Also, would like to ask sifus about S&P 500 ETFs.

Is there any reason not to consider ETFs like VTI/VOO from Vanguard. Assuming for 10 years long hold, the returns are almost the same, but the tracking error from Vanguard ETF is slightly better. The fees charged on Vanguard is 0.03% compared to 0.07% on CSPX.

Below are the data collected:

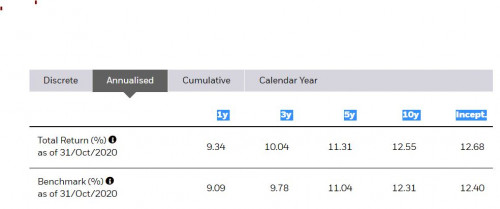

For iShare:

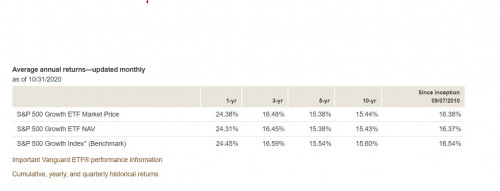

For VOO:

Also, while researching about VOO, I stumbled upon VOOG which offers better performance and looks promising albeit with the higher fees of 1.00% p.a.

VOOG:

Any thoughts on the above?

Nov 29 2020, 11:13 PM

Nov 29 2020, 11:13 PM

Quote

Quote

0.0543sec

0.0543sec

2.52

2.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled