Outline ·

[ Standard ] ·

Linear+

EPF - self contribution, need advise

|

RigerZ

|

Feb 25 2023, 06:27 PM Feb 25 2023, 06:27 PM

|

|

So, this new/additional RM3,000 tax relief is specifically for self-contribution. Whereas the current RM4000 relief doesnt specify what kind of contribution, it only says "EPF contributions". So I am guessing this refers to the automatic contribution which is deducted from your salary? Or can it also be combined with self-contribution until the RM4000 limit? All this while I thought the RM4000 relief was only for self contribution  Attached thumbnail(s) Attached thumbnail(s)

|

|

|

|

|

|

MUM

|

Feb 26 2023, 12:22 AM Feb 26 2023, 12:22 AM

|

|

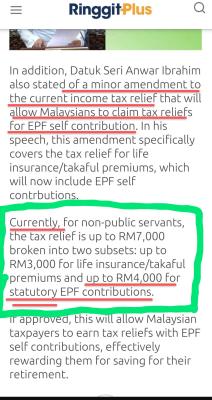

QUOTE(RigerZ @ Feb 25 2023, 06:27 PM) So, this new/additional RM3,000 tax relief is specifically for self-contribution. Whereas the current RM4000 relief doesnt specify what kind of contribution, it only says "EPF contributions". So I am guessing this refers to the automatic contribution which is deducted from your salary? Or can it also be combined with self-contribution until the RM4000 limit? All this while I thought the RM4000 relief was only for self contribution  I got this info as per image from this site, ... https://ringgitplus.com/en/blog/budget-2023...20contributions. Attached thumbnail(s)

|

|

|

|

|

|

RigerZ

|

Feb 26 2023, 07:11 AM Feb 26 2023, 07:11 AM

|

|

QUOTE(MUM @ Feb 26 2023, 12:22 AM) Yes I saw this too. So lets say my statutory contribution in a year is RM2000 And then I self contribution another RM3000 I can only claim tax relief for RM2000? |

|

|

|

|

|

kiddokitt

|

Feb 26 2023, 07:31 AM Feb 26 2023, 07:31 AM

|

|

QUOTE(RigerZ @ Feb 26 2023, 07:11 AM) Yes I saw this too. So lets say my statutory contribution in a year is RM2000 And then I self contribution another RM3000 I can only claim tax relief for RM2000? No, from my understanding of what I read, it’s RM4000. Total up both statutory and self-contribution to add up to 4000. |

|

|

|

|

|

MUM

|

Feb 26 2023, 08:49 AM Feb 26 2023, 08:49 AM

|

|

QUOTE(RigerZ @ Feb 26 2023, 07:11 AM) Yes I saw this too. So lets say my statutory contribution in a year is RM2000 And then I self contribution another RM3000 I can only claim tax relief for RM2000? I got this from https://www.yycadvisors.com/can-claim-epf-t...ontributes.html..... I believe that, that tax advise was published and applicable before the latest budget 2023 announcement This post has been edited by MUM: Feb 26 2023, 08:58 AM Attached thumbnail(s)

|

|

|

|

|

|

CommodoreAmiga

|

Feb 26 2023, 08:56 AM Feb 26 2023, 08:56 AM

|

|

QUOTE(MUM @ Feb 26 2023, 08:49 AM) Means if employed cannot claim, but if runs own Nasi Lemak stall can claim? |

|

|

|

|

|

MUM

|

Feb 26 2023, 09:03 AM Feb 26 2023, 09:03 AM

|

|

QUOTE(CommodoreAmiga @ Feb 26 2023, 08:56 AM) Means if employed cannot claim, but if runs own Nasi Lemak stall can claim? Yes, That is what I read and interpret from that too. Added with my earlier posted image from ringgitplus too ( notice the mention "statutory epf contribution") That is probably why budget 2023 added in specifically "self contribuition" (both in wording and criteria.) This post has been edited by MUM: Feb 26 2023, 09:14 AM Attached thumbnail(s)

|

|

|

|

|

|

Cyclopes

|

Feb 27 2023, 10:49 AM Feb 27 2023, 10:49 AM

|

|

"The EPF welcomes the initiative to expand the scope of annual tax relief for life insurance premiums or life takaful contributions to cover voluntary contributions to the EPF of up to RM3,000. This initiative can be enjoyed by all workers, both in the formal or informal sector, who make voluntary contributions to the EPF. This means that a member who contributes compulsorily (tax relief up to RM4,000) and increases savings with voluntary contributions will be able to enjoy tax relief of up to RM7,000. This effort will encourage more Malaysians to increase their retirement savings for old age."

If both your mandatory EPF plus insurance premium totals less than RM7,000, you can now top up the difference as voluntary contribution. These will also be a good time to relook on the insurance premium you are currently paying.

This post has been edited by Cyclopes: Feb 27 2023, 11:00 AM

|

|

|

|

|

|

romuluz777

|

Feb 27 2023, 10:56 AM Feb 27 2023, 10:56 AM

|

|

QUOTE(MUM @ Feb 26 2023, 09:49 AM) I got this from https://www.yycadvisors.com/can-claim-epf-t...ontributes.html..... I believe that, that tax advise was published and applicable before the latest budget 2023 announcement Sounds like self-employed contributor has the same status as a salaried contributor, enjoying the same tax relief categorization as the latter. |

|

|

|

|

|

MUM

|

Feb 27 2023, 11:20 AM Feb 27 2023, 11:20 AM

|

|

QUOTE(romuluz777 @ Feb 27 2023, 10:56 AM) Sounds like self-employed contributor has the same status as a salaried contributor, enjoying the same tax relief categorization as the latter. Perhaps they are trying to tap into the civil servants... |

|

|

|

|

|

Afterburner1.0

|

Feb 27 2023, 11:39 AM Feb 27 2023, 11:39 AM

|

|

so banyak hoo haa... eh u all not interested to know if EPF self contribution still stands at 60K per yr or is it 100K per yr as proposed in the Dec 2022 budget? Why no mentioned at all this round by anwar? suddenly dissapear from radar this topic???? anyone got updates?

|

|

|

|

|

|

romuluz777

|

Feb 27 2023, 11:51 AM Feb 27 2023, 11:51 AM

|

|

QUOTE(Afterburner1.0 @ Feb 27 2023, 12:39 PM) so banyak hoo haa... eh u all not interested to know if EPF self contribution still stands at 60K per yr or is it 100K per yr as proposed in the Dec 2022 budget? Why no mentioned at all this round by anwar? suddenly dissapear from radar this topic???? anyone got updates? thats the Bermuda Triangle of EPF discussions. We shall find out soon after the Budget 2023 is passed in Parliament. |

|

|

|

|

|

Afterburner1.0

|

Feb 27 2023, 11:55 AM Feb 27 2023, 11:55 AM

|

|

QUOTE(romuluz777 @ Feb 27 2023, 11:51 AM) thats the Bermuda Triangle of EPF discussions. We shall find out soon after the Budget 2023 is passed in Parliament. Can't believe nobody is highlighting this n pushing for it.... EPF is for ur old age MF! lol.... when will it b tabled in parliament? |

|

|

|

|

|

Cyclopes

|

Feb 27 2023, 12:01 PM Feb 27 2023, 12:01 PM

|

|

QUOTE(Afterburner1.0 @ Feb 27 2023, 11:55 AM) Can't believe nobody is highlighting this n pushing for it.... EPF is for ur old age MF! lol.... when will it b tabled in parliament? B40 don't have 40K that they can save (untouched) long term. |

|

|

|

|

|

Afterburner1.0

|

Feb 27 2023, 12:03 PM Feb 27 2023, 12:03 PM

|

|

QUOTE(Cyclopes @ Feb 27 2023, 12:01 PM) B40 don't have 40K that they can save (untouched) long term. the increase is good for those M40 & T20 that has lots of spare cash.... n prob will help reload the EPF acc once B40 all take out alredi.... |

|

|

|

|

|

confusedway

|

Feb 27 2023, 12:31 PM Feb 27 2023, 12:31 PM

|

|

QUOTE(confusedway @ Feb 25 2023, 11:16 AM) • KWSP o Kajian semula pelepasan cukai bagi caruman mandotari/sukarela kepada skim yang diluluskan/ KWSP dan premium insurans nyawa atau takaful hayat atau caruman sukarela tambahan kepada KWSP o Menaikkan had caruman sukarela KWSP daripada RM60,000 kepada RM100,000 setahun https://budget.mof.gov.my/pdf/belanjawan202...-touchpoint.pdfFrom MOF and the link mention is Budget 2023 (24 Feb 2023) thus i belief you can trust this... Search KWSP... QUOTE(Afterburner1.0 @ Feb 27 2023, 11:39 AM) so banyak hoo haa... eh u all not interested to know if EPF self contribution still stands at 60K per yr or is it 100K per yr as proposed in the Dec 2022 budget? Why no mentioned at all this round by anwar? suddenly dissapear from radar this topic???? anyone got updates? |

|

|

|

|

|

MUM

|

Feb 27 2023, 12:33 PM Feb 27 2023, 12:33 PM

|

|

QUOTE(Afterburner1.0 @ Feb 27 2023, 11:39 AM) so banyak hoo haa... eh u all not interested to know if EPF self contribution still stands at 60K per yr or is it 100K per yr as proposed in the Dec 2022 budget? Why no mentioned at all this round by anwar? suddenly dissapear from radar this topic???? anyone got updates? Check this post and its link.. Attached thumbnail(s)

|

|

|

|

|

|

confusedway

|

Feb 27 2023, 12:40 PM Feb 27 2023, 12:40 PM

|

|

QUOTE(MUM @ Feb 26 2023, 09:03 AM) Yes, That is what I read and interpret from that too. Added with my earlier posted image from ringgitplus too ( notice the mention "statutory epf contribution") That is probably why budget 2023 added in specifically "self contribuition" (both in wording and criteria.) Refer to https://budget.mof.gov.my/pdf/belanjawan202...oint-budget.pdfPage 36 • KWSP o Scope of tax relief for life insurance premiums or life takaful contributions is expanded to include voluntary contributions to EPF up to RM3,000 this part read like existing rm3k on life insurance whereby people have not fully utilised now expend to self contribution... meaning if life insurance you only able to claim 2k and you can topup 1k (self contribution but not statutory contribution by the way of 11% deduction) can now (2023) be consider as relief... |

|

|

|

|

|

Afterburner1.0

|

Feb 27 2023, 12:55 PM Feb 27 2023, 12:55 PM

|

|

Thanks for the updates... so its confirm epf self contribution is now 60K to 100K per yr.... starting when ah?

|

|

|

|

|

|

MUM

|

Feb 27 2023, 01:07 PM Feb 27 2023, 01:07 PM

|

|

QUOTE(Afterburner1.0 @ Feb 27 2023, 12:55 PM) Thanks for the updates... so its confirm epf self contribution is now 60K to 100K per yr.... starting when ah? Depends on when it was approved. |

|

|

|

|

Feb 25 2023, 06:27 PM

Feb 25 2023, 06:27 PM

Quote

Quote

0.0171sec

0.0171sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled