QUOTE(Ancient-XinG- @ Oct 26 2018, 05:04 PM)

This thread is strictly for the discussion for ASNB Variable priced fund only.

Any enquiry on Fixed priced fund - https://forum.lowyat.net/topic/4677986

Just if anyone wanted to try their VP, the above 2 are worthwhile to mentioned. They are newly launched on Sept 2018.

ASN SARA 2

Fund Name

ASN SARA (MIXED ASSET CONSERVATIVE) 2, (ASN SARA 2)

Type

Conservative

Category

Mixed Asset

Launch Date

24 September 2018

Investment Objective

ASN Sara 2 seeks to provide the investors with liquidity and regular income stream with potential long term capital growth.

Potential Investors

ASN Sara 2 is suitable for:

•Conservative and risk averse investors

•Investors with preference for income and liquidity

•Understand the risk of investment

Eligibility

•Malaysian individual who is 18 years and above.

•Guardian from the above category applying for units as the guardian for a Malaysian minor who holds a valid birth certificate but is below 18 years of age.

Note: The Manager has the absolute discretion to change the eligibility age of minor subject to provision of the Deed and approval from the Trustee.

Investment Manager

Permodalan Nasional Berhad

Financial Year End

30 September

TRANSACTION INFORMATION

Price per Unit

The price of Units of the Fund is based on NAV per unit that is determined based on Forward Pricing.

Form of Investment

Cash/Cash equivalent

Minimum Initial Investment

RM10 via cash or cheques

Minimum Additional Investment

RM1 via cash or cheques

Maximum Investment

Unlimited

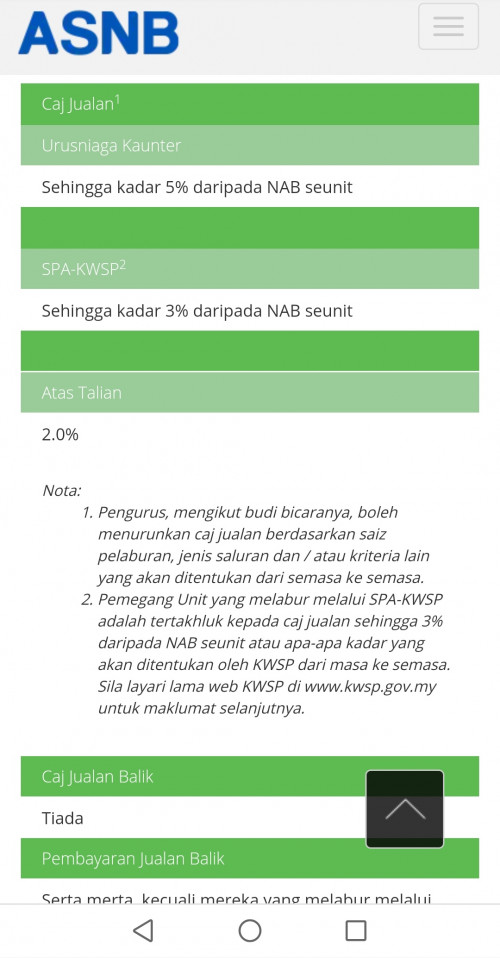

Sales Charge

3.5% of NAV per unit is charged to unit holder

Repurchase Charge

None

Payment of Redemption

Under the Guidelines, the payment of repurchase money is allowed to be made within ten (10) days upon receipt of repurchase request.

Cooling-off Period

Within six (6) Business Days commencing from the date of investment i.e the date on which the Manager receives the duly completed application form and the investment amount.

EPF Members Investment Scheme

None

Distribution Polciy

The fund will distribute earnings from its income, if any, at our discretion, subject to approval from the Trustee

Account Closure and Income Distribution Entitlement

Based on the Deed of the funds, ASNB is allowed to close the account should the balance in the account fall below the minimum investment balance as stated in the Master Prospectus. Therefore, unit holders are advised to maintain the minimum investment balance in the account at all times throughout the financial year of the fund(s), to avoid closure of the said account thus affecting future income distribution entitlement, if any.

ASN EQUITY 5

Fund Name

ASN EQUITY 5

Type

Growth

Category

Equity

Launch Date

24 September 2018

Investment Objective

ASN Equity 5 aims to provide investment opportunity which generate a reasonable level of capital appreciation and income distribution to the Unit Holders through a diversified portfolio of investments

Potential Investors

ASN Equity 5 is suitable for investors whom:

•Seek capital appreciation

•Have high risk tolerance

•Understand the risks of investment

Eligibility

•Malaysian individual who is 18 years and above.

•Guardian from the above category applying for units as the guardian for a Malaysian minor who holds a valid birth certificate but is below 18 years of age.

Note: The Manager has the absolute discretion to change the eligibility age of minor subject to provision of the Deed and approval from the Trustee.

Investment Manager

Permodalan Nasional Berhad

Financial Year End

30 September

TRANSACTION INFORMATION

Price per Unit

The price of Units of the Fund is based on NAV per unit that is determined based on Forward Pricing.

Form of Investment

Cash/cash equivalent

Minimum Initial Investment

RM10 via cash or cheques

Minimum Additional Investment

RM1 via cash or cheques

Maximum Investment

Unlimited

Sales Charge

5% of NAV per unit is charged to unit holder

Repurchase Charge

None

Payment of Redemption

Under the Guidelines, the payment of repurchase money is allowed to be made within ten (10) days upon receipt of repurchase request.

Cooling-off Period

Within six (6) Business Days commencing from the date of investment i.e the date on which the Manager receives the duly completed application form and the investment amount.

EPF Members Investment Scheme

None

Distribution Polciy

The Fund will distribute earnings from its income, if any, at our discretion, subject to approval from the Trustee.

Account Closure and Income Distribution Entitlement

Based on the Deed of the funds, ASNB is allowed to close the account should the balance in the account fall below the minimum investment balance as stated in the Master Prospectus. Therefore, unit holders are advised to maintain the minimum investment balance in the account at all times throughout the financial year of the fund(s), to avoid closure of the said account thus affecting future income distribution entitlement, if any.

VP is the fund that follow the NAV price. Dividend distribution in VP is equally meaningless as the NAV will drop accordingly. Sale charge (SC) the price you paid initially on the purchasing of the units. ASN SARA 2 is heavy on fixed income security, while the equity 5 is heavy on equity, mainly in KLCI.

Kindly read the fund prospectus for further information.

M-O-M for

ASN SARA 2

01/10/2018 - 1.00

31/10/2018 - 0.9962

(0.0038)

01/11/2018 - 0.9974

ASN EQUITY 5

01/10/2018 - 1.00

31/10/2018 - 0.9917

(0.0083)

01/11/2018 - 0.9958

They have lower sales charge for online portal now. Any enquiry on Fixed priced fund - https://forum.lowyat.net/topic/4677986

Just if anyone wanted to try their VP, the above 2 are worthwhile to mentioned. They are newly launched on Sept 2018.

ASN SARA 2

Fund Name

ASN SARA (MIXED ASSET CONSERVATIVE) 2, (ASN SARA 2)

Type

Conservative

Category

Mixed Asset

Launch Date

24 September 2018

Investment Objective

ASN Sara 2 seeks to provide the investors with liquidity and regular income stream with potential long term capital growth.

Potential Investors

ASN Sara 2 is suitable for:

•Conservative and risk averse investors

•Investors with preference for income and liquidity

•Understand the risk of investment

Eligibility

•Malaysian individual who is 18 years and above.

•Guardian from the above category applying for units as the guardian for a Malaysian minor who holds a valid birth certificate but is below 18 years of age.

Note: The Manager has the absolute discretion to change the eligibility age of minor subject to provision of the Deed and approval from the Trustee.

Investment Manager

Permodalan Nasional Berhad

Financial Year End

30 September

TRANSACTION INFORMATION

Price per Unit

The price of Units of the Fund is based on NAV per unit that is determined based on Forward Pricing.

Form of Investment

Cash/Cash equivalent

Minimum Initial Investment

RM10 via cash or cheques

Minimum Additional Investment

RM1 via cash or cheques

Maximum Investment

Unlimited

Sales Charge

3.5% of NAV per unit is charged to unit holder

Repurchase Charge

None

Payment of Redemption

Under the Guidelines, the payment of repurchase money is allowed to be made within ten (10) days upon receipt of repurchase request.

Cooling-off Period

Within six (6) Business Days commencing from the date of investment i.e the date on which the Manager receives the duly completed application form and the investment amount.

EPF Members Investment Scheme

None

Distribution Polciy

The fund will distribute earnings from its income, if any, at our discretion, subject to approval from the Trustee

Account Closure and Income Distribution Entitlement

Based on the Deed of the funds, ASNB is allowed to close the account should the balance in the account fall below the minimum investment balance as stated in the Master Prospectus. Therefore, unit holders are advised to maintain the minimum investment balance in the account at all times throughout the financial year of the fund(s), to avoid closure of the said account thus affecting future income distribution entitlement, if any.

ASN EQUITY 5

Fund Name

ASN EQUITY 5

Type

Growth

Category

Equity

Launch Date

24 September 2018

Investment Objective

ASN Equity 5 aims to provide investment opportunity which generate a reasonable level of capital appreciation and income distribution to the Unit Holders through a diversified portfolio of investments

Potential Investors

ASN Equity 5 is suitable for investors whom:

•Seek capital appreciation

•Have high risk tolerance

•Understand the risks of investment

Eligibility

•Malaysian individual who is 18 years and above.

•Guardian from the above category applying for units as the guardian for a Malaysian minor who holds a valid birth certificate but is below 18 years of age.

Note: The Manager has the absolute discretion to change the eligibility age of minor subject to provision of the Deed and approval from the Trustee.

Investment Manager

Permodalan Nasional Berhad

Financial Year End

30 September

TRANSACTION INFORMATION

Price per Unit

The price of Units of the Fund is based on NAV per unit that is determined based on Forward Pricing.

Form of Investment

Cash/cash equivalent

Minimum Initial Investment

RM10 via cash or cheques

Minimum Additional Investment

RM1 via cash or cheques

Maximum Investment

Unlimited

Sales Charge

5% of NAV per unit is charged to unit holder

Repurchase Charge

None

Payment of Redemption

Under the Guidelines, the payment of repurchase money is allowed to be made within ten (10) days upon receipt of repurchase request.

Cooling-off Period

Within six (6) Business Days commencing from the date of investment i.e the date on which the Manager receives the duly completed application form and the investment amount.

EPF Members Investment Scheme

None

Distribution Polciy

The Fund will distribute earnings from its income, if any, at our discretion, subject to approval from the Trustee.

Account Closure and Income Distribution Entitlement

Based on the Deed of the funds, ASNB is allowed to close the account should the balance in the account fall below the minimum investment balance as stated in the Master Prospectus. Therefore, unit holders are advised to maintain the minimum investment balance in the account at all times throughout the financial year of the fund(s), to avoid closure of the said account thus affecting future income distribution entitlement, if any.

VP is the fund that follow the NAV price. Dividend distribution in VP is equally meaningless as the NAV will drop accordingly. Sale charge (SC) the price you paid initially on the purchasing of the units. ASN SARA 2 is heavy on fixed income security, while the equity 5 is heavy on equity, mainly in KLCI.

Kindly read the fund prospectus for further information.

M-O-M for

ASN SARA 2

01/10/2018 - 1.00

31/10/2018 - 0.9962

(0.0038)

01/11/2018 - 0.9974

ASN EQUITY 5

01/10/2018 - 1.00

31/10/2018 - 0.9917

(0.0083)

01/11/2018 - 0.9958

Jul 20 2019, 10:42 PM

Jul 20 2019, 10:42 PM

Quote

Quote 0.0197sec

0.0197sec

0.20

0.20

7 queries

7 queries

GZIP Disabled

GZIP Disabled