QUOTE(melondance @ Mar 15 2022, 11:54 AM)

Yes, I hold VT because of the market cap weightage of global market. Should US outperform International or vice versa, VT can never beat both of them but should sit somewhere in the middle for performance. If US outperform, I win but not as much as holding US only ETF.

I am not comfortable with holding near to 30% International stocks... so I chose SCHD to reduce it to about 20%. I didnt choose VTI as there is a 58% weight overlap between VTI and VT. Seeing how the market is going right now, I feel more comfortable with its high quality value stock and almost 1/4 of them is midcap and smallcap companies which provide room for growth aswell. The 30% withholding tax is inevitable..

For Stashaway, you lose 30% to dividend withholding tax and 0.80% to management fee. I rather do it my way..

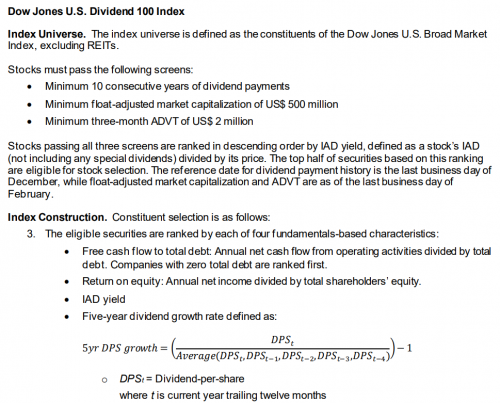

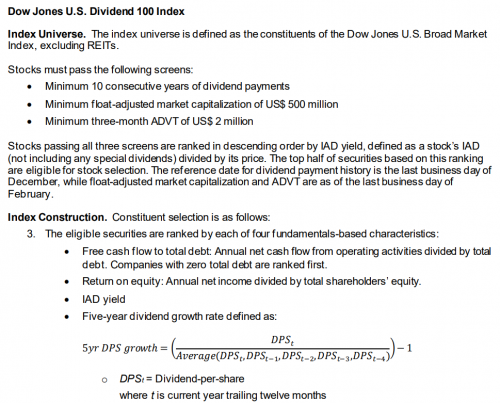

This is the underlying index (how the stocks are picked) for SCHD ETF

You should come swing by our LYN's Bogleheads thread Bogleheads Local Chapter [Malaysia Edisi], feel like you'd belong there I am not comfortable with holding near to 30% International stocks... so I chose SCHD to reduce it to about 20%. I didnt choose VTI as there is a 58% weight overlap between VTI and VT. Seeing how the market is going right now, I feel more comfortable with its high quality value stock and almost 1/4 of them is midcap and smallcap companies which provide room for growth aswell. The 30% withholding tax is inevitable..

For Stashaway, you lose 30% to dividend withholding tax and 0.80% to management fee. I rather do it my way..

This is the underlying index (how the stocks are picked) for SCHD ETF

Me myself are pretty happy with owning 30-40% international, non-US stocks, so my portfolio is VWRA (all world large-mid caps by market weight) + a little filtered small cap via AVUV/AVDV.

I pinged you not in the context of Stashaway, but in context of DIY - because both VT and SCHD generates quite a bit of dividend,

I think I've done the math before, DCA into VT vs VWRA for 7 years, VWRA will outperform VT by about 0.5% annualized return from dividend alone, whether that is large or small is up to you.

But SCHD's dividend heavy-ness will hurt your returns quite badly with the 30% withholding tax, are you sure you don't want to look for Irish-domiciled equivalent?

Mar 15 2022, 02:00 PM

Mar 15 2022, 02:00 PM

Quote

Quote

0.4566sec

0.4566sec

0.85

0.85

7 queries

7 queries

GZIP Disabled

GZIP Disabled