Outline ·

[ Standard ] ·

Linear+

Credit Cards Maybankard 2 Gold & Platinum Cards V20, 5% M2 Amex on weekend spending (NOT ALL)

|

zstan

|

Dec 14 2018, 08:41 AM Dec 14 2018, 08:41 AM

|

|

I've had a fraud with AMEX causing it to be charged RM9k which naturally made my credit limit burst for two months. In M2U also stated my credit limit exceeded but I can still swipe as usual.

|

|

|

|

|

|

zstan

|

Dec 18 2018, 11:51 AM Dec 18 2018, 11:51 AM

|

|

QUOTE(joevo2 @ Dec 18 2018, 08:02 AM) Maybank QRPay now support credit card! More place to use Amex now. that's good to know. thanks! |

|

|

|

|

|

zstan

|

Dec 20 2018, 08:12 AM Dec 20 2018, 08:12 AM

|

|

QUOTE(ericlks91 @ Dec 20 2018, 08:09 AM) ahha i on the other hand use these 2 reasons together: I am not using this card at all, hence i will not pay blindly for the RM25 SST. Settle! QUOTE(alexanderclz @ Dec 20 2018, 08:12 AM) as long as the keyword 'sst' is there ah why i so stupid go pay for the RM 25  okla cancel next year |

|

|

|

|

|

zstan

|

Mar 20 2019, 08:09 AM Mar 20 2019, 08:09 AM

|

|

So glad that AMEX can be linked to Boost now. Removed from Maybank Barcelona from Boost immediately.  Boost acceptance rate is actually much higher in some places compared to credit cards. Also Boost gives extra shake rewards so you even get more cashback. Really hope Maybank doesn't revert the weekend spending back to food only like the dark times. |

|

|

|

|

|

zstan

|

May 6 2019, 08:27 AM May 6 2019, 08:27 AM

|

|

QUOTE(Harfan @ May 3 2019, 11:11 PM) Hi guys! Just collected about 100k TP last month. Been using Amex cards for about a year already, so slow to accumulate point. Anyway, any suggestions on what to redeem to make it worthwhile? What do you guys usually redeem it for? Air Miles. Redeem suite class. |

|

|

|

|

|

zstan

|

May 6 2019, 11:18 AM May 6 2019, 11:18 AM

|

|

QUOTE(fruitie @ May 6 2019, 09:16 AM) 100k TP is way too little for even a business class, what's more suite class.  the rest can top up with cash  but if the treat points not expiring i would rather accumulate. unless the person really needs the cash vouchers to support their shopping expenses then by all means. |

|

|

|

|

|

zstan

|

May 17 2019, 01:58 PM May 17 2019, 01:58 PM

|

|

QUOTE(hikarireika @ May 17 2019, 01:04 PM) Hello, sorry if this is a silly question, but I'm finding it kinda hard to find this information. I currently have Maybank 2 Card Gold, and it's about to expire next month. However, I am now within the income bracket to apply for M2C Platinum. My questions are: 1. Is it a good idea to upgrade to Platinum simply because I am within the income bracket to apply? I'm happy with the Gold, and I don't forsee my credit card habits changing. I only use it to pay for monthly deductions for insurance, maybe for some bills in the future, and some one-off purchases once in a while. 2. If I were to upgrade to Platinum, would there be any major differences that I need to look out for or be wary about? (Besides Platinum's Travel Insurance) Thanks in advance  the travel insurance is pointless though. better to get a proper travel insurance. it's always better to have a higher credit limit as it may make your CTOS score prettier. |

|

|

|

|

|

zstan

|

May 23 2019, 08:26 AM May 23 2019, 08:26 AM

|

|

QUOTE(beebee1314 @ May 18 2019, 07:36 AM) Higher credit limit means ctos prettier meh? I thought higher credit limit means it'll eat into your financial commitments. Higher credit limit, I believe will affect the ability for you to borrow loan later for your house. This is because, even if you don't utilise upto the limit for your monthly spending, it is already committed for you. Hmmm. I always call banks to reduce my limit. Like affinbhp at 1.5k, public bank at 3k and etc. higher credit limit doesn't mean ask you spend until your limit la boss. This is because, even if you don't utilise upto the limit for your monthly spending, it is already committed for you. a limit is just a limit, not your spending |

|

|

|

|

|

zstan

|

May 23 2019, 10:28 AM May 23 2019, 10:28 AM

|

|

QUOTE(laymank @ May 23 2019, 10:22 AM) beebee1314 is correct though. The total commitments given to you will affect your loan/credit applications in the future, regardless whether you spend it or not. depending on your spending patterns lor. if you can pay back all your bills on time i don't see why the bank will limit your loan applications. it is always easier to reduce your credit limit than to increase it. you never know when you need emergency funds (e.g. hospitalisation) and a higher credit limit will give you much needed breathing space. |

|

|

|

|

|

zstan

|

Jul 29 2019, 11:13 AM Jul 29 2019, 11:13 AM

|

|

QUOTE(yahiko @ Jul 29 2019, 11:03 AM) hey guys just got the news ( yes i am late) all Maybank card does not get any cashback or point for Ewallet but still gets it when we use as direct pay? eg fave and grab pay directly? i am right? if no then no point for me to keep this card because my area not many people accept amex directly. it's free for life can just keep ah |

|

|

|

|

|

zstan

|

Jul 29 2019, 11:25 AM Jul 29 2019, 11:25 AM

|

|

QUOTE(cybpsych @ Jul 29 2019, 11:14 AM) can use treatpoints to waive what. This is like the best entry level card out there. |

|

|

|

|

|

zstan

|

Nov 13 2019, 11:01 AM Nov 13 2019, 11:01 AM

|

|

QUOTE(Fak3-1234 @ Nov 13 2019, 10:55 AM) i been to haidilao and several restaurants. they dont accept AMEX? then how can i get the maximum cashback? so far i use AMEX to pump petrol, and i have to ask every merchant whether they accept AMEX only i swipe the card mastercard only get points... why do u need to force yourself to get maximum cashback if you are not spending that much in the first place? |

|

|

|

|

|

zstan

|

May 21 2020, 02:17 PM May 21 2020, 02:17 PM

|

|

QUOTE(cappuccino vs latte @ May 21 2020, 02:10 PM) Using grabfood + Amex all the while. No issue. yeah but you wouldn't get any treatpoints or cash back for that. |

|

|

|

|

|

zstan

|

Jul 7 2020, 02:35 PM Jul 7 2020, 02:35 PM

|

|

|

|

|

|

|

|

zstan

|

Nov 27 2020, 11:40 AM Nov 27 2020, 11:40 AM

|

|

QUOTE(ericlaiys @ Nov 26 2020, 07:52 PM) Syukur alhamdullilah |

|

|

|

|

|

zstan

|

Nov 27 2020, 03:54 PM Nov 27 2020, 03:54 PM

|

|

QUOTE(ClarenceT @ Nov 27 2020, 01:31 PM) Direct pay to Sarawak Energy - no weekend CB. Shopee Bill payment - I can pay 75% [Amex] + 25% [Shopee Coins]. just realised Shopee can do bill payments. now with Amex inclusion i'm conficted whether to use Shopee or GrabPay to pay my bills  |

|

|

|

|

|

zstan

|

Sep 21 2021, 09:00 AM Sep 21 2021, 09:00 AM

|

|

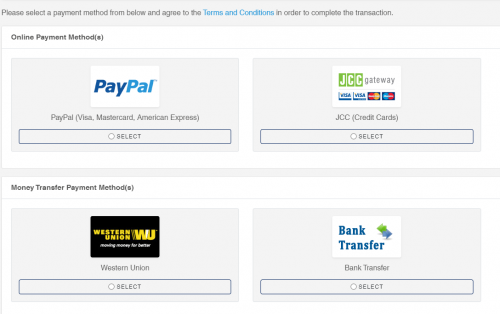

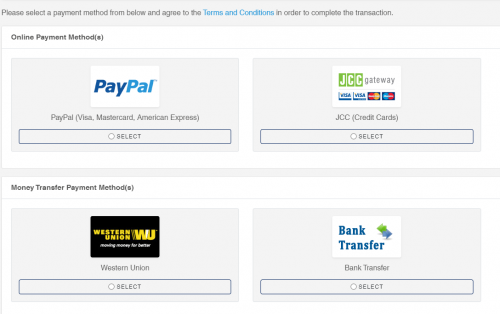

QUOTE(raul88 @ Sep 17 2021, 04:33 PM) hi guys uncle has 1 question hope u all can help uncle need to pay son university fee. I was thinking to pay using amex for the bonus cashback for selected customer so my question is do paypal amex charge more? cos no direct amex cc under "credit card" thank you  paypal has the worst currency exchange rates |

|

|

|

|

|

zstan

|

Feb 8 2022, 03:53 PM Feb 8 2022, 03:53 PM

|

|

QUOTE(kw @ Feb 8 2022, 03:52 PM) Sorry for asking a noob question again, wonder topup ewallet using Amex during weekdays will earn TP or not? Nope. Ewallet get zero rewards. |

|

|

|

|

|

zstan

|

Feb 11 2022, 09:08 AM Feb 11 2022, 09:08 AM

|

|

QUOTE(cybpsych @ Feb 11 2022, 06:38 AM) ah no wonder i got RM 1 cashback lulz |

|

|

|

|

|

zstan

|

Jul 6 2022, 02:26 PM Jul 6 2022, 02:26 PM

|

|

Am I late to the party or Lazada had just began to accept Amex?

|

|

|

|

|

Dec 14 2018, 08:41 AM

Dec 14 2018, 08:41 AM

Quote

Quote

0.0453sec

0.0453sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled