Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

James1983

|

May 14 2020, 01:10 PM May 14 2020, 01:10 PM

|

|

QUOTE(PortgasDerekAce @ May 14 2020, 01:03 PM) Why do they even invest in China now China is a time bomb, with the global tensions and countries trying to decouple supply chain from China, and boycott sentiment getting stronger |

|

|

|

|

|

James1983

|

May 15 2020, 08:31 AM May 15 2020, 08:31 AM

|

|

QUOTE(stormseeker92 @ May 14 2020, 02:20 PM) Hmmm. first time I am experiencing this major re-optimisation. Plus with China getting pressured from everyone, and sanctions coming in from US, India prefers investors from Taiwan instead of China, Japan already saved up cash to migrate manufacturing out of China. I don't think many major countries want to continue with China's trade after all this fucked up virus, Hong Kong protestors, WHO incident, Uighurs concentration camps. And now SAMY wants to invest in a Chinese Tech ETFs. I am concerned to say the least. Bad vibes. Industry giants like Apple are already compelled to shift supply chain out of China, risky move indeed e.g. Latest news of moving 20% to India. This post has been edited by James1983: May 15 2020, 08:32 AM |

|

|

|

|

|

James1983

|

May 15 2020, 08:43 AM May 15 2020, 08:43 AM

|

|

QUOTE(xcxa23 @ May 15 2020, 08:37 AM) hmm really? there seems to be contradicting news then lol New Delhi: Several meetings between Apple’s senior executives and top ranking government officials over the last few months have paved the way for the iPhone maker examining the possibility of shifting nearly a fifth of its production capacity from China to India and scaling up its local manufacturing revenues, through its contract manufacturers, to around $40 billion over the next five years, say officials familiar with the matter. Read more at: https://economictimes.indiatimes.com/tech/h..._campaign=cppst |

|

|

|

|

|

James1983

|

May 15 2020, 08:47 AM May 15 2020, 08:47 AM

|

|

QUOTE(djhenry91 @ May 15 2020, 08:45 AM) even US companies go Indonesia to set up their manufacturing plant Good point. I think the lesson from this COVID nightmare is that most MNC realised that they can't put their eggs all into 1 basket, especially Supply Chain. When China went to lock-down, many global companies got hit because their supply chain got severely disrupted. They are all planning longer term 'geographical diversification' to avoid concentrated supply chain risk, i.e. heavy reliance on China. Vietnam, Indonesia, India are all beneficiaries of this shift This post has been edited by James1983: May 15 2020, 08:48 AM |

|

|

|

|

|

James1983

|

Jun 18 2020, 09:29 AM Jun 18 2020, 09:29 AM

|

|

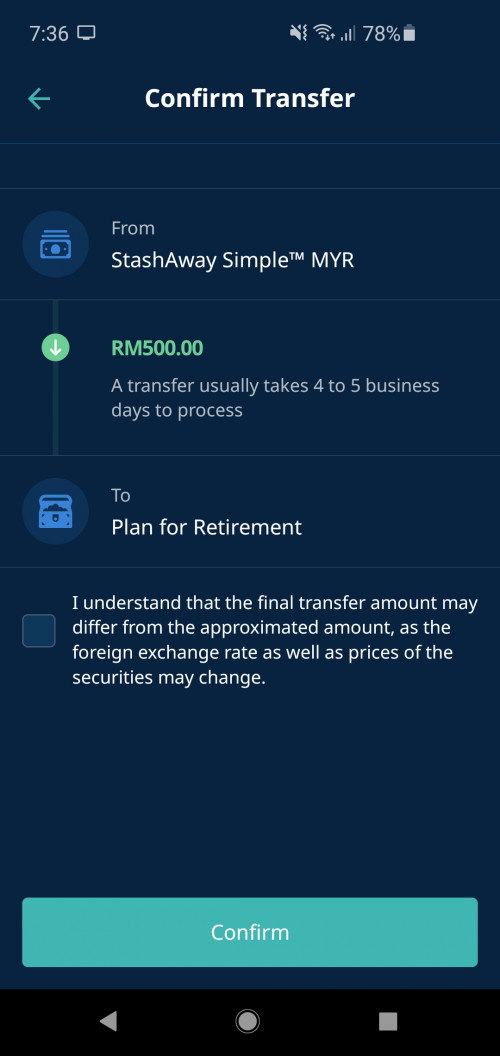

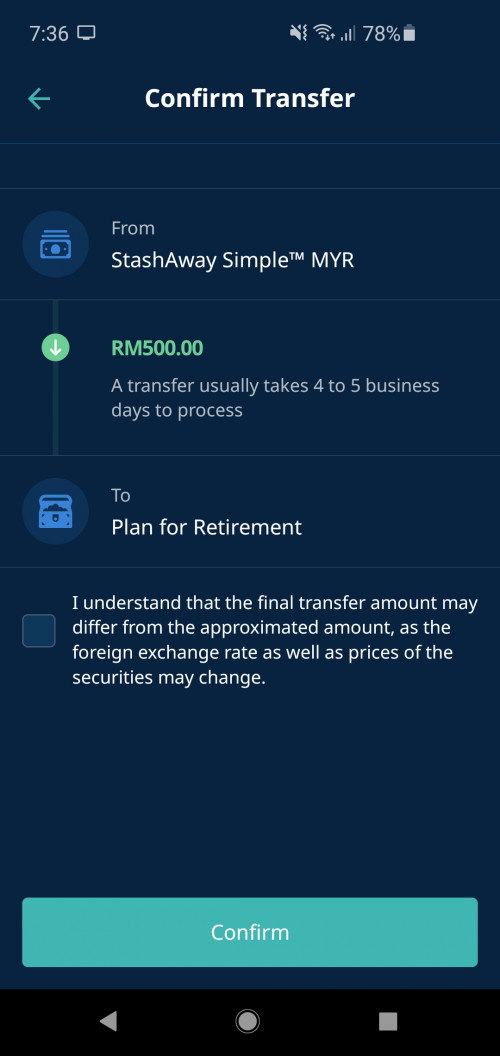

QUOTE(joshtlk1 @ Jun 17 2020, 07:37 PM) But it doesn't make much sense. Because it will take longer ie. 4 to 5 business days.  yes. Transferring from Simple to Portfolios is even slower, I kena before also lol because they have to sell the MMF in Simple first which takes days then buy into the Portfolio components |

|

|

|

|

|

James1983

|

Jun 18 2020, 09:32 AM Jun 18 2020, 09:32 AM

|

|

QUOTE(tehoice @ Jun 18 2020, 09:30 AM) then might as well transfer directly from bank account and is even faster right. erm, depends on whether you want to store the money with the alleged higher interest lor Simple is supposed to give higher interest rate than normal bank saving's account. But yes, it's less liquid for sure  This post has been edited by James1983: Jun 18 2020, 09:32 AM This post has been edited by James1983: Jun 18 2020, 09:32 AM |

|

|

|

|

|

James1983

|

Oct 1 2020, 07:31 PM Oct 1 2020, 07:31 PM

|

|

Got a feeling equities will drop again this month

|

|

|

|

|

|

James1983

|

Oct 1 2020, 08:40 PM Oct 1 2020, 08:40 PM

|

|

QUOTE(woonsc @ Oct 1 2020, 08:08 PM) If you are young, drop is good Yup... I’m keeping some bullet to buy in when the time is right  |

|

|

|

|

|

James1983

|

May 14 2021, 08:45 AM May 14 2021, 08:45 AM

|

|

things ain't looking good at the moment  |

|

|

|

|

|

James1983

|

Jul 27 2021, 07:18 AM Jul 27 2021, 07:18 AM

|

|

It’s gonna be brutal. When the value is updated today

China tech got hit hard

|

|

|

|

|

|

James1983

|

Jul 27 2021, 08:56 AM Jul 27 2021, 08:56 AM

|

|

QUOTE(thecurious @ Jul 27 2021, 08:48 AM) Worst part is reoptimisation literally just happened so stashaway bought a whole bunch of kweb, and its dropping straightaway lolol.. imagine if the reoptimisation happen this week instead. yea!  really bad timing |

|

|

|

|

|

James1983

|

Aug 14 2021, 09:20 AM Aug 14 2021, 09:20 AM

|

|

QUOTE(jacksonpang @ Aug 14 2021, 09:19 AM) One of the worst performing robo lol Thank god I’ve already completely pulled out of Stashaway. |

|

|

|

|

|

James1983

|

Aug 14 2021, 09:50 AM Aug 14 2021, 09:50 AM

|

|

QUOTE(Quazacolt @ Aug 14 2021, 09:47 AM) Please allow me to cherry pick Nah, other robo have better long term returns too |

|

|

|

|

|

James1983

|

Aug 14 2021, 10:07 AM Aug 14 2021, 10:07 AM

|

|

QUOTE(Oklahoma @ Aug 14 2021, 09:57 AM) Where you I vesting instead? I'm also contemplating Now I’ve moved to self investing of a few UTs and ETFs Some that tracks Global indices, and some that are high growth ETFs, and some ESG UTs |

|

|

|

|

|

James1983

|

Aug 14 2021, 10:36 AM Aug 14 2021, 10:36 AM

|

|

QUOTE(gundamsp01 @ Aug 14 2021, 10:10 AM) may i know what platform? is it endorsed by SC? QUOTE(Oklahoma @ Aug 14 2021, 10:29 AM) Hmm good idea...which platform you using? The transaction n mgmt fee won't be higher than SA? I mainly use IBKR (interactive broker), one of the largest eTrading platform in the world. With excellent forex rate too Fees are lower than SA but you need to know what to buy lor, ownself do some research and select the UT or ETF which has a good track record You can seek advise here, a lot of sifu to teach you https://forum.lowyat.net/topic/4843925/allThis post has been edited by James1983: Aug 14 2021, 10:37 AM |

|

|

|

|

|

James1983

|

Oct 27 2021, 04:16 AM Oct 27 2021, 04:16 AM

|

|

QUOTE(honsiong @ Oct 27 2021, 12:33 AM) HENG AH!!! I got a heart attack seeing syfe mentioned as good option LOL. Endowus is far more level headed in their approach to investments. Agree. Endowus is by far the best, way better than Syfe and SA |

|

|

|

|

May 14 2020, 01:10 PM

May 14 2020, 01:10 PM

Quote

Quote

0.3036sec

0.3036sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled