A: yes, foreigners can buy private residentiall (non landed), commercial and industrial property in Singapore.

Q: other than the property price, what are the other cost?

A: for residential, foreigners need to pay 18-19% stamp duty. For commercial and industrial properties, buyers need to pay 3% stamp amd 6% GST. Legal fees cost are $3000.

Q: Are foreigners eligible for bank loan:

A: Yes, loan to valuation up to 80%

Q: does buyers need to pay commission

A: buyer does not need to pay commission.

Q: currently what is the bank loan interest rate (2018)

A: it is around 1.5%-2%

Q: what is the rental yield

A: around 3-3.5%

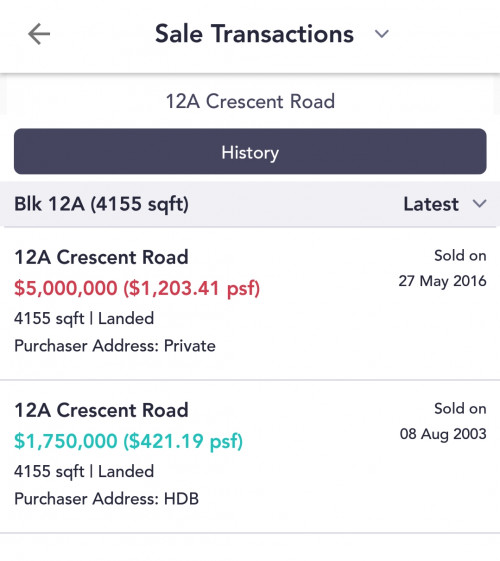

Q: what is the quantum of Singapore private property?

A: it is from S$600,000 onward.

Q: why Malaysians buy Singapore properties?

A: 1. Singapore property market is well regulated by Singapore governmemt.

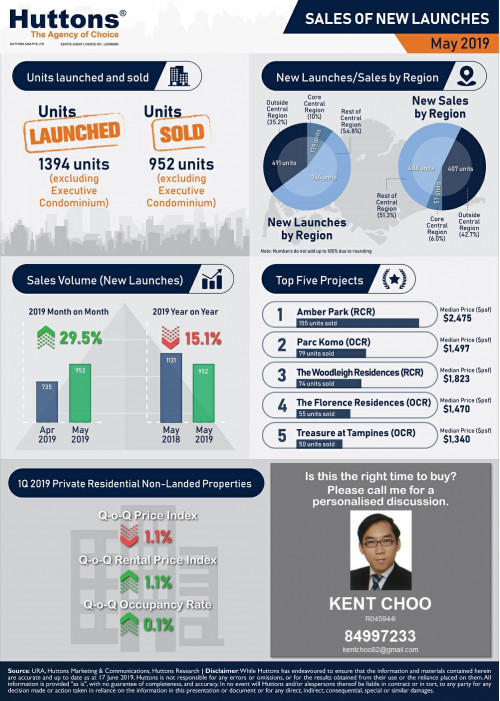

2. Easy to rent out. Vacancy rate for residential property is only around 5-8%. Many expatriates work in Singapore

3. Positive cash flow. Rental yield is around 3-3.5%, bank loaninterest is 1.5% only.

4. Good capital appreciation.

5. Stable and appreciating currency. It was RM1 = $1 in 1960. Now it RM3 = $1

6. Easy to collect rent. Dont have to worry too much that the tenant does not pay rent

7. Singapore land scarcity

8. Growing population. Singapore targets population of 6.9 million. Currently, Singapore population is 5.6 million.

9. Malaysians buying Singapore property for their children who are working or studying in Singapore.

10 Diversification

11. One of the world safest country.

For more detail about Singapore property investment. You may pm me for discussion.

Mar 30 2018, 05:47 PM, updated 7y ago

Mar 30 2018, 05:47 PM, updated 7y ago

Quote

Quote

0.0370sec

0.0370sec

0.35

0.35

6 queries

6 queries

GZIP Disabled

GZIP Disabled