QUOTE(stormseeker92 @ Jan 14 2021, 12:24 AM)

Just DCA with any amount you'll be comfortable investing and will not need in the near future.

Dont mind the ups and downs. Long term stonks always go up

Dont mind the ups and downs. Long term stonks always go up

QUOTE(ironman16 @ Jan 14 2021, 12:43 AM)

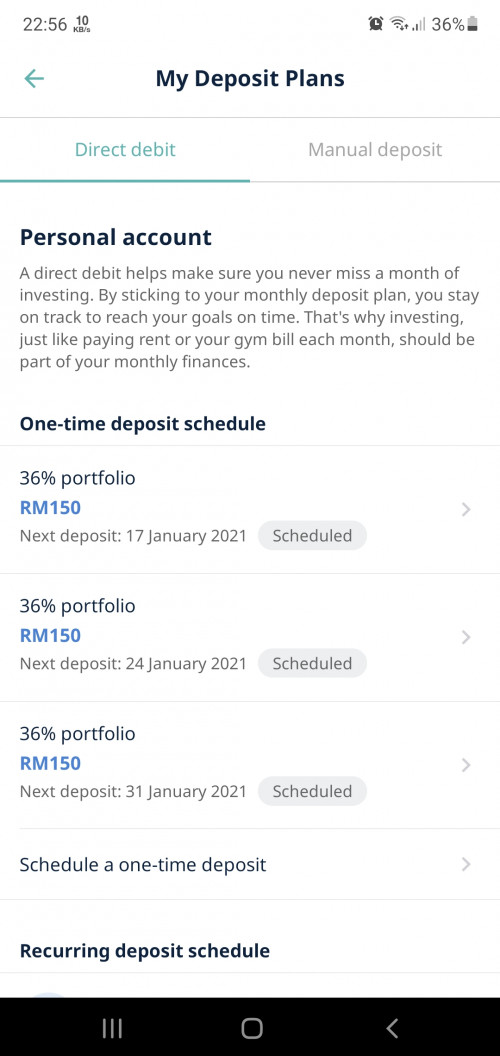

With amount i'm comfortable probably RM600 monthly, which will seperated weekly RM150.00

Izzit too small for me to start with

Beside of setting schedule one time deposit in SA app (each setup take me 30 seconds), any other recommended convenience way?

It doesn't cost me "more" that if i doing weekly dca comparing to monthly dca right?

Worried if there is any "hidden charge" like i have to pay sales charge per deposit or etc

Btw i'm aware that there is account management fee subject to 1.5% or etc

So i have to put some 'referral code' into somewhere, where can i do this, i saw in previous post that had to contact CS to manually submit the 'free management fee' code

Jan 14 2021, 01:29 PM

Jan 14 2021, 01:29 PM

Quote

Quote

0.0240sec

0.0240sec

0.93

0.93

6 queries

6 queries

GZIP Disabled

GZIP Disabled