They used to be 1k USD minimum @ TradeStation Global, as of 1st Dec they just changed that to minimum $2.5k USD holding (cash/stock portfolio) in TradeStation Global.

You can use InstaRem to transfer into IBKR (not in USD though) in other currencies (e.g. SGD), then do spot-rate conversion in IBKR ($2 commission) into USD. Or just use TransferWise if the nett amount is similar (and you can TransferWise directly into IBKR, tho they might be held back for days/weeks for review/audit). I tend to avoid TransferWise transfer into IBKR account and always go through my own overseas account.

For more on funding into TSGread more here:

Step-by-step to getting started via TradeStation Global (Interactive Brokers)For trading platform, with buy&hold long term strategy, TradeStation Global (Interactive Brokers) is one of the cheapest method (plus they have wide access to multiple markets), unless if you have got >100K USD portfolio/cash then can opt for Interactive Brokers directly since their fees are even cheaper.

For funding into trading platform, another alternative is TransferWise - and IBKR/TSG also allows direct funding (USD/EUR) into IBKR account via TransferWise - meaning one less conversion for you to do (tho IBKR's conversion rate is so cheap at spot rate, only $2 commissions). Can read more here if interested:

Step-by-step to getting started via TradeStation Global (Interactive Brokers)For the ETF differences - see below quote.

» Click to show Spoiler - click again to hide... «

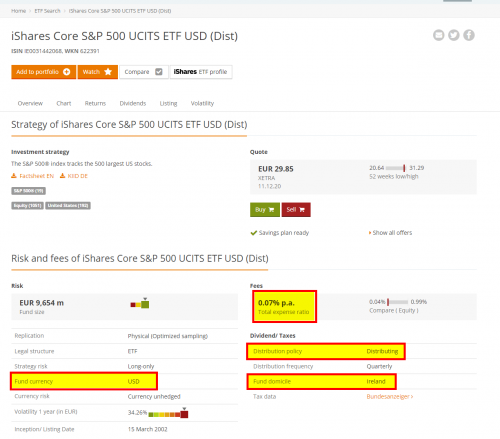

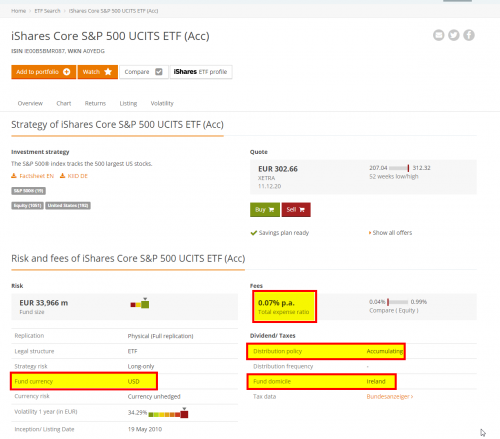

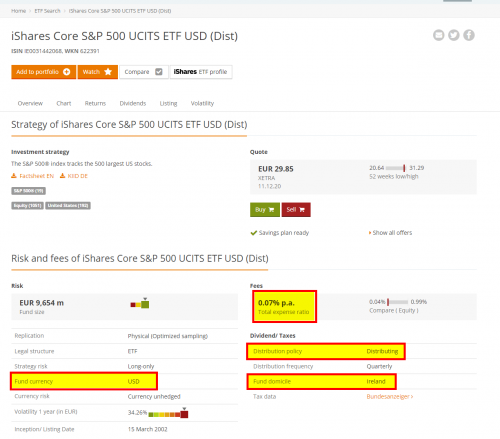

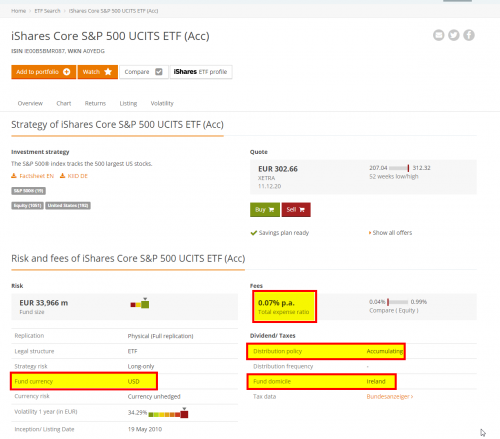

quote=polarzbearz,Dec 11 2020, 07:30 PM]Just two examples of exact same fund, look at distribution policy.

Other important things to look at are such as Currency, Fund Domicile, and Expense Ratio. Those examples were Domiciled in Ireland (

for 15% Witholding Tax for Malaysians, instead of 30% WHT if domiciled in the US) albeit in different currencies (but has same underlying shares)

"Distributing" (i.e. distributes dividend AFTER witholding tax to your brokerage account for manual reinvestment, or auto reinvestment by your brokerage with typical trade commissions)

https://www.justetf.com/en/etf-profile.html...in=IE0031442068"Accumulating"

https://www.justetf.com/en/etf-profile.html...in=IE0031442068"Accumulating" (i.e. accumulates dividend within your holdings AFTER witholding tax, without involving your brokerage hence no "trades" were involved)

https://www.justetf.com/en/etf-profile.html...in=IE00B5BMR087

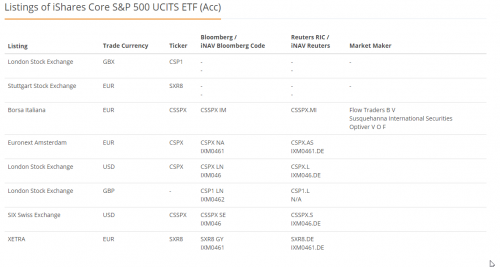

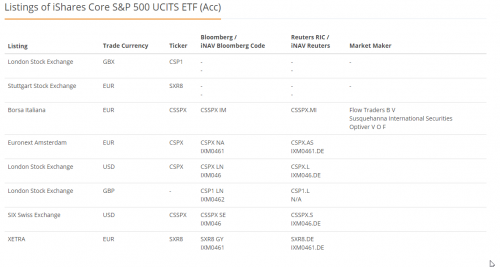

https://www.justetf.com/en/etf-profile.html...in=IE00B5BMR087Another thing to note - sometimes the EXACT SAME ETF will have listings in multiple stock exchanges

Read more:

https://forum.lowyat.net/topic/4744515https://forum.lowyat.net/topic/3396549

Dec 20 2020, 06:45 PM

Dec 20 2020, 06:45 PM

Quote

Quote

0.0517sec

0.0517sec

0.95

0.95

7 queries

7 queries

GZIP Disabled

GZIP Disabled