Outline ·

[ Standard ] ·

Linear+

Prepaid Cards BigPay - Prepaid MasterCard (with Mobile Apps) V2, CashBack, BigPoint & Remittance

|

Tigerr

|

Jul 16 2019, 01:33 PM Jul 16 2019, 01:33 PM

|

|

QUOTE(svefz @ Jul 16 2019, 01:19 PM) I think they just randomly pick the user. My sis and bro withdrawal also no get the email. But I can confirm if we can explain the reason of withdrawal will be okay. She told me a lot of user reload and cash out  So reload n cash out. Is it acceptable if within the limit n parameter set by BP? Reason for doing that? To test out how long BP can challenge the bank.  |

|

|

|

|

|

Tigerr

|

Jul 16 2019, 03:16 PM Jul 16 2019, 03:16 PM

|

|

QUOTE(svefz @ Jul 16 2019, 03:11 PM) She said it is okay but not encourage  I just said want to get cash bonus for my credit card Why is not encouraged? If thats the case, dont allow users to withdraw and BP will instantly become a card belongs to the drawer. Or BP can charge 5% withdrawal fees like cc. The bank will not stop us from withdrawing till our limit. How to challenge bank if like that? Aiyoh |

|

|

|

|

|

Tigerr

|

Jul 16 2019, 04:30 PM Jul 16 2019, 04:30 PM

|

|

QUOTE(tohff7 @ Jul 16 2019, 04:21 PM) I think ppl that 'maximise' the potential of BigPay is very shrewd. No way they will let their CC charged them interest I used to withdraw money from cc n pay 5% fees + 18% interest. U know how much $$$ i saved with BP? |

|

|

|

|

|

Tigerr

|

Jul 16 2019, 06:54 PM Jul 16 2019, 06:54 PM

|

|

QUOTE(digidigi @ Jul 16 2019, 06:32 PM) Yes. I paid 5% in fees to cc also breach 5 figures liao. One thing i know from my cash advance is the cash advance is counted towards the spending used to waived off the annual fees for the premiere cards. So, right now, every 10k i draw out from cc, i saved 500 in fees + interest 18%. |

|

|

|

|

|

Tigerr

|

Jul 16 2019, 11:05 PM Jul 16 2019, 11:05 PM

|

|

QUOTE(won931106 @ Jul 16 2019, 10:38 PM) yes it's true actually ...... but need to have a good way to manage the amount (cause still need to pay back the CC statement due but without the fee plus a longer period given if you able to make it few day after last statement cycle) If you need cash flow n the fastest way is to get it thru cc cash advance other than going to ah long. |

|

|

|

|

|

Tigerr

|

Jul 17 2019, 12:42 PM Jul 17 2019, 12:42 PM

|

|

QUOTE(milky12388 @ Jul 17 2019, 11:32 AM) yesterday topup my bigpay with HSBC amanah, i purchase good from amazon with bigpay via paypal. the exchange rate is really good deal. i would say very close to xe currency rate. The regret part is my hsbc amanah only offer 0.2% cashback. will terminate it to get better cash back for bigpay. Today 0.2% cb is bad for u. Tomorrow probably 0.2% is best in the market.  |

|

|

|

|

|

Tigerr

|

Jul 18 2019, 10:21 AM Jul 18 2019, 10:21 AM

|

|

QUOTE(jefftan4888 @ Jul 18 2019, 08:53 AM) Go to CIMB ATM & let the card eaten by machine. Report CS & tell them this is not your fault. Get the replacement free. Later u received calls from bank to come on banking hours to collect back the card.  |

|

|

|

|

|

Tigerr

|

Jul 18 2019, 01:23 PM Jul 18 2019, 01:23 PM

|

|

QUOTE(digidigi @ Jul 18 2019, 12:03 PM) they want market share, big data, they are very behind boost and touch and go.... This startup all losing big money like grab My boss every year also said company lose money but every year i see my boss change new sports car n buy big more n more bungalows. Is it really lose money or not?  |

|

|

|

|

|

Tigerr

|

Jul 20 2019, 08:39 PM Jul 20 2019, 08:39 PM

|

|

QUOTE(majorarmstrong @ Jul 20 2019, 04:44 PM) Is just single primary card that is the reason why I can't figure it out. If i know how to do, share it out means i close it up.  |

|

|

|

|

|

Tigerr

|

Jul 23 2019, 01:18 PM Jul 23 2019, 01:18 PM

|

|

QUOTE(#Victor @ Jul 23 2019, 01:09 PM) supposed using contactless price same as existing card fares. However, an administrative fee will be levied if you are using a foreign-issued contactless bank card for transit payment. Similarly. Having a monthly parking is cheaper than paying daily. |

|

|

|

|

|

Tigerr

|

Aug 2 2019, 01:55 PM Aug 2 2019, 01:55 PM

|

|

QUOTE(WaCKy-Angel @ Aug 2 2019, 01:33 PM) Why balance transfer out of business? infact gonna be even better because u withdraw money out from card then balance transfer to another card u get cash to turnover Do u want to do BT with bank with 3% interest ? |

|

|

|

|

|

Tigerr

|

Sep 11 2019, 06:50 PM Sep 11 2019, 06:50 PM

|

|

QUOTE(henry930821 @ Sep 11 2019, 02:10 PM) Can transfer 10,000 per day? That one may be not transfer out. More likely a reverse transaction n she able to re top up. Else why need to mask out?  |

|

|

|

|

|

Tigerr

|

Sep 22 2019, 11:04 PM Sep 22 2019, 11:04 PM

|

|

QUOTE(taiping... @ Sep 22 2019, 08:15 PM) I hav a noob question andsorry if been asked many times. May I know the best credit card for unlimited cash back? To top up bigpay of rm10k and withdraw 9k cycle. Please excuse me if there is no such thing I using muvi to do this every month but no cb or any tp now. This post has been edited by Tigerr: Sep 22 2019, 11:04 PM |

|

|

|

|

|

Tigerr

|

Sep 23 2019, 05:03 PM Sep 23 2019, 05:03 PM

|

|

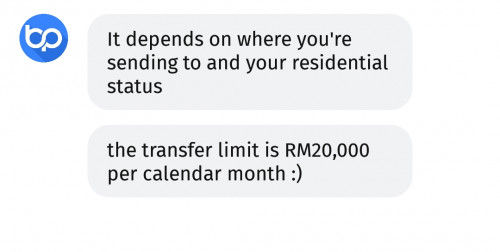

QUOTE(koala225 @ Sep 23 2019, 04:45 PM)  I found the answer of maximum limit. Limit 20k per month is useless as top up limit to 10k. If need to transfer from casa into BP n transfer back to ownself. Play for fun only.  This post has been edited by Tigerr: Sep 23 2019, 05:04 PM This post has been edited by Tigerr: Sep 23 2019, 05:04 PM |

|

|

|

|

|

Tigerr

|

Sep 25 2019, 01:05 PM Sep 25 2019, 01:05 PM

|

|

QUOTE(TongCN @ Sep 25 2019, 11:59 AM) 1) RM10 charges apply (Admin fee from ATM unknown and depends) 2) Remit charge RM7 and currency exchange vary I will choose Option 2 for more convenient ? Option 1 definately better |

|

|

|

|

Jul 16 2019, 01:33 PM

Jul 16 2019, 01:33 PM

Quote

Quote

0.6092sec

0.6092sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled