QUOTE(honsiong @ Aug 7 2021, 10:31 PM)

It’s China. I see it as good for citizens, bad for shareholders, thats it.

They may hurt some local investors, but 100% beneficiaries are at least their citizens.

If you can invest, you arent too poor, but the big tech monopolies can wreak havoc in their society if goes unchecked.

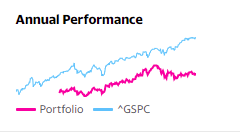

but as investor, the main objective is to earn money, everything else is irrelevant, hence the drop in KWEB share price.

If there is no plan on how to align with gov direction and bring confidence to investors, it is hard for investor like me to continue to believe in KWEB...

Anyway, i am not bashing SA, just voicing out for a healthy discussion.

QUOTE(pinksapphire @ Aug 7 2021, 10:33 PM)

What's your revised holding period based on these factors? Or no change?

I'm patient, so can still wait till next year to see if it's still as bad as it looks...unless it's severely hit, or better competitors come along, I'm gonna still let it park here for some years.

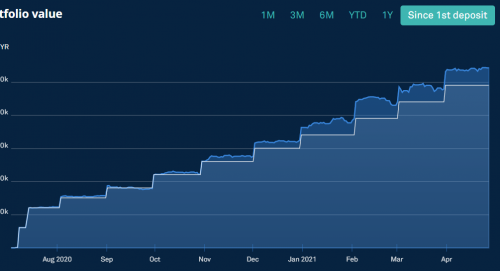

my plan is 5 years (until 2025) started back in 2020, normally in bear market, i would double down.

But with China gov doing the opposite, and without those companies in KWEB (or china gov) laying a positive plan, i am not sure, maybe will give till end of the year, if no change in plan, maybe will stop and invest somewhere else. Just my thought, again, not bashing SA.

This post has been edited by gundamsp01: Aug 7 2021, 11:00 PM

Feb 4 2021, 09:00 PM

Feb 4 2021, 09:00 PM

Quote

Quote

0.4626sec

0.4626sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled