QUOTE(Unkerpanjang @ May 23 2019, 06:20 AM)

Errr Xeon, you must still be young n pure at heart....

After married, all the $$$$ belongs to Auntie. Unker just talk big in forum, take daily allowance only.Shhhh, don't laugh too loud, in case Auntie finds out.

Lol, Unker so funny and humble...

QUOTE(Hansel @ May 23 2019, 06:56 AM)

Yeh,... I pprecited unker's stories too,...

Perhaps I might offer an opinion here : I think working in SG helped to expose me to the available opportunities in the world outside beyond Msia. We get to see the disparity of the situations in Msia compared against the world. But don't get me wrong - not everything OUTSIDE there is better than Msia.

In terms of making money FROM INVESTMENTS, yes, SG is better than Msia, Australia, and a whole lot of other countries in the world..

There are many factors to consider,... we need to be exposed to the outside world.

This resonates with my friend's experience after she moved there. She got so much better in her investment skills, knowledge and gained alot more money (stress do come with it), after she exposed herself to that world. I do envy her for having that opportunity to move...still hustling and waiting for mine *sobs*

Exposure to outside world is extremely important, we must not be frog under tempurung. If your job doesn't allow for that, then read more, and research more till the cows come home. Don't sit and expect miracle.

QUOTE(Hansel @ May 23 2019, 07:01 AM)

Don't know-lar, unker,... for myself, I want to be able to manage my own funds for the rest of my life as long as I'm physically able to, till I go,.. I'll never leave all the funds to someone else to manage.

Sure, if that someone loves you enough not to question your expenses,.. BUT the day will come when that someone starts to question your productivity and economic contribution to the household.Anyway,... investing is an activity that we can do for the rest of our life. Not too much of physical activity involved. The more we do, the more we exercise our brains, the stronger we become in this field.

Good for you, Hansel.

I also can't imagine having another half questioning about this. Guess must find one that can mutually complement each other so can move forward together by working together, no letting the other sit and expect spoon feeding. For guys, don't spoil your ladies like this if you want them to not degenerate in future.

QUOTE(Unkerpanjang @ May 23 2019, 08:08 AM)

Xeon,

Pretty well thought responses, well done.... If both parties are working, then split the income fairly (both in agreement) into shared 3 accounts = household vs him vs her accounts.

You struck the right cord abt being independent n self learning.

Bravo! Lastly, don't just save, save, save... Wor, if like a Korea or Osaka trip, just redeem some $ n go... Experience is more important than things.

Yeah, friendly reminder, life is also not all about work and money. If made decent amount, go holiday also good for your well being. Although, I cannot do fancy ones like Unker yet

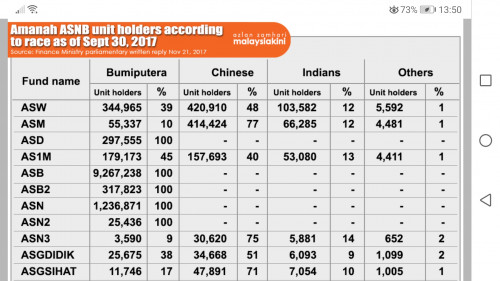

![]() Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

Apr 26 2019, 09:21 PM

Apr 26 2019, 09:21 PM

Quote

Quote

0.2515sec

0.2515sec

1.13

1.13

7 queries

7 queries

GZIP Disabled

GZIP Disabled