Outline ·

[ Standard ] ·

Linear+

[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

|

batman1172

|

May 19 2025, 02:04 PM May 19 2025, 02:04 PM

|

|

QUOTE(Eugenet @ May 19 2025, 01:27 PM) As far as I know, the only way to buy LSE is via Interactive Brokers (IBKR). Here's the thread: https://forum.lowyat.net/topic/4843925/+8420. |

|

|

|

|

|

Angry Clerk

|

May 20 2025, 12:22 PM May 20 2025, 12:22 PM

|

Getting Started

|

QUOTE(batman1172 @ May 19 2025, 02:04 PM) Min GBP 25 commission is a bit high if doing monthly DCA 😭 |

|

|

|

|

|

zebras

|

May 23 2025, 08:50 AM May 23 2025, 08:50 AM

|

|

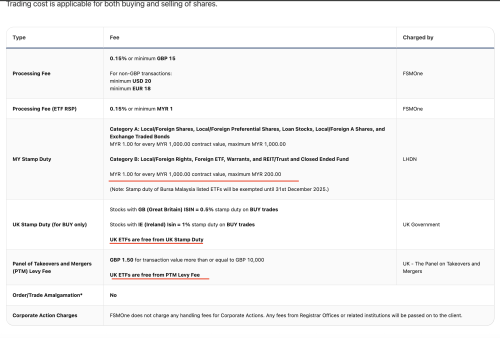

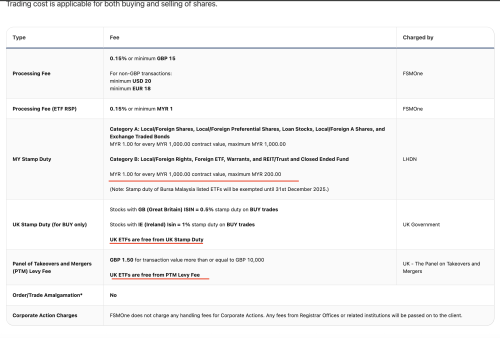

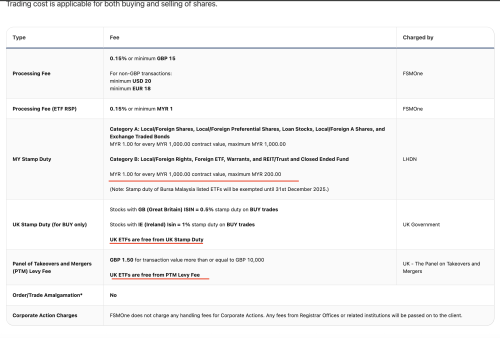

https://www.fsmone.com.my/funds/research/ar...-details/327341 https://www.fsmone.com.my/funds/research/ar...-details/327341fsmone 0 fee to DCA into LSE ETFs and from RM100, seems like the best way to DCA into SP500 |

|

|

|

|

|

Medufsaid

|

May 23 2025, 09:01 AM May 23 2025, 09:01 AM

|

|

zebras got malaysian stamp duty fee or not?  This post has been edited by Medufsaid: May 23 2025, 09:04 AM This post has been edited by Medufsaid: May 23 2025, 09:04 AM

|

|

|

|

|

|

zebras

|

May 23 2025, 09:10 AM May 23 2025, 09:10 AM

|

|

QUOTE(Medufsaid @ May 23 2025, 09:01 AM) zebras got malaysian stamp duty fee or not?   got it from their pricing, seems yes. RM1 for every RM1000, paying 0.1% stamp duty to government if DCA RM1000 per month. but it offer fractional LSE etfs though |

|

|

|

|

|

terriblyrawtea

|

May 23 2025, 01:15 PM May 23 2025, 01:15 PM

|

Getting Started

|

QUOTE(zebras @ May 23 2025, 09:10 AM)  got it from their pricing, seems yes. RM1 for every RM1000, paying 0.1% stamp duty to government if DCA RM1000 per month. but it offer fractional LSE etfs though 0.1% stamp duty honestly seems pretty alright. 0% processing fee, but after promo is atleast RM 1, or RM 1.5 (0.15%) for every RM 1000 - which also seems okay if im not calculating this wrong This post has been edited by terriblyrawtea: May 23 2025, 01:16 PM |

|

|

|

|

|

Angry Clerk

|

Jun 25 2025, 08:10 AM Jun 25 2025, 08:10 AM

|

Getting Started

|

QUOTE(zebras @ May 23 2025, 08:50 AM)  https://www.fsmone.com.my/funds/research/ar...-details/327341 https://www.fsmone.com.my/funds/research/ar...-details/327341fsmone 0 fee to DCA into LSE ETFs and from RM100, seems like the best way to DCA into SP500 QUOTE(Medufsaid @ May 23 2025, 09:01 AM) zebras got malaysian stamp duty fee or not?  Guys sorry if stupid question, to buy CSPX or VUAA? |

|

|

|

|

|

cempedaklife

|

Jun 25 2025, 10:45 AM Jun 25 2025, 10:45 AM

|

|

QUOTE(zebras @ May 23 2025, 08:50 AM)  https://www.fsmone.com.my/funds/research/ar...-details/327341 https://www.fsmone.com.my/funds/research/ar...-details/327341fsmone 0 fee to DCA into LSE ETFs and from RM100, seems like the best way to DCA into SP500 thanks to your information, i started the DCA. |

|

|

|

|

|

TSalexkos

|

Jul 1 2025, 04:36 PM Jul 1 2025, 04:36 PM

|

|

glad to find that there are more convenient ways for Malaysian these days to have SP500 exposures. It was unlike such many years back when the thread was started to help more people to find the cheapest way to get exposure on US equity.

This post has been edited by alexkos: Jul 1 2025, 04:37 PM

|

|

|

|

|

|

coyouth

|

Jul 4 2025, 09:54 AM Jul 4 2025, 09:54 AM

|

|

QUOTE(zebras @ May 23 2025, 08:50 AM)  https://www.fsmone.com.my/funds/research/ar...-details/327341 https://www.fsmone.com.my/funds/research/ar...-details/327341fsmone 0 fee to DCA into LSE ETFs and from RM100, seems like the best way to DCA into SP500 fees cheaper compared to IBKR? |

|

|

|

|

|

buffa

|

Jul 4 2025, 09:58 AM Jul 4 2025, 09:58 AM

|

|

QUOTE(coyouth @ Jul 4 2025, 09:54 AM) fees cheaper compared to IBKR? If you do DCA to those ETF, FSMOne is slightly cheaper. If you buy ETF manually, IBKR cheaper. |

|

|

|

|

|

SUSfuzzy

|

Jul 29 2025, 10:22 AM Jul 29 2025, 10:22 AM

|

|

My current broker is closing so imma porting out. Am thinking to port to IBKR, so anyone who wants to give me their referral please feel free.

|

|

|

|

|

|

jutamind

|

Jul 29 2025, 08:30 PM Jul 29 2025, 08:30 PM

|

|

Which broker is closing? QUOTE(fuzzy @ Jul 29 2025, 10:22 AM) My current broker is closing so imma porting out. Am thinking to port to IBKR, so anyone who wants to give me their referral please feel free. |

|

|

|

|

|

Ramjade

|

Jul 29 2025, 09:05 PM Jul 29 2025, 09:05 PM

|

|

QUOTE(fuzzy @ Jul 29 2025, 10:22 AM) My current broker is closing so imma porting out. Am thinking to port to IBKR, so anyone who wants to give me their referral please feel free. PMed |

|

|

|

|

|

kucingfight

|

Jul 30 2025, 05:04 PM Jul 30 2025, 05:04 PM

|

Look at all my stars!!

|

QUOTE(buffa @ Jul 4 2025, 09:58 AM) If you do DCA to those ETF, FSMOne is slightly cheaper. If you buy ETF manually, IBKR cheaper. how about if selling off ETF in future? what is the rate? |

|

|

|

|

|

buffa

|

Jul 30 2025, 08:13 PM Jul 30 2025, 08:13 PM

|

|

QUOTE(kucingfight @ Jul 30 2025, 05:04 PM) how about if selling off ETF in future? what is the rate? IIRC For odd lot, you can schedule sell only on 15 every month. Now Fees is FOC + Stamp duty by Malaysia. Next time Fee might be USD3.80, Normal lot if you want to sell any day, it will be USD3.80 + Stamp duty by Malaysia. |

|

|

|

|

|

genuinehuman

|

Aug 10 2025, 02:36 PM Aug 10 2025, 02:36 PM

|

|

Hi guys,

If I buy LSE ETF VUAA via fsmone platform

When I want to sell the ETF in fsmone platform, the ETF will sell to buyer from fsmone platform only (limited buyer) or to all buyer in LSE regardless of what platform (all buyer in the market)?

Just wondering how it work , if platform selection is a critical criteria since it is a long term investment i.e 10 years and above

Thank you !

This post has been edited by genuinehuman: Aug 10 2025, 02:37 PM

|

|

|

|

|

|

Medufsaid

|

Aug 10 2025, 02:43 PM Aug 10 2025, 02:43 PM

|

|

genuinehuman you'll sell using regular real time or sell using RSP? QUOTE There's rsp scheduled selling of ETFs at 0.15% (min MYR 1) for LSE Source here: https://support.fsmone.com.my/hc/en-us/arti...RSP-investments

|

|

|

|

|

|

genuinehuman

|

Aug 10 2025, 02:58 PM Aug 10 2025, 02:58 PM

|

|

QUOTE(Medufsaid @ Aug 10 2025, 02:43 PM) genuinehuman you'll sell using regular real time or sell using RSP? Hi Medufsaid, regular real time |

|

|

|

|

|

TSalexkos

|

Aug 13 2025, 02:39 PM Aug 13 2025, 02:39 PM

|

|

i am using moomoo recently and just found that our gomen charges 0.1% stamp duty on US stocks. I don't recall having this expense item when using foreign broker such as IBKR. Anyone gain exposure to US index fund thru moomoo can confirm this? btw there's an ongoing paid research survey (conducted by yours truly) targeting Malaysian passive investors. If your investing style is largely passive by nature, such as holding S&P 500 or related widely diversified index fund, then this research survey is for you.  » Click to show Spoiler - click again to hide... « https://forms.gle/69zK59Hb7czu97D7A This post has been edited by alexkos: Aug 13 2025, 02:41 PM |

|

|

|

|

May 19 2025, 02:04 PM

May 19 2025, 02:04 PM

Quote

Quote

0.0344sec

0.0344sec

0.75

0.75

6 queries

6 queries

GZIP Disabled

GZIP Disabled