QUOTE(backspace66 @ Jan 11 2021, 04:13 PM)

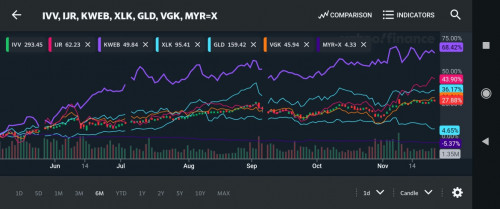

I find it quite weird to see you time the market based on forex, did you check the underlying etf price before you consider that?

It would be better to take all the underlying etf into consideration in term of myr. Based on your logic, one should not invest during march crash since USD/MYR is pretty high back then. You get "less" USD.

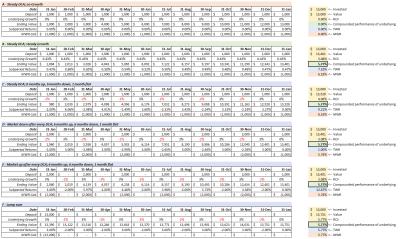

Of course I did on the FX conversion spot rate on to USD with prices to buy ETF in USD with comparison on levels which is when to buy ETF price which mine strategy is different due to weekly monitoring

I will cash out my gains just my returns when the USD is stronger against the RM wand ETF prices is on range trading otherwise just adjust the risk 30 to 36 or vice versa

March was not the time to invest but May was because FX conversion and it’s ETF was rock bottom then which I bought into it then when my money was on Simple since Jan to May

QUOTE(pinksapphire @ Jan 11 2021, 05:02 PM)

Thanks, I think I'm getting what you're saying.

Also, mine is on 36% RI, and I plan to put in lump sum, maybe more when the USD is weak now. Later probably will DCA when I know how much I should put in, lol

If put lump sum at 36% just be patient because the gains will show within 3 to 6 months

Jan 11 2021, 01:42 PM

Jan 11 2021, 01:42 PM

Quote

Quote

0.0279sec

0.0279sec

0.68

0.68

6 queries

6 queries

GZIP Disabled

GZIP Disabled