That's why it's called StashAway. It is for people who have no time to do research and balance their portfolio.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Feb 5 2021, 09:43 PM Feb 5 2021, 09:43 PM

|

Junior Member

369 posts Joined: Jul 2010 |

That's why it's called StashAway. It is for people who have no time to do research and balance their portfolio.

|

|

|

|

|

|

Feb 5 2021, 11:19 PM Feb 5 2021, 11:19 PM

Show posts by this member only | IPv6 | Post

#11662

|

Junior Member

75 posts Joined: Jun 2015 |

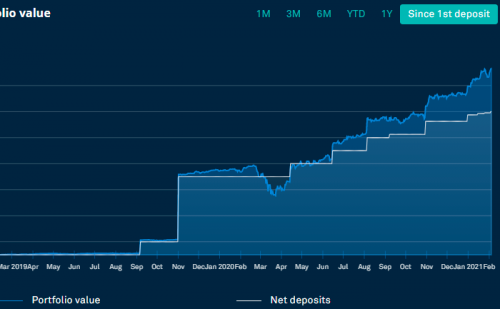

QUOTE(Jitty @ Feb 5 2021, 11:06 AM) can see see some screenshot? This is amazing for the time you invested, please may I ask, which risk portfolio did you choose for this returns ?cant be that low. My MWR and TWR is Money-weighted return 59.47% Time-weighted return 48.48% I start investing to SAMY September 2019. About 1yr and 4 months ago  |

|

|

Feb 6 2021, 09:07 AM Feb 6 2021, 09:07 AM

|

Junior Member

296 posts Joined: Aug 2012 From: Subang Jaya |

QUOTE(AnasM @ Jan 31 2021, 10:59 PM) Usually come in 3 components where they charge you:1. Sales charge (5-6%, some even double charge you when withdrawal) 2. Annual management fees (for equities usually about 1~2%) 3. Expense ratio (depending on which UT fund) For UTs, you have to really believe in the fund managers/organization to actively manage your fund to outperform the benchmark/market. Although past performance does not indicate future performance, 70% actively managed fund cant even bear the S&P Composite 1500 (Source: https://www.forbes.com/sites/lcarrel/2020/0...h=7b792ab947b0). Stashaway's selling point is taking your trigger finger and emotions of your investment journey, while providing consistent returns. If you were to understand the fundamentals of ETFs (the main vehicle of SA's investments), it was never to beat the market, but more of tracking the market. That's why each ETF has crazy amount of holdings and stakes in so many companies and businesses. With SA, you are not tied to your emotions in terms of what to buy or sell, or react rashly to market news or outcomes, just let it's algorithm do the diversification and balancing, while you consistently DCA into it. If UTs can outperform SA, hooray great for you, but most of us do not have the time or effort to research on the thousands of UTs out there, comparing the charges, the underlying assets, geographical allocation etc. We just want consistent returns for the future, hence SA. |

|

|

Feb 6 2021, 09:15 AM Feb 6 2021, 09:15 AM

Show posts by this member only | IPv6 | Post

#11664

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(infernape772 @ Feb 6 2021, 09:07 AM) ...With SA, you are not tied to your emotions in terms of what to buy or sell, or react rashly to market news or outcomes, just let it's algorithm do the diversification and balancing, while you consistently DCA into it... Haha, unfortunately from what I have been reading, the freedom and ease SA provided for managing it also seems to let people change portfolio every other week and stop depositing when there is a dip then regret and top-up after when it's up... no wonder cannot reach projected gains. infernape772 and DragonReine liked this post

|

|

|

Feb 6 2021, 10:00 AM Feb 6 2021, 10:00 AM

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Hoshiyuu @ Feb 6 2021, 09:15 AM) Haha, unfortunately from what I have been reading, the freedom and ease SA provided for managing it also seems to let people change portfolio every other week and stop depositing when there is a dip then regret and top-up after when it's up... no wonder cannot reach projected gains. These are the people who never read or learn the very basics of investing to begin with and overestimate their risk appetite This is the main weakness of robo advisor in that unlike dealing with a financial advisor who helps you plan to invest, robo advisor is reliant on your self-declaration and your own management. It's easy to use, but some people shouldn't be given easy mode to start off (personally I underestimated my risk appetite and invested too safely for first few months oops, now that I switch to higher risk I'm happier to watch the ups and downs happen) thecurious liked this post

|

|

|

Feb 6 2021, 11:08 AM Feb 6 2021, 11:08 AM

Show posts by this member only | IPv6 | Post

#11666

|

Junior Member

109 posts Joined: Sep 2019 |

There was a question raised in this week's Market Commentary about the returns if you opted in or out of the auto re-optimisation of portfolio.

Here's the answer from the CIO, Quote "And now the final point is in terms of actual data; what's the difference in performance? In the very, very long term, actually, total returns have very small differences, but the volatility of getting there, the path of getting there, the way we get there has become a lot more stable, a lot less volatile with the re-optimisation. So this means that if you divide the return by volatility, the risk-adjusted return actually becomes significantly improved with the re-optimisation." Link below: https://youtu.be/uoy4A2RLe_Y |

|

|

|

|

|

Feb 6 2021, 12:44 PM Feb 6 2021, 12:44 PM

|

Junior Member

296 posts Joined: Aug 2012 From: Subang Jaya |

QUOTE(Hoshiyuu @ Feb 6 2021, 09:15 AM) Haha, unfortunately from what I have been reading, the freedom and ease SA provided for managing it also seems to let people change portfolio every other week and stop depositing when there is a dip then regret and top-up after when it's up... no wonder cannot reach projected gains. People should learn that time in the market beats timing the market. Rebalancing and changing your portfolio would mean buying and selling certain ETFs in your portfolio, taking away the potential gains throughout that transaction time period. DragonReine liked this post

|

|

|

Feb 6 2021, 02:37 PM Feb 6 2021, 02:37 PM

|

Senior Member

1,046 posts Joined: Nov 2014 |

QUOTE(Xenopher @ Feb 5 2021, 12:32 PM) Either one or more of the below: agree with sifus here. 1. Panic withdraw during market dip 2. Fear of missing out and pump a lot more during market raise 3. Switch to lower risk index during market dip 4. Switch to higher risk index during market raise Easy method that works for almost everyone: Consistently 'stash away' a portion of active income and ignore for 10-30 years. DCA nia. no matter is Rm 10 per week or Rm 100 per week or Rm 1000 per week. sedikit sedikit, lama lama jadi bukit. |

|

|

Feb 6 2021, 02:42 PM Feb 6 2021, 02:42 PM

|

Junior Member

74 posts Joined: Nov 2008 From: KUALA LUMPUR |

|

|

|

Feb 6 2021, 02:51 PM Feb 6 2021, 02:51 PM

|

Senior Member

1,046 posts Joined: Nov 2014 |

|

|

|

Feb 6 2021, 02:53 PM Feb 6 2021, 02:53 PM

|

Junior Member

74 posts Joined: Nov 2008 From: KUALA LUMPUR |

|

|

|

Feb 6 2021, 02:53 PM Feb 6 2021, 02:53 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

|

|

|

Feb 6 2021, 03:02 PM Feb 6 2021, 03:02 PM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(honsiong @ Feb 6 2021, 02:53 PM) In that manner you are actually lump sum. Dca is actually those who are sitting on a pile of cash, actually choosing to slowly invest over time. By the time you are dca'ing every month out of your regular income, that is actually lump sum. |

|

|

|

|

|

Feb 6 2021, 04:45 PM Feb 6 2021, 04:45 PM

|

Junior Member

244 posts Joined: Jul 2008 |

|

|

|

Feb 6 2021, 04:50 PM Feb 6 2021, 04:50 PM

Show posts by this member only | IPv6 | Post

#11675

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Feb 6 2021, 05:00 PM Feb 6 2021, 05:00 PM

|

Senior Member

1,537 posts Joined: Jul 2008 |

QUOTE(lee82gx @ Feb 6 2021, 03:02 PM) In that manner you are actually lump sum. Dca is actually those who are sitting on a pile of cash, actually choosing to slowly invest over time. By the time you are dca'ing every month out of your regular income, that is actually lump sum. hahahaha so if technicality mattersmy RM1000 per month "lumpsum" is not the same as your RM1000 per month "DCA" because your available cash is RM100k ? Barricade liked this post

|

|

|

Feb 6 2021, 05:02 PM Feb 6 2021, 05:02 PM

Show posts by this member only | IPv6 | Post

#11677

|

Junior Member

689 posts Joined: Mar 2020 |

|

|

|

Feb 6 2021, 05:07 PM Feb 6 2021, 05:07 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

For stashaway, I think lump sum is fine because they invest in multiple distinct asset classes. By right, it won't be like all asset classes drop at the same time. If that happens, that means fiat money is appreciating which is a bit unthinkable in long run. If you say 100% equities portfolio, then yea DCA may be safer. But for a mixed portfolio like stashaway, YOLO and lump sum should be fine. Not investing your cash is the same as taking long position in cash. This post has been edited by honsiong: Feb 6 2021, 05:08 PM SithBuster, Quazacolt, and 3 others liked this post

|

|

|

Feb 6 2021, 05:27 PM Feb 6 2021, 05:27 PM

Show posts by this member only | IPv6 | Post

#11679

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(stormseeker92 @ Feb 6 2021, 05:02 PM) but, how about now is the peak and the coming few year (let say 5 or 10 year ) baru dia recovery from the dip? that why i say DCA + timing (spare , may b a few hundred monthly, to top in case dip is coming) may b u r right, now is the lower and for the coming few year it will rally...... u will only know after a few year ... ur money, ur choice.... i make my choice, others ppl just reference.... |

|

|

Feb 6 2021, 05:37 PM Feb 6 2021, 05:37 PM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Pewufod @ Feb 6 2021, 05:00 PM) hahahaha so if technicality matters its not a technicality. it is the truth, if you have 100k cash marked for investment, sitting on it and spreading it out over 100 months, it is by definition "averaging"my RM1000 per month "lumpsum" is not the same as your RM1000 per month "DCA" because your available cash is RM100k ? Sure, 1000 per month of your regular income also achieves the same effect regardless of whether you had 100k in your Savings or not, but in reality we are trying to talk about 100k, not the 1000. The longer you drag it out in a bull market the less harder it will work for you. |

| Change to: |  0.0255sec 0.0255sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 01:09 PM |