QUOTE(cheefai7 @ Nov 29 2019, 03:17 PM)

Mind if I ask, have you ever use leverage to build your current wealth? Since no debt was mentioned numerous time, especially when building the real estate/property section.

QUOTE(hksgmy @ Nov 29 2019, 03:29 PM)

And to answer your question, no. We’ve never leveraged on our investments but obviously we had to take loans for our Singapore properties purchases. We did as much capital prepayments as contractually allowed and paid off the mortgages at the earliest opportunity. So, we’ve been debt free since 40 years of age.

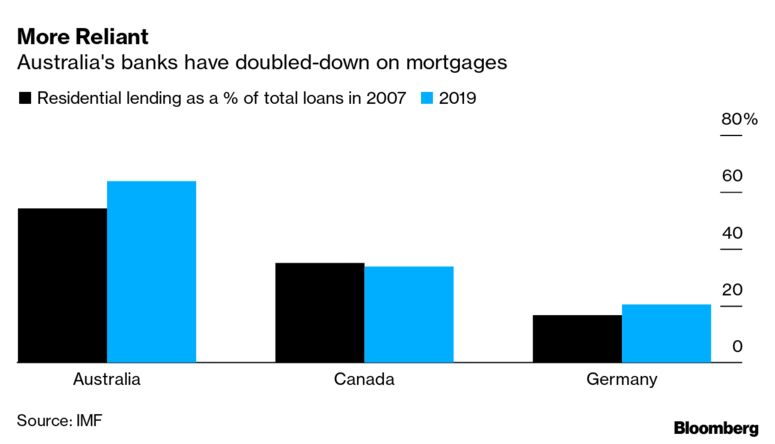

As I mentioned, my wife and I are not a typical case. We are both professionals earning a very respectable income each (hers isn’t anything to scoff at either) and her income alone is more than enough to sustain our annual expenditures and multiple holiday trips overseas - the latter being the most expensive expense item on our outgoings. We also agreed early on in our marriage that we did not want children (because I didn’t think we could be good parents and still give 110% at at careers - it’s a lifestyle choice and a decision that we arrived at with much soul searching: 30 years later, we still have no regrets whatsoever).

My philosophy is simple - a bird in the hand is worth two in the bush, every penny saved is a penny earned. Leverage can unravel too quickly. Margin trading can inflict crippling burns in the blink of an eye. Those strategies are for braver people with wills of steel and courage of lions.

So much has changed in the world since November 2019. Barely 1/2 a year ago, the world was a different place compared to the present state where COVID19 dominates the headlines nearly as frequently as how oil has plunged...

Having said that, some basic principles that were brought up during our discussion have been brought back into sharp focus - and I’m so so glad that leverage was a dirty word for me back then, for that attitude had saved me from a lot of pain and heartbreak that might have occurred otherwise.

I managed to pick up good quality bonds at distressed prices because other highly leveraged people were made to sell at a loss to make good their margin calls.

QUOTE(hksgmy @ Nov 29 2019, 03:39 PM)

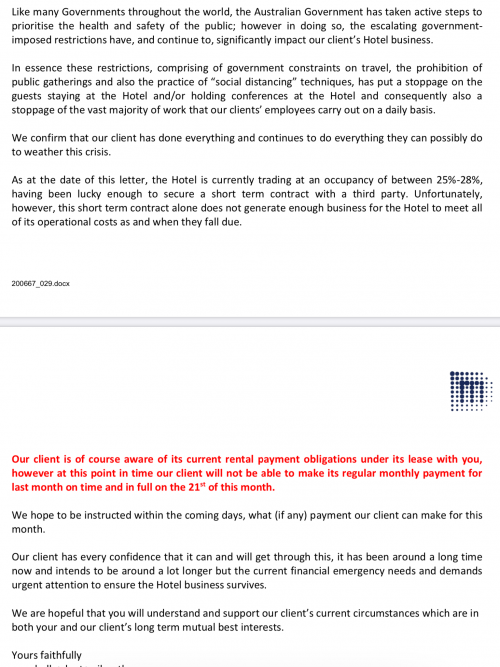

Multiple mortgages that I don’t have the ability to pay off within a set of strict rules that I’ve put in place for myself are a different cup of tea. These properties are at the mercy of valuations and rental sentiments and tax regime changes and if you find yourself requiring a certain rental return in order to pay off a loan due, then you hamper your ability to undercut the next landlord who might not need to achieve a target rental since he’s debt free on that investment property.

It’s precisely because I don’t have the pressure of a mortgage on any of our investment properties that we chose quality tenants even if they pay a slightly lower rental - and paradoxically, quality tenants more often than not end up paying good rentals and on time! Imagine that.

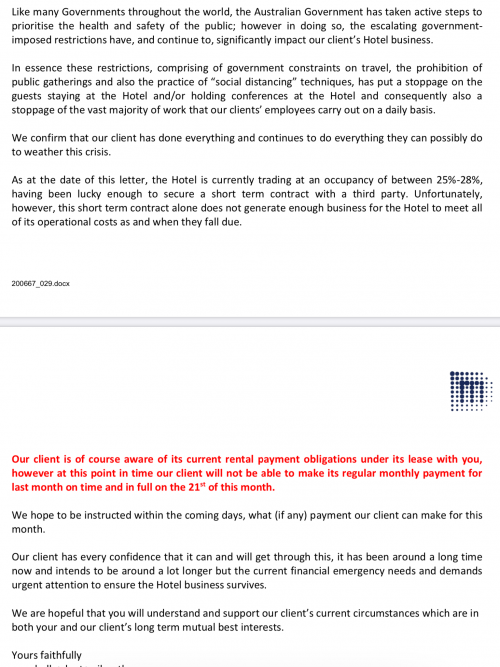

And again, the fear of mortgages my wife and I exhibited have proven to be a conservative life saver. We just received a letter from the master tenant that we let a number of units of ours to:

I’m glad none of those suites and units have mortgage repayments due. We’ll sit tight and weather the storm and wait for the eventual recovery.

May I just wish and pray that all of your investments are safe, and your incomes intact, in these difficult times - and stay safe, my friends!

Apr 20 2020, 05:43 PM

Apr 20 2020, 05:43 PM

Quote

Quote

0.1129sec

0.1129sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled