QUOTE(honsiong @ Nov 13 2019, 07:57 PM)

They close ur account, worst case you get back your money, best case they never found out and you get filthy rich.

Worse case, they charge u for breach of FEA regulations and u go to jail.Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Nov 13 2019, 11:07 PM Nov 13 2019, 11:07 PM

Return to original view | Post

#1

|

Senior Member

4,487 posts Joined: Mar 2014 |

|

|

|

|

|

|

Jan 29 2020, 02:09 PM Jan 29 2020, 02:09 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

4,487 posts Joined: Mar 2014 |

|

|

|

Oct 7 2021, 08:59 AM Oct 7 2021, 08:59 AM

Return to original view | Post

#3

|

Senior Member

4,487 posts Joined: Mar 2014 |

Hi

I'm not an SA investor, but Im on their email.list. What's the YTD performance of SA high risk portfolio? Anyone knows? |

|

|

Oct 7 2021, 09:44 AM Oct 7 2021, 09:44 AM

Return to original view | Post

#4

|

Senior Member

4,487 posts Joined: Mar 2014 |

QUOTE(Medufsaid @ Oct 7 2021, 09:12 AM) that is a hard question to answer bcos unlike say, Public Mutual, there's no website to lookup past performance, and no one I know here actually deposits 1 lump sum in early Oct 2020 and leave it untouched. So it's about 10% drawdown if investing from January this year. although I can probably say, negative returns if you started on Jan 2021? This is due to exposure to KWEB. If you started before 2021 you might have some gains Thanks for sharing. Btw that's not too bad for a high risk portfolio. |

|

|

Oct 7 2021, 11:19 AM Oct 7 2021, 11:19 AM

Return to original view | Post

#5

|

Senior Member

4,487 posts Joined: Mar 2014 |

QUOTE(Hoshiyuu @ Oct 7 2021, 10:16 AM) Hey bro! I think I saw you before in Bursa ETF thread. Thanks. Interesting that daily has more losses than lump sum.Here's a benchmark portfolio I made to track this since February. I created this near peak so should be representative of one shot lump-sum during ATH. Here's the same portfolio under daily deposits. The drawdown is bigger because I increased my deposit during the first major drop. I DIY invest using etf n stocks and do my own type of "ERAA" strategy. This requires much more reading than using robo, but something like a hobby I enjoy. I also don't mind using bursa listed etf for convenience, but I also buy offshore etf. Hoshiyuu liked this post

|

|

|

Dec 31 2021, 09:30 AM Dec 31 2021, 09:30 AM

Return to original view | IPv6 | Post

#6

|

Senior Member

4,487 posts Joined: Mar 2014 |

|

|

|

|

|

|

Jan 27 2022, 04:21 PM Jan 27 2022, 04:21 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

4,487 posts Joined: Mar 2014 |

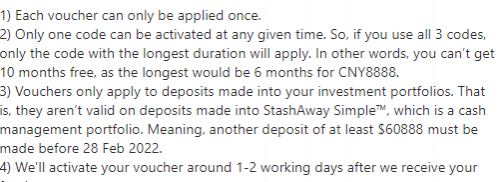

QUOTE(Medufsaid @ Jan 27 2022, 09:44 AM) bourse just checked. my 36% and 6% will be reopted. Percentages below What's the YTD performance of these 36 n 6 portfolios?36% KWEB 20 EWA 8 EWC 9 IJR 12.6 XLE 6 XLP 8 XLK 9.4 XLF 8 VNQ 8.6 GLD 9.4 Cash 1 6% KWEB 4.4 XLE 3.8 BNDX 13.1 EMB 10 IGOV 13.1 TIP 13.1 FLOT 13.1 AGG 13.1 GLD 3 Cash 13.1 CoolStoryWriter ESG promo code here https://www.stashaway.my/r/introducing-envi...-esg-portfolios generic promo code below: QUOTE(FB) Get free investing for up to 6 months when you invest before 28 February 2022* with the following voucher codes: Invest more than RM1,888 for 2 months of free investing CNY8 Invest more than RM15,888 for 3 months of free investing CNY88 Invest more than RM35,888 for 4 months of free investing CNY888 Invest more than RM60,888 for 6 months of free investing CNY8888  |

|

|

Feb 10 2022, 11:09 AM Feb 10 2022, 11:09 AM

Return to original view | IPv6 | Post

#8

|

Senior Member

4,487 posts Joined: Mar 2014 |

QUOTE(zstan @ Feb 10 2022, 10:34 AM) Not sure why so many people are fixated to earn their retirement money via investing instead of trying to increase their salary instead. Because this is an investment forum, not a career forum? onthefly, Daenthylin, and 3 others liked this post

|

|

|

Feb 10 2022, 01:55 PM Feb 10 2022, 01:55 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

4,487 posts Joined: Mar 2014 |

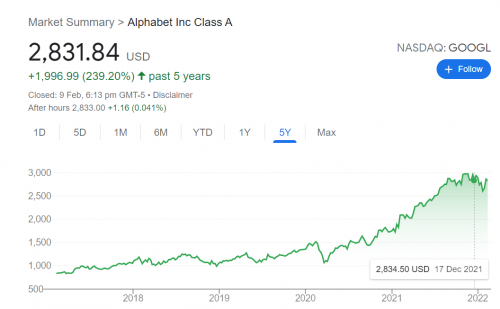

QUOTE(Davidtcf @ Feb 10 2022, 01:46 PM) Yes already bought insurance, I have savings/emergency funds readied. Past performance is not a guarantee of future results.Thanks for your concern. To quote: “In investing, what is comfortable is rarely profitable.” ― Robert Arnott Can Google's value be wiped out overnight? How much will that take? Or Microsoft, Tesla, Nvidia. A major crisis like US to be hit by a meteor before that can happen. Do these charts lie? (5 years timeline)    |

|

|

Mar 2 2022, 09:59 PM Mar 2 2022, 09:59 PM

Return to original view | Post

#10

|

Senior Member

4,487 posts Joined: Mar 2014 |

QUOTE(Medufsaid @ Mar 2 2022, 02:04 PM) all robo-advisors giving negative returns (unless you timed the market & take profit) but EPF 6.1. need to know their secret EPF compute profits on realized gains...meaning they can ignore volatility n hold long term.Robo are marked to market value. |

|

|

May 4 2022, 05:37 PM May 4 2022, 05:37 PM

Return to original view | Post

#11

|

Senior Member

4,487 posts Joined: Mar 2014 |

QUOTE(YS3nsatiOn @ May 4 2022, 05:25 PM) Should I withdraw all of my SA investment or continue to DCA every month? Currently, I'm depositing about RM1k monthly into SA and it keeps disappointing me... :/ How long have u been DCA monthly? N what's ur risk index?This post has been edited by Cubalagi: May 4 2022, 05:37 PM |

|

|

Jun 9 2022, 08:41 AM Jun 9 2022, 08:41 AM

Return to original view | Post

#12

|

Senior Member

4,487 posts Joined: Mar 2014 |

QUOTE(sgh @ Jun 8 2022, 12:58 PM) China ETF seem to be slowly rising so far (not in straight line though), will SA buy back KWEB? Or wait for it to rise higher before buy? KWEB has been outperforming S&P500, YTD performance.Basically the humans panicked and sold at the very bottom. langstrasse liked this post

|

|

|

Jun 11 2022, 09:41 AM Jun 11 2022, 09:41 AM

Return to original view | Post

#13

|

Senior Member

4,487 posts Joined: Mar 2014 |

|

|

|

|

|

|

Jun 17 2022, 08:18 AM Jun 17 2022, 08:18 AM

Return to original view | Post

#14

|

Senior Member

4,487 posts Joined: Mar 2014 |

|

|

|

Jun 18 2022, 09:48 AM Jun 18 2022, 09:48 AM

Return to original view | Post

#15

|

Senior Member

4,487 posts Joined: Mar 2014 |

|

|

|

Dec 29 2022, 11:26 PM Dec 29 2022, 11:26 PM

Return to original view | Post

#16

|

Senior Member

4,487 posts Joined: Mar 2014 |

QUOTE(zstan @ Dec 29 2022, 10:45 PM) u'd be a genius investor if you made it out this year with positive gains on your own. well those who invested in FD entirely are also the smartest ones Or if they just buy Maybank..for abt 12% total returns (incl.divy) this year.This post has been edited by Cubalagi: Dec 29 2022, 11:27 PM |

|

|

Dec 30 2022, 09:27 AM Dec 30 2022, 09:27 AM

Return to original view | Post

#17

|

Senior Member

4,487 posts Joined: Mar 2014 |

QUOTE(zstan @ Dec 30 2022, 08:51 AM) You mentioned FD. So you were comparing ETF with other things. Medufsaid liked this post

|

|

|

Dec 30 2022, 09:51 AM Dec 30 2022, 09:51 AM

Return to original view | Post

#18

|

Senior Member

4,487 posts Joined: Mar 2014 |

|

|

|

Jan 27 2023, 02:59 PM Jan 27 2023, 02:59 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

4,487 posts Joined: Mar 2014 |

|

|

|

Mar 8 2023, 02:25 PM Mar 8 2023, 02:25 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

4,487 posts Joined: Mar 2014 |

QUOTE(MUM @ Mar 8 2023, 10:31 AM) My thoughts.That was performance and benchmark for May 22 correct? So if want to compare with FD, should compare with FD rate for May 21 (if take 12 month FD), not current FD rate. This post has been edited by Cubalagi: Mar 8 2023, 02:25 PM |

| Change to: |  0.4359sec 0.4359sec

0.53 0.53

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 02:34 AM |