Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

KingArthurVI

|

Jan 29 2021, 01:23 PM Jan 29 2021, 01:23 PM

|

|

I opened an account and deposited some money a few days ago, I just noticed my current weight for my portfolio is weighted 100% towards cash in USD. How many days does it normally take for SA to fully invest this cash into the assets shown in the pie chart? Thanks.

|

|

|

|

|

|

KingArthurVI

|

Apr 6 2021, 04:13 PM Apr 6 2021, 04:13 PM

|

|

QUOTE(DragonReine @ Apr 6 2021, 11:45 AM) Very bad  takes a week Sell order in Simple then to trustee account for portfolio investment: T+4 biz days on average Convert from MYR to USD and then execute buy order: T+2 biz days on average Total time takes around T+6 biz days Damn. That 1-week transfer time is really killer. I was seriously considering putting a lump sum in Simple and slowly DCA. Looks like need to go the direct debit route now  |

|

|

|

|

|

KingArthurVI

|

Apr 15 2021, 01:57 PM Apr 15 2021, 01:57 PM

|

|

QUOTE(littlegamer @ Apr 15 2021, 01:14 PM) I have equal distribution of 36 30 26 and 22% risk. I think should be quite safe. To get 0.2%fee need deposit 1m above I think and the rate is prorated Prorated as in if I have 1,000,001, only the RM1 will be 0.2%?  |

|

|

|

|

|

KingArthurVI

|

Apr 15 2021, 02:34 PM Apr 15 2021, 02:34 PM

|

|

QUOTE(littlegamer @ Apr 15 2021, 02:30 PM) Correct. On second check, the increased the fee, used to be 1m above all 0.2% now 1 mil. Above is 0.3%, only 3mil above is 0.2% . Many mistaken here if u put 1 million the total is 0.2 of your 1mil(rm 2k per year) Is not It should be 50k - > 400 50k to 100k - > 350. 100 to 250k - > 900 250 to 500k - > 1250 500k to 1 mil - > 2000 Total fee per annum pm for 1 mil rm4. 9k Equivalent of 0.5% effective annual fee This is really good to know, thanks for sharing.  I also thought the % is based on your entire AUM and not tier-based. |

|

|

|

|

|

KingArthurVI

|

Jul 23 2021, 09:42 PM Jul 23 2021, 09:42 PM

|

|

QUOTE(Seth Ho @ Jul 23 2021, 09:36 PM) KWEB drop 8% just now. can do minor lumpsum today but FX not too good though. -9% now holy shit |

|

|

|

|

|

KingArthurVI

|

Sep 26 2021, 02:32 AM Sep 26 2021, 02:32 AM

|

|

Can someone clarify if SA’s fees already includes the underlying ETFs’ expense ratios?

|

|

|

|

|

|

KingArthurVI

|

Sep 26 2021, 11:50 AM Sep 26 2021, 11:50 AM

|

|

QUOTE(backspace66 @ Sep 26 2021, 10:18 AM) Ok, you need to understand how etf fees is charged, it is at a different level (at NAV of the ETF to be exact) You buy through SA or you buy directly yourself ,all will have charges incurred coming from ETF issuer itself. You can refer here; https://www.investopedia.com/ask/answers/07...es-deducted.aspThe management fees (of SA) is inclusive of all charges that is not coming from etf issuer itself, for example brokerage fee. Thank you, very informative. I was trying to decide between starting to buy my own ETFs vs continuing to pour money into SA  i think in the short term will continue to DCA |

|

|

|

|

|

KingArthurVI

|

Sep 26 2021, 01:55 PM Sep 26 2021, 01:55 PM

|

|

QUOTE(MUM @ Sep 26 2021, 11:59 AM) Many had mentioned, if you know about investing in etfs and how to access DIY buying n selling of etfs.... Then it will be better to buy your own for it is "cheaper" & you have full control of what n where you go... Full driver seat instead of being a passenger Yeah I understand that. The main reason I’m a bit hesitant to buy ETFs directly is because of the brokerage or transaction fees. I currently use FSMOne to buy US a counters and the fee is minimum USD8.80, which feels like quite a sum if I were to DCA every couple of weeks. So for now I’ll continue to trust SA to select the best ETFs for me while I DCA regularly/blindly, and their management fees are lower than unit trust funds which is a plus. |

|

|

|

|

|

KingArthurVI

|

Sep 26 2021, 02:39 PM Sep 26 2021, 02:39 PM

|

|

QUOTE(MUM @ Sep 26 2021, 02:03 PM) i think in some threads, forummers did mentioned DIY etfs at other platform can get low brokerage or transaction fees too.... Due to personal reasons I’m only looking at SC-approved platforms, which admittedly limits my options.  QUOTE(thecurious @ Sep 26 2021, 02:04 PM) Thats not really trusting SA though, thats choosing a platform based on fees. I trust their methodology. If I buy my own ETFs it’ll mostly be index funds like VOO, plus some of SA’s holdings. |

|

|

|

|

|

KingArthurVI

|

Sep 29 2021, 05:59 PM Sep 29 2021, 05:59 PM

|

|

I have a USD account but curious why domestic loan > 1M will be "punished" by a GBP account? What if someone's rich and earns 20-30k a month, a 1M loan is normal for them. Shouldn't it be calculated using debt/income ratio instead of a flat 1,000,000?

|

|

|

|

|

|

KingArthurVI

|

Sep 29 2021, 08:01 PM Sep 29 2021, 08:01 PM

|

|

QUOTE(MUM @ Sep 29 2021, 07:06 PM) mind sharing more info or link as to "domestic loan > 1M will be "punished" by a GBP account?" like you mentioned,...should it be guided by debt/income ratio than just a >1M figure? I remember seeing a few posts from a few pages before that seemed to mention high domestic loan being a key factor of people being assigned GBP vs. USD, but not my problem honestly just curious. I have a USD account |

|

|

|

|

|

KingArthurVI

|

Oct 5 2021, 02:56 PM Oct 5 2021, 02:56 PM

|

|

Oof KWEB's bottom still isn't here it seems.

|

|

|

|

|

|

KingArthurVI

|

Oct 15 2021, 03:48 PM Oct 15 2021, 03:48 PM

|

|

Whoa whoa I just went from -4% to +0.05% over the past 2 days, thanks international markets  |

|

|

|

|

|

KingArthurVI

|

Oct 28 2021, 01:26 PM Oct 28 2021, 01:26 PM

|

|

KWEB down again let’s gooo

|

|

|

|

|

|

KingArthurVI

|

Oct 30 2021, 05:56 PM Oct 30 2021, 05:56 PM

|

|

QUOTE(bcombat @ Oct 30 2021, 05:01 PM) Also from what I read here seems like regular here seems to prefer more risky portfolio? Such as 36% risk level. Anyone here who are more conservative like me who prefer something like 8- 15% risk appetite? The "risky" SA portfolios IMO aren't really that risky due to how most SA's portfolios are so diversified except for their Thematic Portfolio recent offerings, but it's all relative so no one can speak for it on your behalf. If you're quite young (under 40 maybe) you can consider 22% and above. My opinion is that if you're considering less than 22% that maybe there are other vehicles like UT bond fund etc. that would provide you with more control over what you're investing in, since SA doesn't let you control directly what the underlying assets are per se. You can see what the asset allocations are for now but after a reoptimization it might be completely different. This post has been edited by KingArthurVI: Oct 30 2021, 05:56 PM |

|

|

|

|

|

KingArthurVI

|

Nov 1 2021, 10:54 AM Nov 1 2021, 10:54 AM

|

|

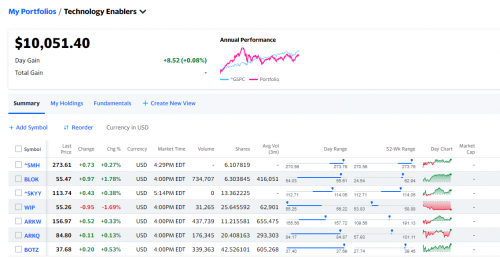

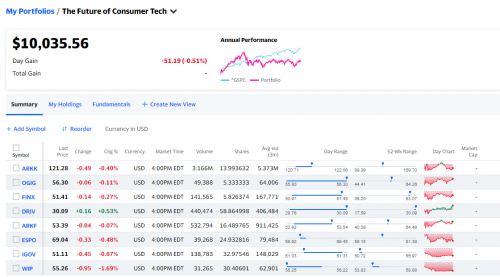

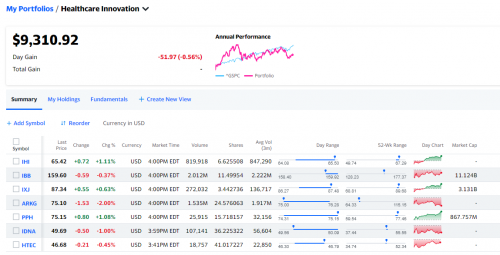

QUOTE(Medufsaid @ Nov 1 2021, 09:32 AM) What tool are you using to make these portfolios? Or can they be shared openly too? Curious if we can have a LYN SA “collection” list lol |

|

|

|

|

|

KingArthurVI

|

Nov 12 2021, 02:00 PM Nov 12 2021, 02:00 PM

|

|

What does it mean if TWR is negative but MWR is positive? Am I actually losing or gaining money? lol

|

|

|

|

|

|

KingArthurVI

|

Nov 12 2021, 03:07 PM Nov 12 2021, 03:07 PM

|

|

QUOTE(xander83 @ Nov 12 2021, 02:58 PM) Losing in time but gain in money Check your portfolio in USD for more accurate performance Your gains is because of RM depreciation Aside from currency fluctuation, I guess the MWR gains could also be attributed to the monthly DCA deposit, so some of the time the deposit bought into the dip, right? |

|

|

|

|

|

KingArthurVI

|

Dec 20 2021, 03:24 PM Dec 20 2021, 03:24 PM

|

|

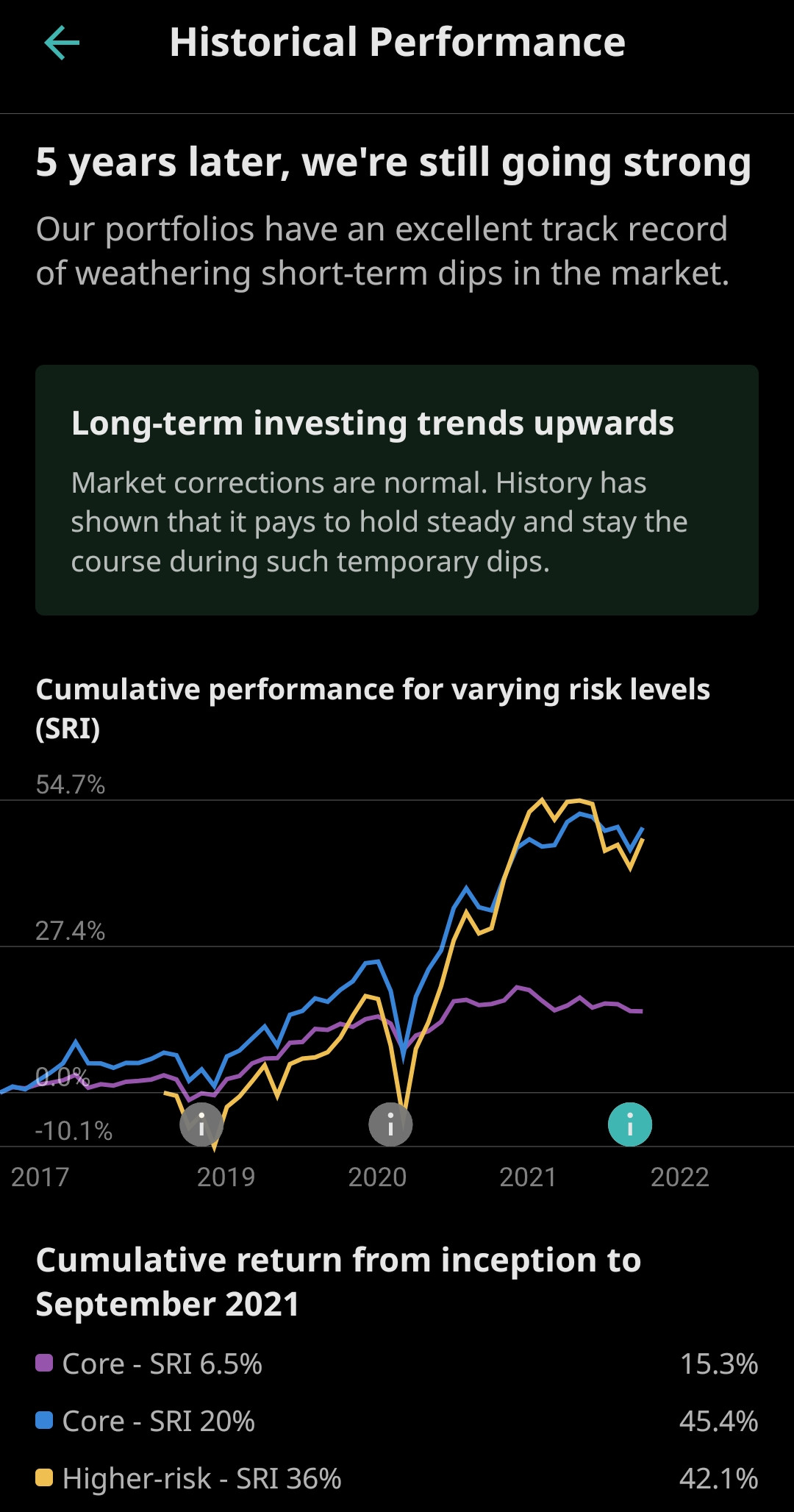

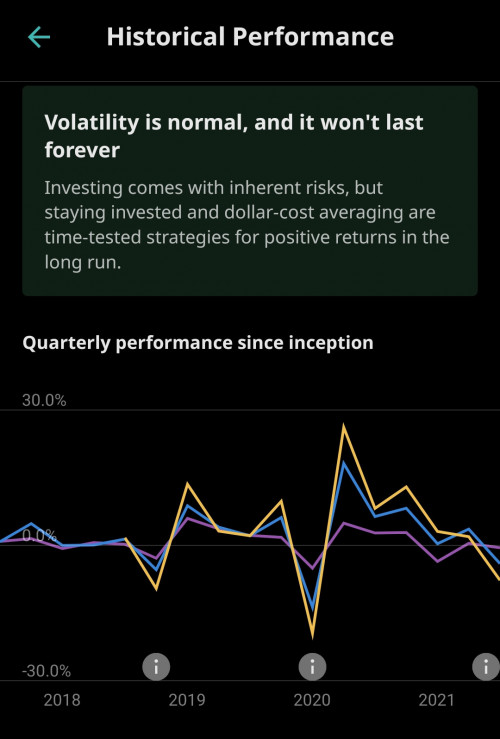

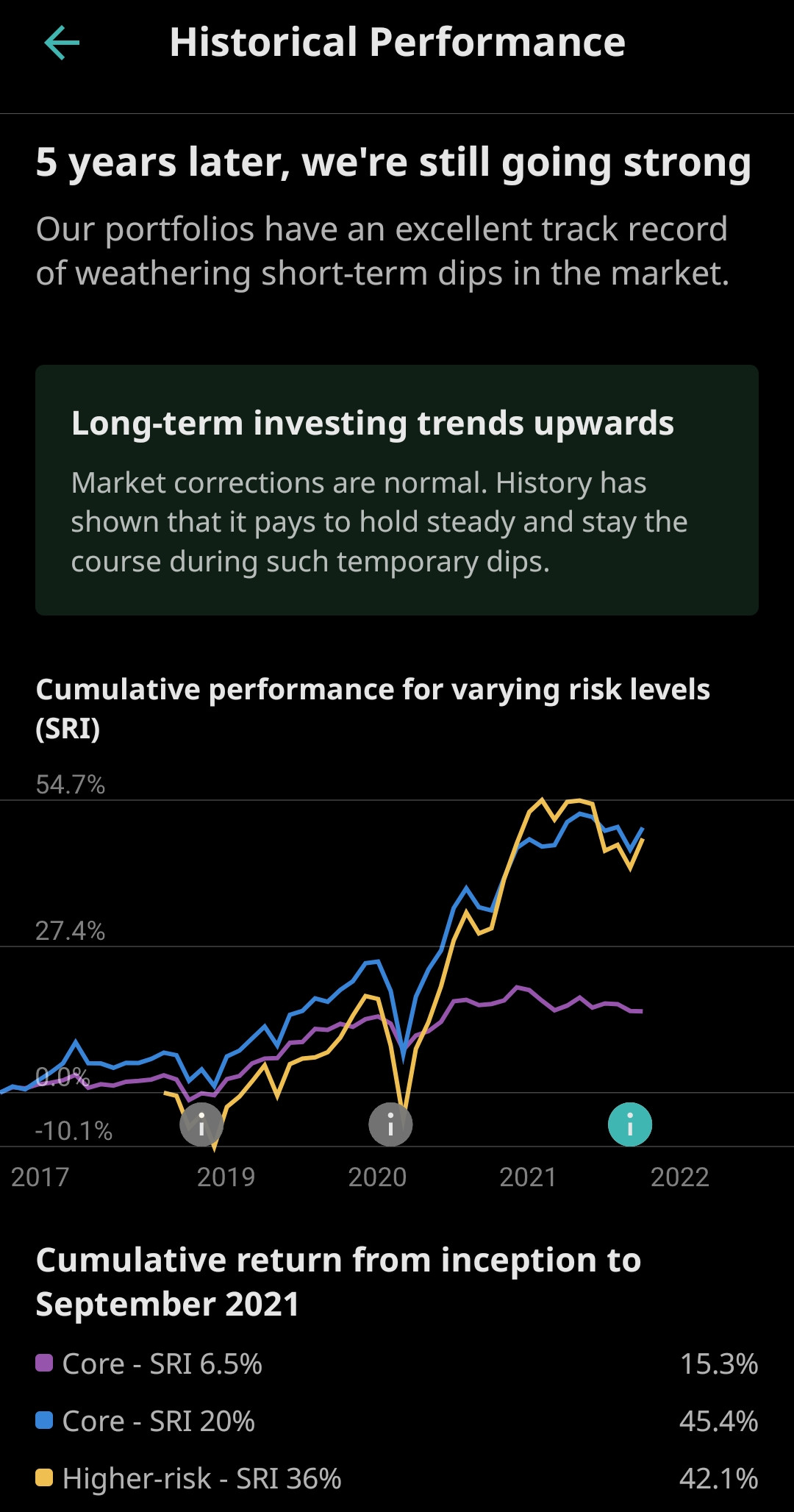

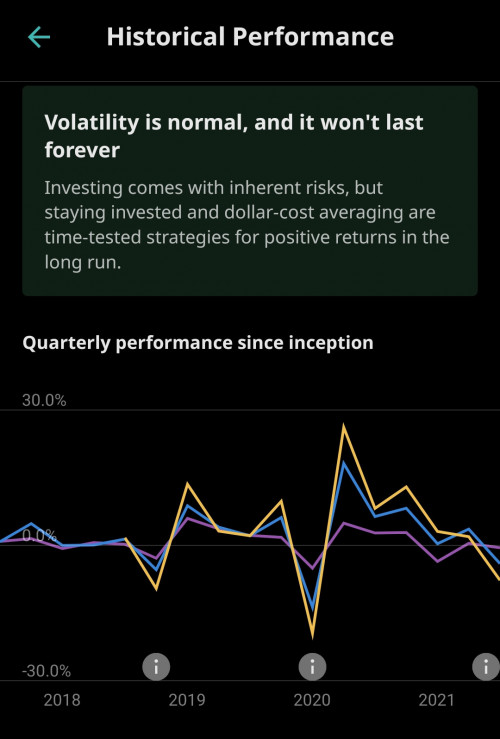

QUOTE(DragonReine @ Dec 20 2021, 11:25 AM) Small "look back on past 5 years" mini review in SAMY app, can click on the (i) icons to review on the dips.   Noticed that too yesterday. I think they received too many complaints/flaming on FB and also perhaps some significant fund outflow, so decided to do something about it. |

|

|

|

|

|

KingArthurVI

|

Dec 22 2021, 10:42 PM Dec 22 2021, 10:42 PM

|

|

Another red day for KWEB, here we go boyssss

|

|

|

|

|

Jan 29 2021, 01:23 PM

Jan 29 2021, 01:23 PM

Quote

Quote

0.0556sec

0.0556sec

0.64

0.64

7 queries

7 queries

GZIP Disabled

GZIP Disabled