x

This post has been edited by johnsonlim777: Jun 20 2020, 11:40 PM

Investment SOLASTA @ PERSIARAN DUTAMAS, Dutamas' Latest New Project

Investment SOLASTA @ PERSIARAN DUTAMAS, Dutamas' Latest New Project

|

|

Mar 28 2019, 06:45 PM Mar 28 2019, 06:45 PM

Return to original view | Post

#1

|

Newbie

44 posts Joined: Sep 2018 |

x

This post has been edited by johnsonlim777: Jun 20 2020, 11:40 PM |

|

|

|

|

|

Apr 1 2019, 10:52 AM Apr 1 2019, 10:52 AM

Return to original view | Post

#2

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(Joanne Alia @ Apr 1 2019, 10:40 AM) Apparently he recommended MCT Cyber South. If you want to see how bad the quality is, check out the public group here : https://www.facebook.com/groups/2196202403735945/ To be clear, I am not his competitor. I used to be his follower but I realised how greedy and unscrupulous Faizul has become. Guys, I urge you to share my initial post and make it go viral on social media. Let's expose these unethical business practices that are threatening our great society. This post has been edited by johnsonlim777: Apr 1 2019, 10:53 AM |

|

|

Apr 1 2019, 02:42 PM Apr 1 2019, 02:42 PM

Return to original view | Post

#3

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(kochin @ Apr 1 2019, 11:47 AM) aiyoh, everybody also need to cari makan mah. If you sell what you preach, then no problem. It is not wrong for a person/company to maximise profits, this is perfectly legal and encouraged (economic boost, job opportunities, etc.). What is totally wrong is engaging in marketing fraud. in the end, if one proceed without doing their own due diligence, they are fully responsible for their own action lor. When you promote properties or units that you have purchased yourself, this is called vested interest. When you give false promises/claims regarding the nature or quality of a product, this is called misrepresentation. MCT Cybersouth is a perfect example: https://www.facebook.com/groups/2196202403735945/ This post has been edited by johnsonlim777: Apr 1 2019, 04:30 PM |

|

|

Apr 1 2019, 04:29 PM Apr 1 2019, 04:29 PM

Return to original view | Post

#4

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(kochin @ Apr 1 2019, 02:51 PM) hhmmmm... i don't quite get you there. Ok I think the right term to use here is vested interest. I agree with you to a certain extent. a representative or a promoter of a product who uses the promoted product would be deemed conflict of interest? so if michael jordan promotes nike's air jordan, then it's bulls if he uses it? and if michael jackson promotes pepsi but never drinks it, then he should just should beat it? on the contrary i think it gives more assurance to a fans or followers if the promoter have their own skin in the game. shareholders like steve jobs, warren buffet, mark z, etc does it all the time. promoting their companies to shareholders to consider taking up or buying their shares. it will be scary if i would to buy from someone who preaches and promotes a firm that they have zero association with. are you referring to financial analyst that does stock recommendations? But if someone has bought units (with the understanding that the unit has many defects) but still claims that the developer is good, would you still buy them? This post has been edited by johnsonlim777: Apr 1 2019, 04:49 PM |

|

|

Apr 1 2019, 07:35 PM Apr 1 2019, 07:35 PM

Return to original view | IPv6 | Post

#5

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(Syahrim Naim @ Apr 1 2019, 07:18 PM) Isn’t it better that the person selling the project, buy the project himself together with his purchasers? I agree but you shouldn’t mislead people when you are aware of the true situation.Its his job to find good project. If he finds one and he didn’t buy, then you would say “he don’t even buy the project he said is good”. And aspartame, you don’t understand the grading system right? Oklah, share with us how you identify good and bad project. Look at MCT Cybersouth. Faizul said that the developer is good even though the units are full of defects. Btw when Faizul says he owns any units, do you think he owns the property 100%? You can be an owner by putting in RM1 (the rest can be covered by an unsuspecting JV partner) |

|

|

Apr 2 2019, 08:02 PM Apr 2 2019, 08:02 PM

Return to original view | IPv6 | Post

#6

|

Newbie

44 posts Joined: Sep 2018 |

This Syahrim Naim is from the Below Bank Value Group, Faizul’s partner sales agency.

Apparently these guys are purchasing a block too. Go and check his LinkedIn profile to verify yourself. Check it out here: https://www.linkedin.com/in/syahrim-naim-54...nalSubdomain=my So this guy is definitely biased. This post has been edited by johnsonlim777: Apr 3 2019, 04:09 PM |

|

|

|

|

|

Apr 3 2019, 10:40 AM Apr 3 2019, 10:40 AM

Return to original view | Post

#7

|

Newbie

44 posts Joined: Sep 2018 |

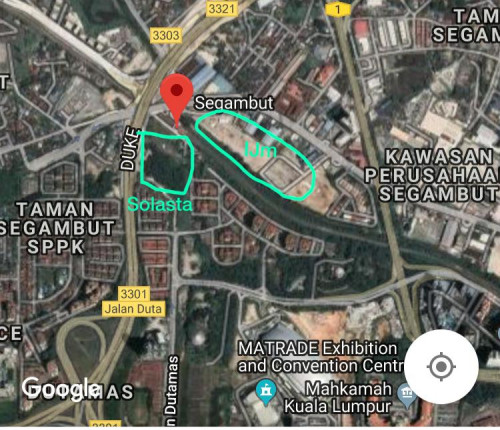

From what I know so far, there are 3 blocks for this development but Block B will be open to the public. How do I know this? I am one of the members of their bulk purchase group.

In short, Solasta Dutamas is an FR-endorsed project. If you come from his bulk purchase groups, he will 'encourage' you to purchase this project. In terms of similar property comparables around the area, they will benchmark it to Icon Residence (launched at ~RM1000psf- which is massively overpriced to start with) to justify their recommendation. Icon Residence was completed in 2015 by Mah Sing Group. However, I have only found 1 transaction on Brickz so far at RM754psf. You can check it out here --> https://www.brickz.my/transactions/resident...nce/non-landed/ Also, do note that a nearby development, Riana Dutamas is not doing well. How do I know this? IJM was promoting their units at the Mapex HOC 2019 property expo in KLCC. On whether KL Metropolis will become a potential booster, it is quite uncertain whether this will turn into a successful business hub. If you read the news, piling and engineering specialist Ikhmas Jaya Group Bhd's RM57.94 million contract has been terminated by TTDI KL Metropolis Sdn Bhd. Check it out here: https://www.theedgemarkets.com/article/ikhm...lopment-project  This post has been edited by johnsonlim777: Jun 20 2020, 11:36 PM |

|

|

Apr 3 2019, 11:14 AM Apr 3 2019, 11:14 AM

Return to original view | Post

#8

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(Syahrim Naim @ Apr 3 2019, 11:00 AM) Don't forget to compare with Arte, Solaris Parq and MET1 guys. The 3 developments that you mentioned are all new/future developments. Savio and Era are located in Jalan Segambut. You can built 10 bridges to cross into Dutamas but the address is still Jalan Segambut. This is big different. There's a big difference between launch price (what developers think the market will pay) and actual transacted price in the market (what the market will actually pay). Although Arte, Solaris Parq and Met1 are/will be launched at ~RM1,000psf, this doesn't mean that Solasta is a good buy at ~RM700psf. Arte, Solaris Parq and Met1 are all heavily mis-priced developments/ sold at future price points. A good case study would be Icon Residence. Mah Sing Group thought that the market would pay RM1,000psf for their properties but in reality, the market is only willing to pay up to ~RM750psf for their units. This is a significant price gap. Most property prices you see on Iproperty and Property Guru are just ‘asking prices’. Most sales agents know that people want discounts/rebates, so if you’re interested they will lower the price to entice you (so that you feel that you have earned something). This also means that the real price of the property is even lower than the listed price. This post has been edited by johnsonlim777: Apr 3 2019, 01:52 PM |

|

|

Apr 3 2019, 11:27 AM Apr 3 2019, 11:27 AM

Return to original view | Post

#9

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(Syahrim Naim @ Apr 3 2019, 11:18 AM) 1 transaction for Icon Residence at ~RM750psf doesn't mean that's it's the market price. If we look at the comps for non-landed properties in the Dutamas area, the psf price is only RM390psf (25th percentile) to RM647psf (75th percentile). Check it out here --> https://www.brickz.my/transactions/resident...mas/non-landed/ If we look at the comps for non-landed properties in the Segambut area (which in reality where Solasta would be more associated with), the psf price is only RM316psf (25th percentile) to RM510psf (75th percentile). Check it out here --> https://www.brickz.my/transactions/resident...but/non-landed/ This concludes that Solasta Dutamas is massively overpriced. Anyway guys, all I can I say is: never ask a barber if you need a haircut. This post has been edited by johnsonlim777: Apr 3 2019, 11:39 AM |

|

|

Apr 4 2019, 04:11 PM Apr 4 2019, 04:11 PM

Return to original view | Post

#10

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(hazwan_zohdi @ Apr 4 2019, 04:05 PM) So what's the point of buying thru him and buying as an outsider if all will get the same rebate kua? If this is true, this means that you are effectively paying the sales agent ("property guru") to purchase a property. Sounds like double dipping as the sales agent ("property guru") collects a) consultant fees from his followers ("investors") and b) sales commissions from the developer. FYI- You need to pay RM5k to purchase 1-3 properties (FAR Capital- 7 Digit Club), RM19k to purchase >3 properties (FAR Capital- 8 Digit Club). What a joke. This post has been edited by johnsonlim777: Apr 4 2019, 04:23 PM |

|

|

Apr 9 2019, 12:17 AM Apr 9 2019, 12:17 AM

Return to original view | IPv6 | Post

#11

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(hazwan_zohdi @ Apr 8 2019, 06:41 PM) FR is YNH’s superstar external sales agent. A top property development sells itself. If you’re a property developer and you know that your units are high in demand and will sell well: - Will you hire an external agent (pay him millions in sales commissions) to help sell your units? - Will you enter into underwriting agreements (a form of insurance to guarantee sales) with third parties/ sales agents? - Will you give a significant/ bulk purchase discount to attract buyers? |

|

|

Apr 17 2019, 10:53 AM Apr 17 2019, 10:53 AM

Return to original view | Post

#12

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(Syahrim Naim @ Apr 13 2019, 03:36 PM) Become client only 5k, not 20k. RM5k is to purchase 1-3 properties only (FAR Capital- 7 Digit Club). 5k is nothing la compared to buying at 20-30% lower than other projects. And as client, no need to buy other projects as well. You still need to pay RM19k if you want to purchase >3 properties (FAR Capital- 8 Digit Club). |

|

|

Apr 23 2019, 04:49 PM Apr 23 2019, 04:49 PM

Return to original view | Post

#13

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(brown.ho @ Apr 23 2019, 12:03 PM) 2nd possibility is likely. YNH not too dumb to sell at cheaper price. But once FR put upfront cash on the table then YNH kecut telur already lor. FR pretty much "determined" the price of this development. Investor infested development FR has stopped his regular FRPG (weekly webinars) for a few months to focus on this project. Feels like this Solasta project is going to be the deal of the decade for him to make big bucks from his naive followers and retire young. Recently he's been organising this Road To 3 Million (RT3M) workshop to entice people to buy his projects. If you ask me, the only person that is really on the road to 3 million is the speaker himself |

|

|

|

|

|

Apr 24 2019, 12:13 PM Apr 24 2019, 12:13 PM

Return to original view | Post

#14

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(New Klang @ Apr 24 2019, 07:46 AM) From refining our grading system, and then looking to conclude another super deal ( hopefully grade A, now grade B saja ). Grade B now because not enough followers buying now. The real grading scale: Grade A: Make RM5m in agent commissions/referrals Grade B: Make RM4m in agent commissions/referrals Grade C: Make RM3m in agent commissions/referrals Grade D: Make RM2m in agent commissions/referrals |

|

|

Jun 3 2019, 06:34 PM Jun 3 2019, 06:34 PM

Return to original view | IPv6 | Post

#15

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(zcalex @ Jun 3 2019, 04:34 PM) FR capital is seem like converting from property investment course to become property agency, which FR actively pushing solasta project to their members recently. FAR Capital is a special type of property agency. *if any LYN members working for FR capital, please take note on this. Typical firms such as GS Realty- customers pay the agents a fee when they actually want to buy the property FAR Capital- customers pay them for getting a list of what they are selling + fee when they actually want to buy the property FR is just a superstar sales agent. All those CSR/ help the world/ help society nonsense that he always post on his social media is bullshit la. Esp when you’re selling a property like Solasta. Let’s call a spade a spade here. |

|

|

Jun 7 2019, 03:00 PM Jun 7 2019, 03:00 PM

Return to original view | Post

#16

|

Newbie

44 posts Joined: Sep 2018 |

QUOTE(David_77 @ Jun 7 2019, 09:15 AM) RM3999 i think. If you go through his success stories/testimonials, the only stories you can find from his students are: how much his students bought at (vs market value) or how many units they purchased simultaneously. The real success story is when your students managed to exit their investment at decent returns, so the real success metrics are like sold property at ROI of xx% within x year, etc. Anyway not only FR is doing these sort of schemes. All of the property gurus in the market operate similar models as well. Next time when you see someone introduce themselves as 'property guru/consultant', in your head, please interpret/translate it to: superstar property agent. If you're a visual person, remember this equation: property guru/consultant= superstar property agent. They all come in all shape and sizes (some more handsome, muscular, got fast cars and girls), but it's the same item, just different packaging and story. They can't fake their looks/build but they can fake the image: Cars- Could be rented/ lent from their friends Girls- The sugar baby, sugar daddy scene is developing in Malaysia. You can hire sugarbabies from sites like Sugarbook here. *To be clear, I am not personally against FR/ his business competitor, I am just using him as an example as I attended some his courses previously so I am familiar with what he has to offer. There are alot more dangerous "gurus" out there that offer properties with massive cashbacks + multiple property purchase through loan compression method to their followers (Adrian Wee, etc.). To be fair, FR has offered some pretty good advice during his courses, what you shouldn't pay attention to are his property recommendations as he has vested interest in them. This post has been edited by johnsonlim777: Jun 7 2019, 06:59 PM |

| Change to: |  0.0495sec 0.0495sec

0.50 0.50

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 05:40 PM |