Outline ·

[ Standard ] ·

Linear+

Singapore property investment

|

corleone74

|

Mar 31 2018, 01:29 AM Mar 31 2018, 01:29 AM

|

|

QUOTE(BEANCOUNTER @ Mar 30 2018, 10:42 PM) I think even fh in singapore is only 999 years. No, goon is right. the title deed is 'estate in fee simple".. Ie freehold. In fact there are a number of freehold properties .. Maybe 20% or more (just quick guess). There are also 60 year lease , 99 year, 999 years , leases. This post has been edited by corleone74: Mar 31 2018, 01:36 AM |

|

|

|

|

|

corleone74

|

Mar 31 2018, 01:30 AM Mar 31 2018, 01:30 AM

|

|

QUOTE(nexona88 @ Mar 30 2018, 11:23 PM) property market so bad until needed to promo here in lowyat  Singaporean all buy at Johor state  Nope, Singapore market alrd pick up. Johor market is doldrums. This post has been edited by corleone74: Mar 31 2018, 01:42 AM |

|

|

|

|

|

hhho

|

Mar 31 2018, 10:13 AM Mar 31 2018, 10:13 AM

|

|

Based on today market value, my Singapore property value at district 19 increased more than 10%. I purchased in July 2015 and already had 91% sold

This post has been edited by hhho: Mar 31 2018, 10:16 AM

|

|

|

|

|

|

TSgoon221

|

Mar 31 2018, 07:05 PM Mar 31 2018, 07:05 PM

|

New Member

|

Singapore property market is trending upward. It is a good time to buy now. Congratulations to those who have already bought Singapore properties.

|

|

|

|

|

|

TSgoon221

|

Apr 3 2018, 09:33 AM Apr 3 2018, 09:33 AM

|

New Member

|

Singapore 2018 Q1 property price jumps 3.1%. Fully year forecast to increase 7-15%. http://www.businesstimes.com.sg/real-estat...ces?xtor=CS3-25 |

|

|

|

|

|

TSgoon221

|

Feb 28 2019, 10:36 PM Feb 28 2019, 10:36 PM

|

New Member

|

How much have condo prices changed in the last 10 years? Between 2008 and 2018, we found that the average selling price for new projects in the East region saw the highest price increase. In 2018, prices of a two-bedroom condo transacted at an average of $1.26 million, compared to an average of $677,768 a decade ago. This translates to a price increase of 86% in 10 years. https://sg.finance.yahoo.com/news/much-cond...-101800563.html |

|

|

|

|

|

Bjorn1688

|

Mar 1 2019, 01:49 AM Mar 1 2019, 01:49 AM

|

|

High barrier to entry but extremely safe investment.

If I remember correctly these days quite hard to get loans unless you have a Singapore PR.

|

|

|

|

|

|

sosobear

|

Mar 1 2019, 01:53 AM Mar 1 2019, 01:53 AM

|

|

QUOTE(Bjorn1688 @ Mar 1 2019, 01:49 AM) High barrier to entry but extremely safe investment. If I remember correctly these days quite hard to get loans unless you have a Singapore PR. Local banks are providing cross border financing |

|

|

|

|

|

icemanfx

|

Mar 1 2019, 04:41 AM Mar 1 2019, 04:41 AM

|

|

QUOTE(goon221 @ Feb 28 2019, 10:36 PM) How much have condo prices changed in the last 10 years? Between 2008 and 2018, we found that the average selling price for new projects in the East region saw the highest price increase. In 2018, prices of a two-bedroom condo transacted at an average of $1.26 million, compared to an average of $677,768 a decade ago. This translates to a price increase of 86% in 10 years. https://sg.finance.yahoo.com/news/much-cond...-101800563.html86% increase in 10 years is about 6.5% p.a compounded. |

|

|

|

|

|

z21j

|

Mar 1 2019, 09:22 AM Mar 1 2019, 09:22 AM

|

|

A lot consideration. Higher monthly maintenance cost, property tax, higher stamp duty etc. Also note that leasehold term in singapore is different from in malaysia. In singapore, leasehold means u lease or rent from government for 99 years. Your property value will turn 0 at end of year 99 (malaysia im supposed gov will arrange a flat for you, or allow you to renew at nominal sum?) Those who are pr or singaporean would reserve their quota to buy hdb (government flat) rather than condo.

However, if you are planning yo get 1, i suggest paya lebar, serangoon, kallang areas, there are quite many freehold condo with decent price and near to mrt stations. Also you may be surprise to see the rental yield for 1 bedroom is way higher than 2 or 3 bedrooms in sg. The monthly rental for 1 bedroom could probably sgd100 or sgd200 lower than 2 bedrooms only due to limited unit.

|

|

|

|

|

|

BEANCOUNTER

|

Mar 2 2019, 09:46 AM Mar 2 2019, 09:46 AM

|

|

Malaysia got so much land......its obscene to even get lishold.

spore 36kms x 24kms in size nia…….

|

|

|

|

|

|

qwerty223

|

Mar 2 2019, 11:14 AM Mar 2 2019, 11:14 AM

|

|

lol last 10 years Klang Valley landed had a 300% run. Yours 86% are taking average against the top sellers.

LYN is not the right place for you to fish big la.

|

|

|

|

|

|

urbanite

|

Mar 2 2019, 12:44 PM Mar 2 2019, 12:44 PM

|

Getting Started

|

QUOTE(qwerty223 @ Mar 2 2019, 11:14 AM) lol last 10 years Klang Valley landed had a 300% run. Yours 86% are taking average against the top sellers. LYN is not the right place for you to fish big la. But Msia lose on currency exchange |

|

|

|

|

|

TSgoon221

|

Mar 9 2019, 11:29 AM Mar 9 2019, 11:29 AM

|

New Member

|

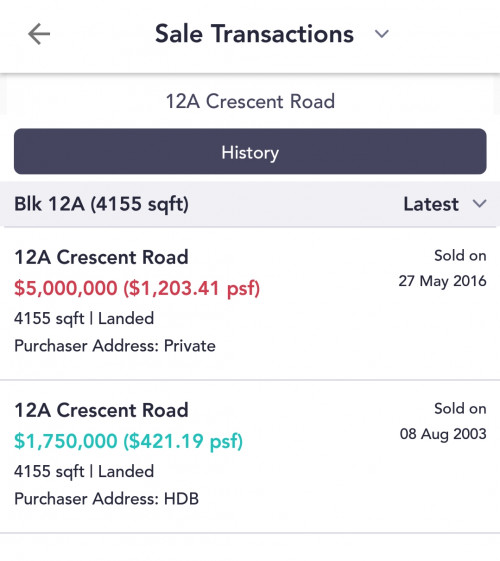

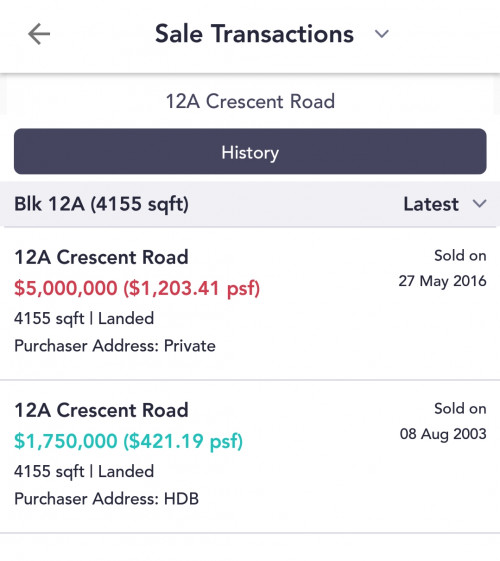

Singapore landed property enjoys great price appreciation too. My friend Singapore landed property up 300% in 13 years. I think it is good to diversify our portfolio. Within the last 10 years, SGD appreciated close to 50% against malaysia ringgit. This post has been edited by goon221: Mar 9 2019, 05:57 PM |

|

|

|

|

|

TSgoon221

|

Mar 9 2019, 11:32 AM Mar 9 2019, 11:32 AM

|

New Member

|

QUOTE(urbanite @ Mar 2 2019, 12:44 PM) But Msia lose on currency exchange Sadly yes. In the past 10 year, from sgd$ 1 vs rm2.2 to sgd$1 vs rm3. There are pro and con for both kl and sg property market. The mortagage interest is 1.x% for the past 10 years. Malaysia interest rate is 4.x% Malaysia stamp duty is lower, though. |

|

|

|

|

|

aspartame

|

Mar 9 2019, 12:29 PM Mar 9 2019, 12:29 PM

|

|

QUOTE(qwerty223 @ Mar 2 2019, 11:14 AM) lol last 10 years Klang Valley landed had a 300% run. Yours 86% are taking average against the top sellers. LYN is not the right place for you to fish big la. Yup yup... those bought landed last 10 years all can retire early |

|

|

|

|

|

TSgoon221

|

Mar 22 2019, 12:37 AM Mar 22 2019, 12:37 AM

|

New Member

|

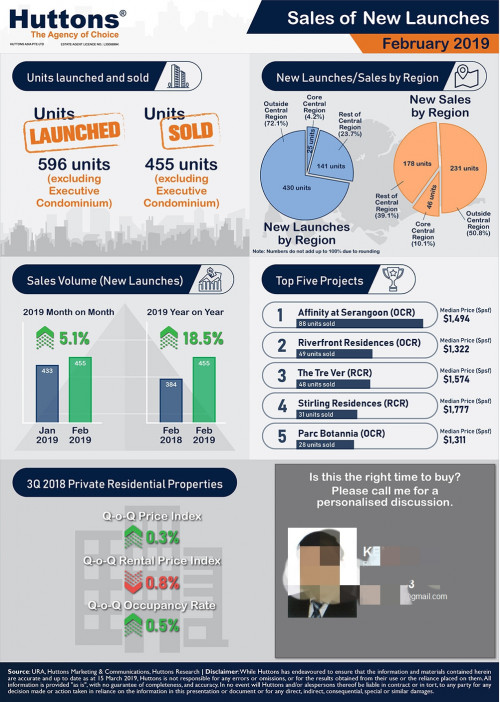

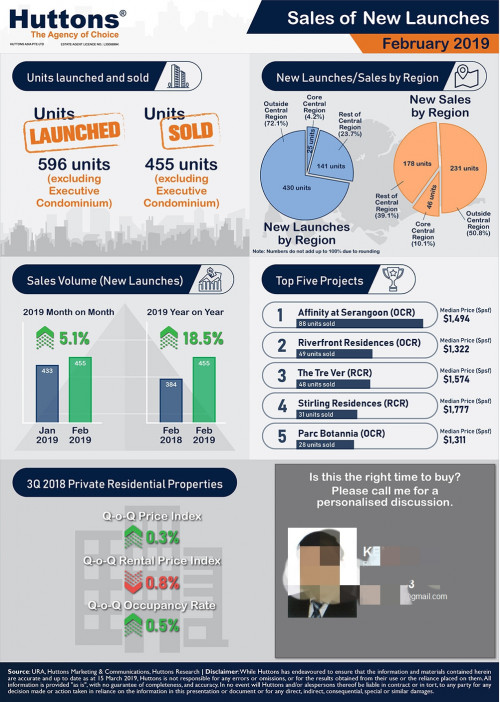

Singapore property sales volume is higher compared to January 2019 and February 2018. Price is pretty stable. Thanks to last year cooling measure. 😉 Affinity at Serangoon sales volume increases tremendously, I think it is because of the new MRT line. Top 5 selling new launches average price is around $1500 psf. 🤔🤔🤔Do you think Singapore new launches price is trending upward or downward? 🤔🤔🤔 |

|

|

|

|

|

prozdennis

|

Mar 22 2019, 08:22 AM Mar 22 2019, 08:22 AM

|

Getting Started

|

Malaysia property industry is 10 years before Singapore, Vietnam is 10 years before Malaysia. Invest in Vietnam will be cheaper than Singapore.

|

|

|

|

|

|

z21j

|

Mar 22 2019, 09:22 AM Mar 22 2019, 09:22 AM

|

|

QUOTE(prozdennis @ Mar 22 2019, 08:22 AM) Malaysia property industry is 10 years before Singapore, Vietnam is 10 years before Malaysia. Invest in Vietnam will be cheaper than Singapore. Foreigner investing in vietnam only entitle for 50 yrs lease, regardless the land title, sure vietnam is a better spot? Even if there are developments that claimed "freehold" for foreigners, these are freehold (to the perpetuity), not fee simple estate. Sg still got many cheap freehold private property, and it is definitely more affordable than in hong kong. |

|

|

|

|

|

prozdennis

|

Mar 22 2019, 10:14 AM Mar 22 2019, 10:14 AM

|

Getting Started

|

QUOTE(z21j @ Mar 22 2019, 09:22 AM) Foreigner investing in vietnam only entitle for 50 yrs lease, regardless the land title, sure vietnam is a better spot? Even if there are developments that claimed "freehold" for foreigners, these are freehold (to the perpetuity), not fee simple estate. Sg still got many cheap freehold private property, and it is definitely more affordable than in hong kong. Erm, i mean still cheaper than SG, nobody will invest for 50 years one and I am not sure what is the maximum loan tenure provided by Vietnam bank... Once the property price hit the price that you want to sell off, you will dispose off one.. |

|

|

|

|

Mar 31 2018, 01:29 AM

Mar 31 2018, 01:29 AM

Quote

Quote

0.0173sec

0.0173sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled