Outline ·

[ Standard ] ·

Linear+

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

Sumofwhich

|

Nov 26 2018, 01:08 PM Nov 26 2018, 01:08 PM

|

|

QUOTE(jusTinMM @ Nov 26 2018, 12:53 PM) how about uob e account? no need to do monthly list...just maintain >50k can get 3.6% pa and interest monthly payout. I guess not everyone has >50k monthly before you cash into ASNB 4.1% is higher than 3.6%, capped at 100k for OCBC 360 account |

|

|

|

|

|

Sumofwhich

|

Feb 1 2019, 09:04 AM Feb 1 2019, 09:04 AM

|

|

Hello everyone, if I invest on 1st of the month e.g. 1 Feb, am I entitled for the interest for Feb? Thanks!

Edit: Oh nvm, just saw it on post #1, thanks!

- Any amount you purchase on the first day of the month, that amount will be eligible for dividend calculation for that particular month.

This post has been edited by Sumofwhich: Feb 1 2019, 09:06 AM

|

|

|

|

|

|

Sumofwhich

|

Feb 1 2019, 09:50 AM Feb 1 2019, 09:50 AM

|

|

Called CIMB CS, they told me payment will only be processed next working day, oh well not my account, that's the consequences of not bothered to sign up for myasnb

This post has been edited by Sumofwhich: Feb 1 2019, 10:00 AM

|

|

|

|

|

|

Sumofwhich

|

Feb 4 2019, 11:47 AM Feb 4 2019, 11:47 AM

|

|

QUOTE(blackseed202 @ Feb 4 2019, 11:40 AM) If bumi. Better to fill up asb2 or other fp funds? My asb1 full. I thought maybe more difficult to get other fp funds so might as well get those now and fill up asb2 later when really cannot get other fp funds. What do you think? Go for higher dividend interest funds first to maximize your returns? |

|

|

|

|

|

Sumofwhich

|

Feb 4 2019, 01:05 PM Feb 4 2019, 01:05 PM

|

|

QUOTE(blackseed202 @ Feb 4 2019, 12:45 PM) Well previous performance doesnt reflect future returns.  p Asb1 asb2 and asb3 are the flagships, meant for bumiputeras. I'm pretty sure it'll stay that away, there are even asb loans with 5.2% loan catered, hence the dividend should be higher by a significant margin. |

|

|

|

|

|

Sumofwhich

|

Feb 4 2019, 01:29 PM Feb 4 2019, 01:29 PM

|

|

QUOTE(ikanbilis @ Feb 4 2019, 01:17 PM) Aka didik earlier |

|

|

|

|

|

Sumofwhich

|

Feb 4 2019, 08:44 PM Feb 4 2019, 08:44 PM

|

|

QUOTE(ikanbilis @ Feb 4 2019, 01:41 PM) But this is not flagship right? Returns same with ASM only... QUOTE(nexona88 @ Feb 4 2019, 01:59 PM) Around like that.. That's why pnb "con" people by rename as ASB3 😑 Moment people see have AS bumiputera name attached.. Sure win / profit investment one 😏 At least it should be as good as ASM, without the need to compete with other myasnb investors This post has been edited by Sumofwhich: Feb 4 2019, 08:44 PM |

|

|

|

|

|

Sumofwhich

|

Feb 4 2019, 09:09 PM Feb 4 2019, 09:09 PM

|

|

QUOTE(nexona88 @ Feb 4 2019, 05:45 PM) QUOTE(nexona88 @ Feb 4 2019, 08:54 PM) Well ASB 3 units still available.. ASB 2.. Huhuh look at the above post 😬 Strange though, thought it should be around middle to end of March before they suspend the asb2 fund |

|

|

|

|

|

Sumofwhich

|

Feb 20 2019, 05:06 PM Feb 20 2019, 05:06 PM

|

|

QUOTE(xeon1989 @ Feb 20 2019, 01:43 PM) Is this cheaper than let's say Maybank will? Thanks |

|

|

|

|

|

Sumofwhich

|

Feb 27 2019, 08:34 AM Feb 27 2019, 08:34 AM

|

|

QUOTE(alexkos @ Feb 26 2019, 05:09 PM) thank you...as a way of thanks, i will pay it forward by offering a DIY method to hoot SP500 at the lowest cost possible route. I will hand carry comrades to own their first low-cost index fund (note: not stashaway).  Thanks Alex, mind pointing me or guiding me? Thanks! UPDATE: sorry I jumped the gun, saw your earlier post, thanks! QUOTE(alexkos @ Feb 26 2019, 10:17 PM) ok done siap https://forum.lowyat.net/index.php?showtopic=4744515everyone is encouraged to diversify his fund. Alex recommend 50% asnb 50% sp500 index fund for a parsimonious, low-cost, broad-based, simple, ignore-efficient-frontier type of investment model =) |

|

|

|

|

|

Sumofwhich

|

Mar 11 2019, 02:16 PM Mar 11 2019, 02:16 PM

|

|

QUOTE(alexkos @ Mar 11 2019, 02:10 PM) as long as higher than Fd rate ayam happy 4.5% for Alex then  |

|

|

|

|

|

Sumofwhich

|

Mar 11 2019, 03:49 PM Mar 11 2019, 03:49 PM

|

|

QUOTE(heybai @ Mar 11 2019, 03:35 PM) Hi guys, newbie here, need some help on a few questions: 1. If we only hold ASM for few months then sell it, will we still be entitled for devidend? 2. Is the dividend paid proportionally? (For example we buy ASM 3 months before dividend declared, we will receive dividend for the 3 months only right?) Yes and yes, if invested on 1st day of the month then eligible for that month's dividend, anything later than day 1 will not be eligible for that month but eligible only for the subsequent month |

|

|

|

|

|

Sumofwhich

|

Mar 11 2019, 06:37 PM Mar 11 2019, 06:37 PM

|

|

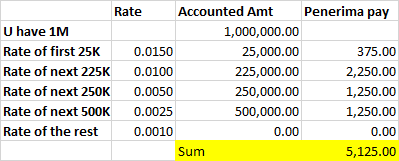

QUOTE(nexona88 @ Mar 11 2019, 06:24 PM) 1k - rm2.50 10k - rm25 100k -rm250 1mil - rm2500 correct ahh my calculation,,,   Calculator says correct |

|

|

|

|

|

Sumofwhich

|

Mar 11 2019, 10:46 PM Mar 11 2019, 10:46 PM

|

|

Asb2 dividend was also lower than Epf when both were announced last year

This post has been edited by Sumofwhich: Mar 11 2019, 10:46 PM

|

|

|

|

|

|

Sumofwhich

|

Mar 15 2019, 07:51 PM Mar 15 2019, 07:51 PM

|

|

Private will / amanah raya / pengisytiharan asnb, which one is best in terms of cost and commission deduction? Appreciate the advice, thanks

This post has been edited by Sumofwhich: Mar 15 2019, 07:54 PM

|

|

|

|

|

|

Sumofwhich

|

Mar 15 2019, 10:21 PM Mar 15 2019, 10:21 PM

|

|

Thanks everyone. Good input on the transfer to beneficiaries

|

|

|

|

|

|

Sumofwhich

|

Mar 16 2019, 12:06 PM Mar 16 2019, 12:06 PM

|

|

QUOTE(beLIEve @ Mar 16 2019, 11:43 AM) Adding to what elder nexona said that physical presence is required.....in their time of dying, where got energy/mood to go transfer shares. they will tell you to just deduct the few thousand bucks and take the rest. before they die, they're not going to give all their belongings to you, just in case you run off and leave them with nothing. When you're sick but still conscious, asnb staff can come to the hospital with the documents, but yeah it's a risky bet. I would cos I am leaving empty-handed anyway This post has been edited by Sumofwhich: Mar 16 2019, 12:07 PM |

|

|

|

|

|

Sumofwhich

|

Mar 16 2019, 02:08 PM Mar 16 2019, 02:08 PM

|

|

QUOTE(beLIEve @ Mar 16 2019, 12:21 PM) hmmmm? Agree it's a risky bet in a sense that ASN staff might say not in the right mind etc etc. Not sure what you mean you would? You mean you will transfer everything to your nominees while you're still alive and kicking or when you're about to enter the veil? When I am about to provided that i trust them then, of course I'd also need to have some reserved money as a backup |

|

|

|

|

|

Sumofwhich

|

Mar 16 2019, 05:51 PM Mar 16 2019, 05:51 PM

|

|

QUOTE(nexona88 @ Mar 16 2019, 02:54 PM) Hmm.. So good asnb can give such services. Doubt seriously... Yes, close relative |

|

|

|

|

|

Sumofwhich

|

Mar 17 2019, 04:15 PM Mar 17 2019, 04:15 PM

|

|

Or we can start referring to them as asm1 asm2 and asm3, pls move on haha, there's a reason why they consolidate the names, I wouldn't be confident investing in as1malaysia after bijan's scandals

This post has been edited by Sumofwhich: Mar 17 2019, 04:17 PM

|

|

|

|

|

Nov 26 2018, 01:08 PM

Nov 26 2018, 01:08 PM

Quote

Quote

0.2917sec

0.2917sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled