QUOTE(Moneylust @ Jul 20 2019, 11:09 PM)

I am interested in GE's Great Love4u as well.

Questions:

1. Does the premium increase every year as I get older?

2. If I want to apply for OCBC's Great Eastern credit card - do I apply through GE agent or through OCBC branch?

3. Insurance beneficiary - can I name anyone? Even a friend with no blood ties?

4. Cannot add any riders, correct?

while waiting for responses,....I kay poh abit here...Questions:

1. Does the premium increase every year as I get older?

2. If I want to apply for OCBC's Great Eastern credit card - do I apply through GE agent or through OCBC branch?

3. Insurance beneficiary - can I name anyone? Even a friend with no blood ties?

4. Cannot add any riders, correct?

found these on google....

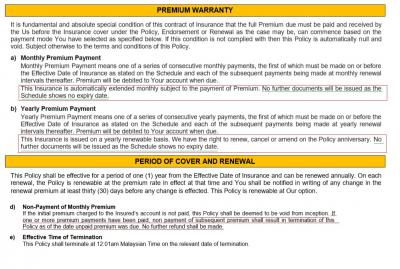

1. Does the premium increase every year as I get older?

Premiums are non guaranteed and may increase based on the attained age next birthday at policy anniversary. The Company reserves the right to revise the premiums of Great Love4u by giving at least 3 months’ advance notice.

https://www.greateasternlife.com/content/da...4u-brochure.pdf

2. If I want to apply for OCBC's Great Eastern credit card - do I apply through GE agent or through OCBC branch?

most probably have to go through OCBC bcos it is an OCBC credit card...

can try apply from ....

https://www.ocbc.com.my/personal-banking/Ca...tern-cards.html

3. Insurance beneficiary - can I name anyone? Even a friend with no blood ties?

You are free to nominate whoever you want. However, not all nominees will receive the policy moneys beneficially or for their own use.

......

Where the nominee is not the policy owner’s spouse or child or parent (if there is no living spouse or child at the time of nomination), the nominee will receive the policy moneys only as an executor and shall distribute it according to the will, or if there is no will, the applicable laws of distribution. In such a case, the policy is called a non-trust policy. The policy moneys form part of the deceased’s estate and are subjected to his debts.

http://www.insuranceinfo.com.my/_system/me...nominations.pdf

the category of nominees who would receive the policy monies beneficially, that is spouse, child or parent.

https://www.liam.org.my/index.php/library/c...w-sunday-times-

4. Cannot add any riders, correct?

since it does not required medical examination....i think/wild guess is cannot add in riders.....

caveat emptor...till confirmed by real insurance sifus....

This post has been edited by MUM: Jul 21 2019, 02:06 AM

Jul 21 2019, 01:17 AM

Jul 21 2019, 01:17 AM

Quote

Quote

0.0238sec

0.0238sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled