QUOTE(shawnme @ Jun 12 2023, 11:54 PM)

What a bummer for the middle of the night. Will have to rack my brain again for alternatives.

I expected these to happen, but still sucks when it does. Haha.

Well this was the initial hype of e-wallets I guess.

I mean it's good that the e-wallets enable more people to be cashless without the need to be using/applying for credit card.

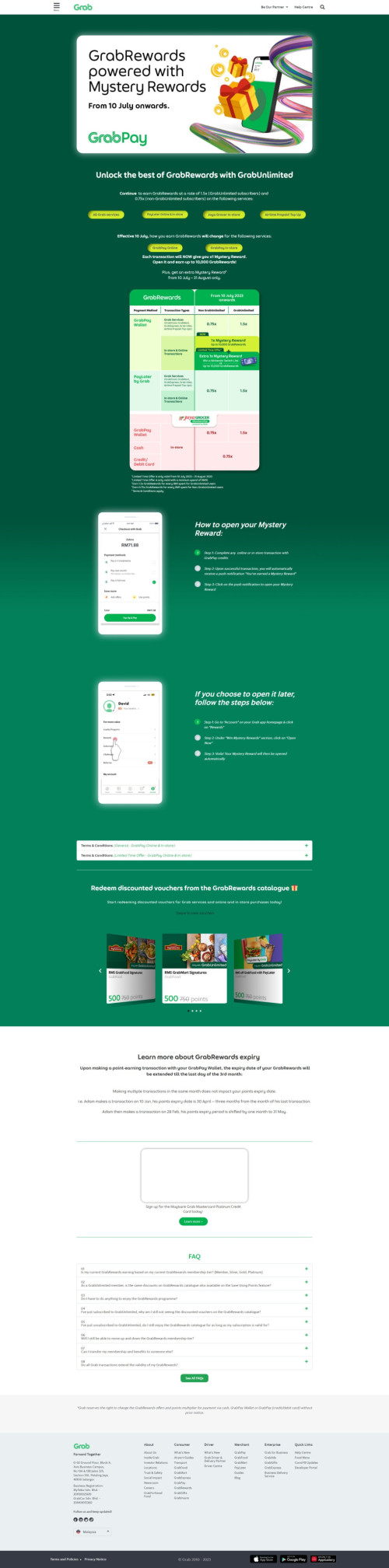

There are less and less added perks of using e-wallet as opposed to just credit/debit card that is tokenized / up and coming virtual tokens or cash or currencies (middle man still there).

So blatantly put, as long as there are credit cards that rewards e-wallet top up, using e-wallet will purely just be rewarding credit card users in places that do e-wallets.

» Click to show Spoiler - click again to hide... «

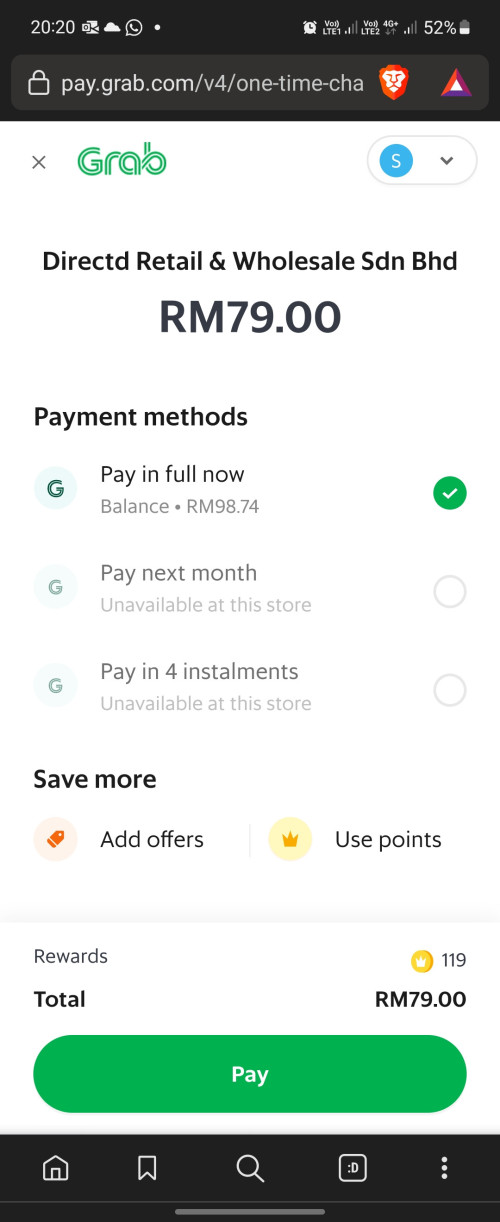

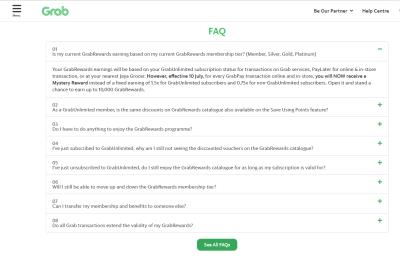

i.e. Grab Card by MBB

RM3 = 1 reward point for physical store

RM1 = 1 reward point for reloading Grab e-wallet

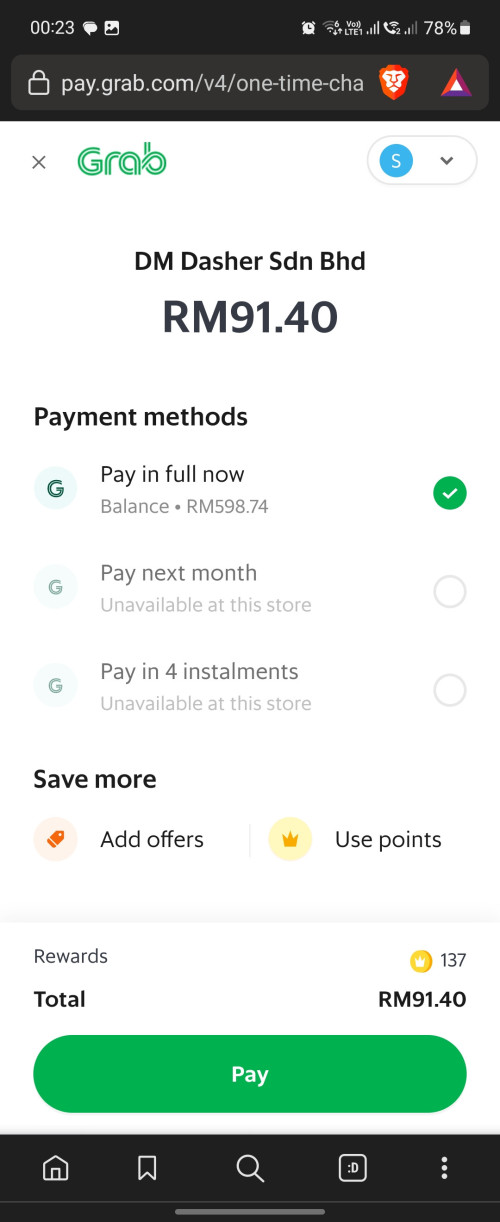

Physical store accepts both CC, GrabPay, Duitnow.

Use CC

RM300 = 100 point

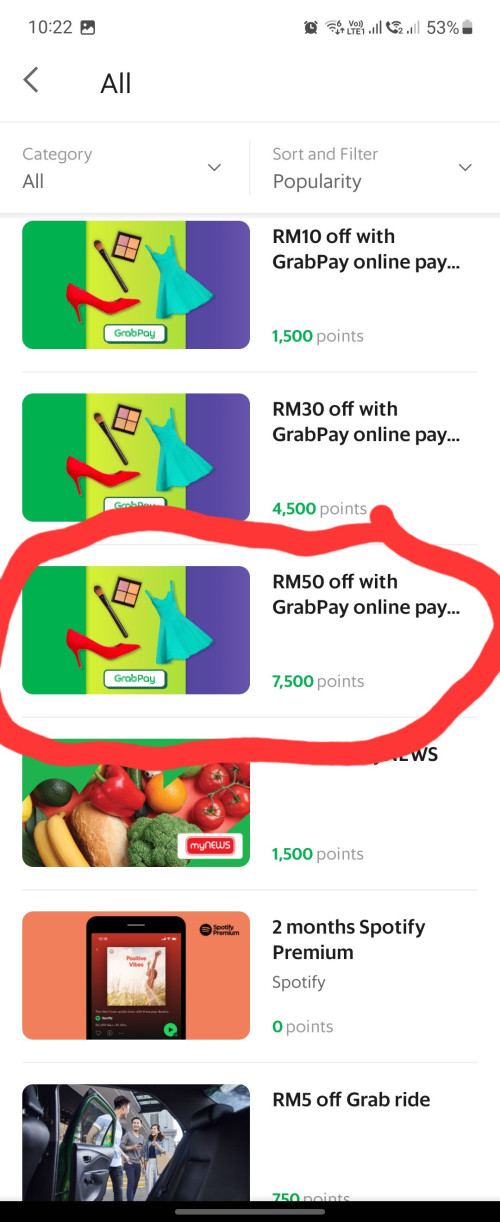

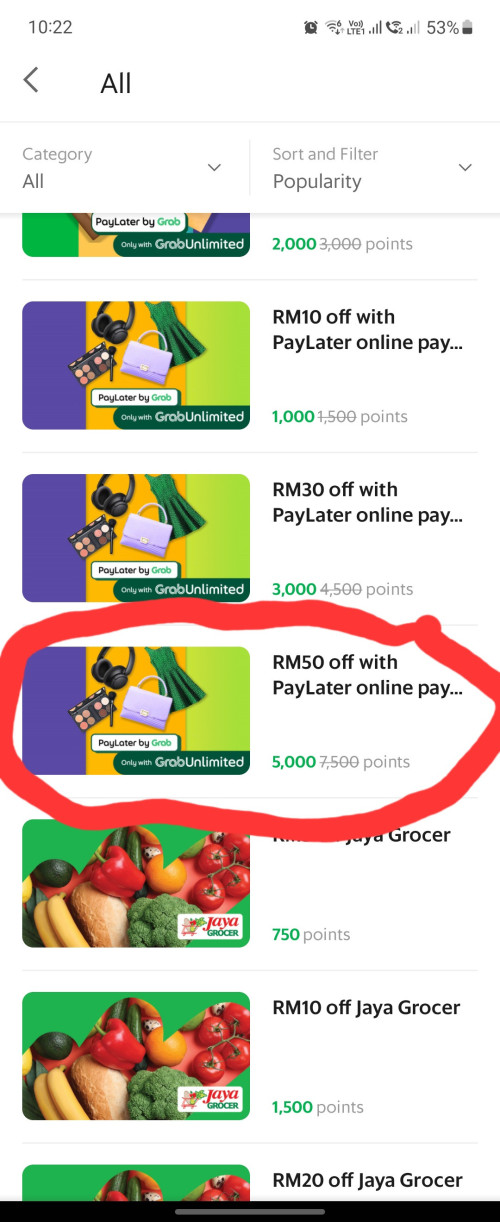

Use CC reload + GrabPay Unlimited

RM300 = 450 point (300 from CC, 150 from grab unlimited)

Use CC reload + Duitnow

RM300 = 300 points

Every reload, MBB/Mastercard/whichever acquirer charge Grab MDR of say 1% for easy calculation.

For every RM100 reloaded, user gets RM100,spends RM100 at shop.

Grab's MDR to merchant is say 1.5% (which is normal), so grab gets RM1.5.

RM1 goes to acquirer for the reload;

RM0.xx goes to reward points redemption eventually;

Grab has its own costs,

Technically, Grab only earns 0.x% could be lower.

We can see why not just grab but every other e-wallet operators tighten the pipe.

Until e-wallets themselves can receive direct bank in of cash / savings account like banks does, where they can circulate the cash within their own ecosystem without costs (even between banks to grab I believe also will have certain fees), e-wallet will continue to deteriorate.

Jun 1 2023, 10:08 AM

Jun 1 2023, 10:08 AM

Quote

Quote

0.2176sec

0.2176sec

1.01

1.01

6 queries

6 queries

GZIP Disabled

GZIP Disabled