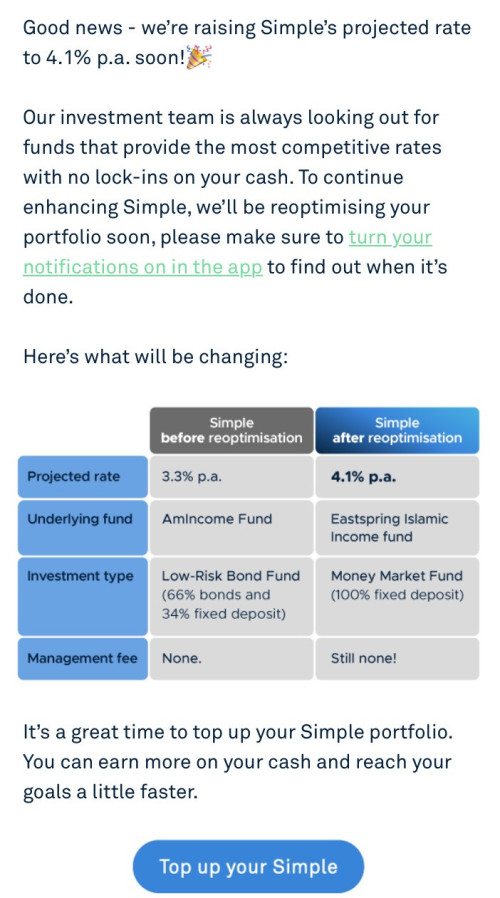

QUOTE(bcombat @ Apr 6 2023, 12:45 PM)  too good to be true… They can pay out 4.1% by investing 100% in fd? This is so hard to believe. What kind of fd can give them so high return that they can pay their investor 4.1% |

|

|

|

|

|

Super2047

|

Apr 20 2023, 09:54 AM Apr 20 2023, 09:54 AM

|

Getting Started

|

Buying into index may not make an investor bankrupt, but may suffer paper losses for a long time if he go in at the wrong timing. If someone bought into S&P500 at year 2000, he only start making money after 2013. That's a 13 years of mental suffering. But having said that, if you can hold longgggg enough till today, even if you bought in at the peak at year 2000, you still earning a compound growth of 4%  This post has been edited by Super2047: Apr 20 2023, 10:02 AM This post has been edited by Super2047: Apr 20 2023, 10:02 AM |

|

|

|

|

|

Super2047

|

Apr 20 2023, 11:47 AM Apr 20 2023, 11:47 AM

|

Getting Started

|

QUOTE(Cubalagi @ Apr 20 2023, 11:28 AM) Valid point. For total return, you actually have to add dividends as well which is not shown in price chart. The breakeven would happen in 2007, but then soon the market would crash again. One would also be the unfortunate fella who went all n at the peak and didnt make any investment onwards to average down. To be fair, quite a number of investors have this behavior (buy at peak n soon give up). Spx, bitcoin, gold..u name it. Even here at Stashaway. I guess the reason why most people give up is because they don't have a long term mindset right from the start. What they are looking for is a fast gain and get rich as quickly as possible (look at crypto and money game). When they see their investment loss 50% 70%, they would just give up and sell all. Some after waiting for few years and see nothing, they also sell it off and want to forget the whole thing. If we can follow Warren buffet quote of "If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes", then it's much easier to handle the up and down of market. |

|

|

|

|

|

Super2047

|

Apr 20 2023, 05:52 PM Apr 20 2023, 05:52 PM

|

Getting Started

|

QUOTE(xander2k8 @ Apr 20 2023, 05:43 PM) There is only a few companies in Malaysia that you meets requirements and unfortunately it is not REITs because it is actually dilution of value while acquiring assets 🤦♀️ hence you don’t realise you are actually losing money instead because you are concentrating on dividends not the actual value against the asset price By far Maybank and Petronas Gas if you did on hold on to 15 years it will grow both in share value and dividends Tenaga and Telekom share value wise it is mixed outlook but dividends it is consistent because the outlook is mixed as the management future vision and plan is very uncertain due to the board changes which can be manipulated by the govt in power 🤦♀️ What makes you think that Petgas has good share value and dividends in the future? It has been moving sideline since 2017 till now  |

|

|

|

|

|

Super2047

|

Apr 20 2023, 06:03 PM Apr 20 2023, 06:03 PM

|

Getting Started

|

QUOTE(xander2k8 @ Apr 20 2023, 06:00 PM) Past few years because of the investment laid on future projects hasn’t been paid off yet Once that is realised hopefully 2024/2025 it will grow back it was but at least hasn’t dropped that much of others unlike TNB Petgas, Petdag, Pchem all are not performing very well even though oil price has been going up lately. |

|

|

|

|

Apr 17 2023, 08:47 AM

Apr 17 2023, 08:47 AM

Quote

Quote

0.0438sec

0.0438sec

0.77

0.77

7 queries

7 queries

GZIP Disabled

GZIP Disabled