QUOTE(rEvivEd- @ Apr 8 2022, 12:00 AM)

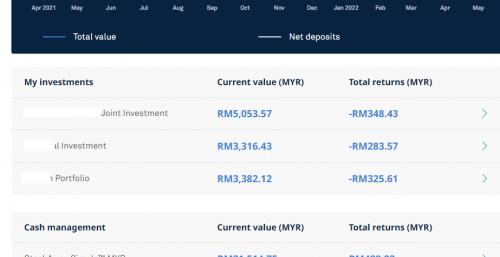

KDI is Kenanga Digital Investing - it's a very recent comer to the roboadvisor foray and their user experience have been very mixed so far to say the least. However, once you get over some quirks, it's offering is very good.In my allocated highest risk portfolio (Aggressive) contains majority VT, a handful of QQQ, SPY and BNDX, which are all very good broad based index to invest in. Their first RM3k invest is fee-free, but you will get charged an 0.3% forex fee on your deposit amount. If I did not have access to a DIY portfolio, I would happily put my money in KDI Invest.

Of course, they are still very, very new, I have no clue on how high their turnover rate is going to be and how actively they are going to mess with the portfolio. I wouldn't put too much money into it, so below the fee-free threshold seems good to try the waters.

I personally can recommend it over Stashaway if you are just starting out, just put RM2500 in it and don't look at it for a while. The rest and new funds you can continue in Stashaway at your selected risk portfolio.

This post has been edited by Hoshiyuu: Apr 8 2022, 12:21 AM

Apr 8 2022, 12:18 AM

Apr 8 2022, 12:18 AM

Quote

Quote

4.1803sec

4.1803sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled