QUOTE(Holocene @ Feb 1 2019, 06:37 PM)

You mentioned that you received a confirmation email on 31/1/2019, what does the email say?

For an insurance policy to be issued/confirmed, premiums have to be paid first (cash before cover). If the policy has been issued/confirmed, then your agent might have paid the January premium for you.

Ask for the "registration fee" receipt. No receipt no pay. Easy.

Best,

Jiansheng

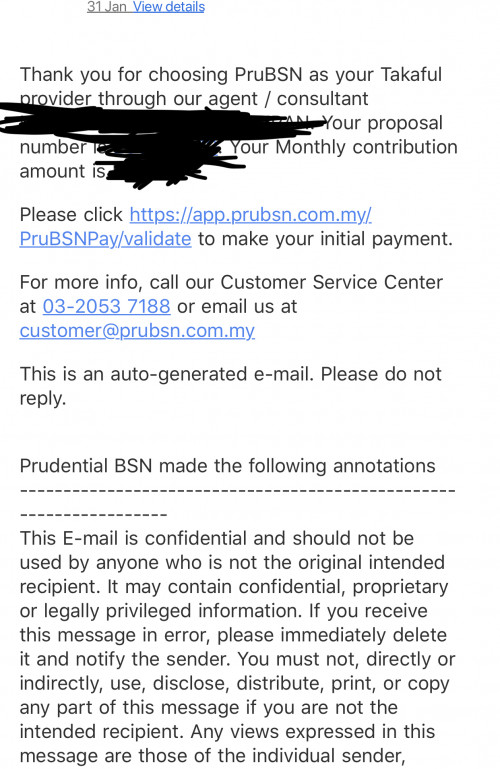

Email of 31/1 is To make first payment. However, agent said he paid for me already. Today i receive email saying that my policy is enforce on 1/2/2019.For an insurance policy to be issued/confirmed, premiums have to be paid first (cash before cover). If the policy has been issued/confirmed, then your agent might have paid the January premium for you.

Ask for the "registration fee" receipt. No receipt no pay. Easy.

Best,

Jiansheng

So actually im paying my february policy myself? I asked a friend who took insurance recently with prudential, there no ‘registration fee’. And no cashback from agent also.

So i feel like this so called ‘cashback’ for february actually doesnt even exist?

Feb 2 2019, 01:24 AM

Feb 2 2019, 01:24 AM

Quote

Quote 0.0318sec

0.0318sec

0.11

0.11

6 queries

6 queries

GZIP Disabled

GZIP Disabled