maybe PNB can invite BR as an advisor?

or maybe PNB can acquire them and get 15+% dividend per year??

![]() Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

|

Mar 29 2019, 12:47 PM Mar 29 2019, 12:47 PM

Return to original view | Post

#1

|

Senior Member

1,917 posts Joined: Sep 2012 |

how did Bank Rakyat manage to distribute 16% dividend last year??

maybe PNB can invite BR as an advisor? or maybe PNB can acquire them and get 15+% dividend per year?? |

|

|

Mar 31 2019, 09:56 AM Mar 31 2019, 09:56 AM

Return to original view | Post

#2

|

Senior Member

1,917 posts Joined: Sep 2012 |

do we know what ASM, ASM2, ASM3 are invested in??

if not, then how do we choose? |

|

|

Mar 31 2019, 10:28 AM Mar 31 2019, 10:28 AM

Return to original view | Post

#3

|

Senior Member

1,917 posts Joined: Sep 2012 |

QUOTE(nexona88 @ Mar 31 2019, 10:14 AM) Can see in annual report of respective funds... which one do you recommend?? BUT ASM 2 didn't specific which counter they invested in full.. They list only top 20 investee company... since they said want to diversify, does it mean all 6 FP funds will start to diversify? |

|

|

Mar 31 2019, 04:57 PM Mar 31 2019, 04:57 PM

Return to original view | Post

#4

|

Senior Member

1,917 posts Joined: Sep 2012 |

QUOTE(nexona88 @ Mar 31 2019, 10:14 AM) Can see in annual report of respective funds... but ASM2 has more proportion in Maybank, compared to the other two. BUT ASM 2 didn't specific which counter they invested in full.. They list only top 20 investee company... for those with detailed stockholding, I see every fund holds some stocks in Sapura Energy and the value has gone down a lot. From the POV of a individual investor, wouldn't it be better to sell this off?? QUOTE(Ramjade @ Mar 31 2019, 11:44 AM) Is all there in Myasnb. If you never have account it won't appear there. yeah, thanks. I found it on the asnb main webpage.There's only 3 fixed price fund for non bumis. |

|

|

Apr 1 2019, 12:54 PM Apr 1 2019, 12:54 PM

Return to original view | Post

#5

|

Senior Member

1,917 posts Joined: Sep 2012 |

since PNB wants to diversify now, which stocks (dead weight) will they start selling (cutting) first?

|

|

|

Apr 2 2019, 12:54 AM Apr 2 2019, 12:54 AM

Return to original view | Post

#6

|

Senior Member

1,917 posts Joined: Sep 2012 |

QUOTE(nexona88 @ Apr 1 2019, 04:25 PM) how many time u missed the chance? TS [Ancient]-XinG- missed around 3 times if I'm not mistaken.. 1. Final Exam 2. Convo 3. Car into accident by some newbie driver QUOTE(bristlebb @ Apr 1 2019, 04:54 PM) I'm also surprised!! Menabung sejak kecil with Rolex and Hermes handbags!! QUOTE(hyelbaine @ Apr 1 2019, 04:46 PM) asm1 has always historically been hard to get even before online time and now it gets even harder. ASM2 oldest, followed by ASM and ASM3. being the oldest fp fund open to non-bumi obviously ppl have a lot more confident but asm2 and 3 are all oso managed by the same ppl. QUOTE(Ancient-XinG- @ Apr 1 2019, 09:41 PM) PNB will reconsider to set up PNB REIT as Zeti mentioned they will diversify and more into their this time around as one of the strategy. That Amanah Tanah Harta PNB REIT is also kinda owned by PNB, no?? |

|

|

Apr 4 2019, 06:30 AM Apr 4 2019, 06:30 AM

Return to original view | Post

#7

|

Senior Member

1,917 posts Joined: Sep 2012 |

do you think PNB has plans to introduce online withdrawal in the future?

|

|

|

Apr 5 2019, 10:47 AM Apr 5 2019, 10:47 AM

Return to original view | Post

#8

|

Senior Member

1,917 posts Joined: Sep 2012 |

|

|

|

Apr 7 2019, 02:46 PM Apr 7 2019, 02:46 PM

Return to original view | Post

#9

|

Senior Member

1,917 posts Joined: Sep 2012 |

why ASB and ASB2 got limit, but the rest no limit??

|

|

|

Apr 8 2019, 05:56 PM Apr 8 2019, 05:56 PM

Return to original view | Post

#10

|

Senior Member

1,917 posts Joined: Sep 2012 |

I can't wait for them to divest out of Bursa M'sia. Even SGX would be good.

|

|

|

Apr 23 2019, 11:29 PM Apr 23 2019, 11:29 PM

Return to original view | Post

#11

|

Senior Member

1,917 posts Joined: Sep 2012 |

Kempen ini akan bermula pada 21 April 2019 sehingga 20 Mei 2019, atau sehingga lima ribu (5,000) pemegang unit yang layak dipilih untuk mendapat unit amanah bernilai Ringgit Malaysia Sepuluh (RM10) secara percuma, yang mana lebih awal (“Tempoh Kempen”). ASNB berhak untuk mengubah, menangguhkan, menjadualkan semula atau melanjutkan Tempoh Kempen atas budi bicara mutlaknya.

already 5000 ppl? |

|

|

May 21 2019, 08:43 PM May 21 2019, 08:43 PM

Return to original view | Post

#12

|

Senior Member

1,917 posts Joined: Sep 2012 |

last time during 1998 financial crisis, how many % did ASB pay out??

|

|

|

May 22 2019, 08:45 PM May 22 2019, 08:45 PM

Return to original view | Post

#13

|

Senior Member

1,917 posts Joined: Sep 2012 |

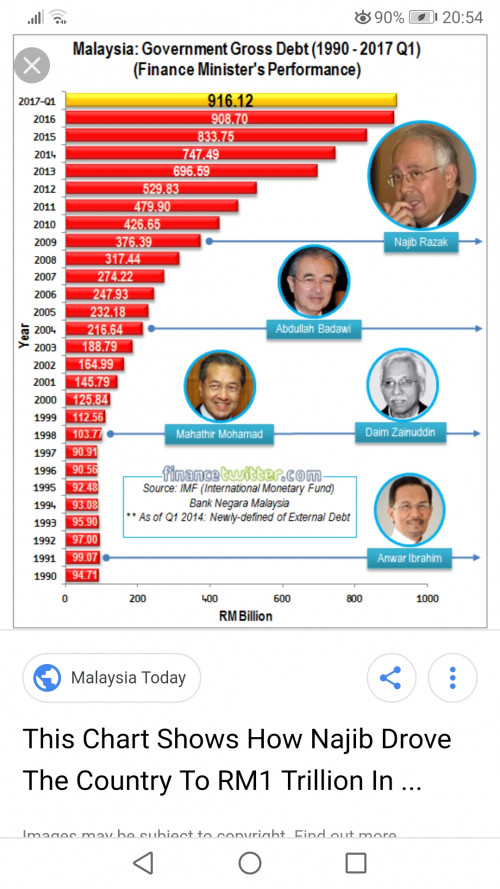

QUOTE(saitong09 @ May 21 2019, 08:46 PM) QUOTE(nexona88 @ May 21 2019, 08:49 PM) QUOTE(Unkerpanjang @ May 21 2019, 09:04 PM) Must see larger picture.... Back in 1997, our Govt debt was much less. Lots of room to play with both fiscal n monetary policies. I see. Thanks. Sadly, you can say, Govt was giving free money to the majority population....by incurring debt n also likely corruption. So, don't hope to go back to the good old days. Whatever, free $$$ we get (if not due to real increased productivity, tech break thru, etc) somehow our children, grandchildren, etc will have to pay back.  I was just curious. I remember vaguely that FD rate went up to 11% or even 12%. |

|

|

May 22 2019, 10:28 PM May 22 2019, 10:28 PM

Return to original view | Post

#14

|

Senior Member

1,917 posts Joined: Sep 2012 |

and how did ASB actually manage to give out around 10% during 98 financial crisis? Didn't KLCI tumble that time??

|

|

|

Jun 23 2019, 02:16 PM Jun 23 2019, 02:16 PM

Return to original view | Post

#15

|

Senior Member

1,917 posts Joined: Sep 2012 |

|

| Bump Topic Topic ClosedOptions New Topic |

| Change to: |  0.2932sec 0.2932sec

0.81 0.81

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 11:29 AM |