QUOTE(Sedih @ Oct 22 2018, 06:27 PM)

Is there any way of reducing interest cumulated spending in card other than balance transfer to other bank?

People use credit card for convenience purpose and cash back. U use credit card to owe money?Credit Cards CIMB Bank Credit Cards V7, Cash Rebate Platinum, up to 5%

|

|

Oct 22 2018, 07:09 PM Oct 22 2018, 07:09 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

1,683 posts Joined: Sep 2018 |

|

|

|

|

|

|

Oct 26 2018, 08:23 PM Oct 26 2018, 08:23 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

1,683 posts Joined: Sep 2018 |

Nobody knows what's wrong with cimb ebanking? Let me tell u all.

Cimb database was compromised. An insider sold all our information to the Indonesian hackers. Thus they stop all activities including atm cash withdrawals pending investigation. I heard their higher management quietly made a police report to the police kl Hq. And how I know all these? An investigation officer told me. I believe they tot they can solve the issue but it got out of control. So they decided to suspend all activities. Many people's account kena hacked and money illegally transferred out. Probably cimb wanna solve this quietly. They dowan this become fb leaked information issue, where the shares dropped sharply after it was announced. |

|

|

Oct 26 2018, 10:09 PM Oct 26 2018, 10:09 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(djhenry91 @ Oct 26 2018, 09:36 PM) which database compromised? few month ago tht wan or new one? Just this week nia. I heard from investigating police officer. Exact details I dunno. But alot kena d. That's why they are having system maintenance today. Say only system maintenance, but they are actually probably checking to monitor suspicious activities.share price already drop badly due to global market sentiment.. Customer database was compromised. That's what I heard. This post has been edited by beebee1314: Oct 26 2018, 10:15 PM |

|

|

Oct 26 2018, 10:14 PM Oct 26 2018, 10:14 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(katowwe @ Oct 26 2018, 09:10 PM) Is this be true, that will be a very serious problem. That mean our saving in the Cimb bank is not secure. In truth no banks are secured. Abo how u get so many calls from unknown ppl. Nowadays bank staff no integrity one. Last time, it's an honour to work in a bank. Now, just meh. They hire too many sampah. These sampah used our bank information and sell it to third party. I was told this time round, the whole database was invaded. Not sure how true this is, but the officer was dead serious when she told me so. My grandma used to say it's safer to keep money in a bank than under your bed. If she's still around, I would have told her it's safer to keep them under my bed. |

|

|

Oct 27 2018, 10:40 AM Oct 27 2018, 10:40 AM

Return to original view | Post

#5

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(djhenry91 @ Oct 26 2018, 10:23 PM) Waiting for them to release an official press statement. Too much insider info not being released. Many ppl got hacked and made police report so let's see how they respond. Most ppl lost RM3,000.Luckily I cancelled my cimb credit card a few weeks ago. Imagine what will happen if I didn't cancel. Probably swipe 20k and I'll be crying. Stupid credit limit. |

|

|

Oct 27 2018, 03:36 PM Oct 27 2018, 03:36 PM

Return to original view | Post

#6

|

Senior Member

1,683 posts Joined: Sep 2018 |

|

|

|

|

|

|

Oct 27 2018, 04:00 PM Oct 27 2018, 04:00 PM

Return to original view | Post

#7

|

Senior Member

1,683 posts Joined: Sep 2018 |

|

|

|

Oct 27 2018, 04:02 PM Oct 27 2018, 04:02 PM

Return to original view | Post

#8

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(fruitie @ Oct 27 2018, 03:57 PM) And you mentioned credit card in your previous post. Or did I read it wrongly? Also there's PIDM protection for savings account. Up to 250k only though. Yup what I'm saying is, my credit card was cancelled, luckily. If they have access to your cimb clicks, they have access to your cards too. That's what I'm sayingAnd again, correct me if I'm wrong. PIDM only insures you in the event member banks become bankrupt. I read this from their website article. Let me know if I'm wrong on this. |

|

|

Oct 28 2018, 11:33 AM Oct 28 2018, 11:33 AM

Return to original view | IPv6 | Post

#9

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(beLIEve @ Oct 28 2018, 04:38 AM) If they can login to her cLICKS account, it means password is stored in cleartext or reversible encryption. CIMB has release a cover up announcement in fb asking us to change our password frequently. Faham2 je la. Anyone has contact with CIMB who can be sent an RFC (Request for Comment)? Don't want to be spreading fake news and caught in the ACT. QUOTE(coolguy99 @ Oct 28 2018, 09:02 AM) Sorry guys I have been reading the last few pages and I am not really sure what is going on. Are you guys saying that there has been a data breach in cimb? I was told so. Apparently someone internal sold the information to third party. Was told the buyers are Indonesians. QUOTE(David83 @ Oct 28 2018, 09:16 AM) Yes but there's no public announcement/press release it. They announce now, their share market gonna drop like waterfall. So instead, they just announce a cover up asking ppl to change password. How I know? I'm one of the affected ones waiting for cimb investigation. It seems like an insider job and CIMB tends to cover it discreetly. P/S: Source from a forumer here. |

|

|

Oct 28 2018, 01:32 PM Oct 28 2018, 01:32 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,683 posts Joined: Sep 2018 |

|

|

|

Oct 29 2018, 02:59 PM Oct 29 2018, 02:59 PM

Return to original view | Post

#11

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(beLIEve @ Oct 28 2018, 04:46 PM) On the surface, everything is straightforward as you said. Heck, mine's even safer than yours. My account is see-no-touch (or maybe, at most, can Jompay with my card) because I don't have a debit card. Haha I got back my money. It seems that the hacker had no choice but to transfer my money to my cimb card (BT account) since I didn't want to provide the TAC for IBFT, and probably would have coerced me into giving the TAC (RM50 worth) to get my money back. Luckily I was calm and called the customer service, who freeze my clicks immediately. If the hackers are smart, from your account, they can extract info and weasel their way to your other bank accounts. And since I didn't use BT anymore, it didn't appear there for me to see. So I tot they made the transfer somewhere else. Anyway to everyone, if u received a TAC request, call bank immediately. And when u check your clicks, high chance the money was transferred internally to another credit card under your name, or a favourites saving account within cimb environment, for example u saved your mother's cimb saving account into favourites. |

|

|

Oct 29 2018, 04:02 PM Oct 29 2018, 04:02 PM

Return to original view | Post

#12

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(beLIEve @ Oct 29 2018, 03:19 PM) you're lucky indeed. As long as money didn't go missing, less hassle. I think that's why banks are extremely careful with favorites. TAC is required to add Favorites. But after u add, they ignore u. Haha they should continue to use TAC even for favourites. Favourites should only be there for lazy ppl like me who don't wanna key in my mother's account everytime I transfer money to her. Too much a hassle. |

|

|

Oct 29 2018, 04:26 PM Oct 29 2018, 04:26 PM

Return to original view | Post

#13

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(koala225 @ Oct 29 2018, 04:06 PM) U can transfer all your cash to FD placement. U can't withdraw without tac. Why people give the scammer tac? why not ask them proceed to the bank? How they can use your phone numbers to register cimb click? Please think logically guys. If your phone numbers is wrong u can't successfully register in cimb click. Nono. I didn't give them TAC. What they did is transfer to your credit card. If u have a cimb credit card and they transfer to it, you don't need tac. And what I did is, I told him to report to cimb of the error. But ya that's what I'm gonna do in future. 1 mth FD placement save me all the hassle |

|

|

|

|

|

Oct 29 2018, 11:07 PM Oct 29 2018, 11:07 PM

Return to original view | Post

#14

|

Senior Member

1,683 posts Joined: Sep 2018 |

|

|

|

Jan 1 2019, 10:58 AM Jan 1 2019, 10:58 AM

Return to original view | IPv6 | Post

#15

|

Senior Member

1,683 posts Joined: Sep 2018 |

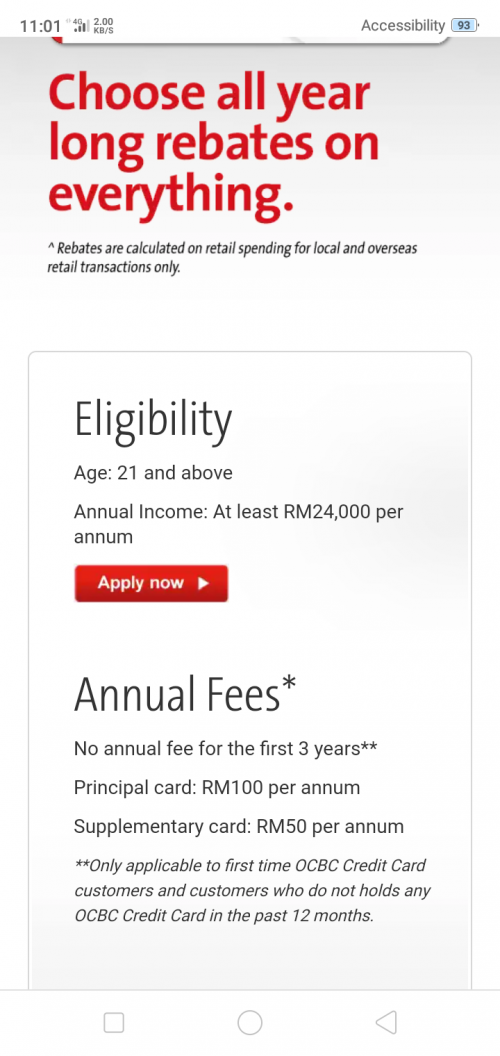

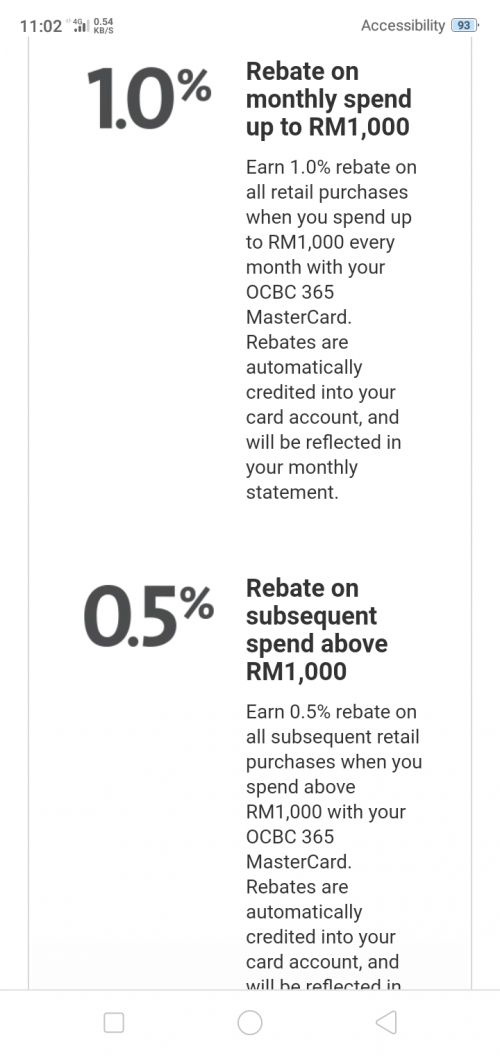

QUOTE(ClarenceT @ Dec 31 2018, 11:34 AM) 1% is always there, since the card was launched in June 2017. Don't agree on 0.2% (most cc) or 0.5% (lazada cimb). Ocbc 365 gives 1% on first 1000 spending. If not enough, hong Leong fortune card also gives 1%, maximum of rm50 (5k) spending. You don't need a 0.5% cash back card. Both only requires 24k salary. One petrol card + one Hong Leong fortune card OR Ocbc365 is good enough.15% is promo, it should end in December 2017, but it was extended a few times till December 2018. It is a Mastercard, you can top up Lazada wallet at a particular day and get 5% rebate from Lazada-Alipay. T&C apply. You can get 0.5% rebate (max RM25/month) on other spends excluding Lazada (1%), Govt and Bigpay. The rate is quite good, as most of CC will give 0.2% rebate/reward only.   This post has been edited by beebee1314: Jan 1 2019, 11:12 AM |

|

|

Feb 9 2019, 12:00 PM Feb 9 2019, 12:00 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

1,683 posts Joined: Sep 2018 |

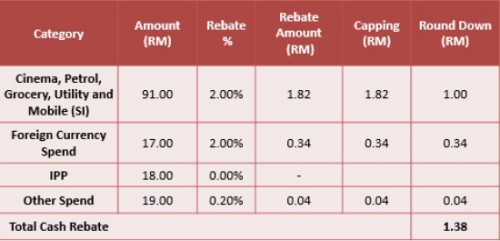

QUOTE(dragonteoh @ Feb 8 2019, 11:10 PM) Hi Guys, Many more petrol cards out there. I cut this card like 6-8 mths ago. Didn't know someone still holding onto this card.Not sure you all aware about CIMB CRCC's Cash Rebate Round Down or not. From 29NOV18 till 28DEC18 i only use the card to pump one time petrol which cost RM61.47 (the only transaction that i had made on that card on that statement period) When the statement came , i only earn RM1 Cash Back (By right should be RM1.23) After contact CS, they mention that effective 3rd December 2018, cash rebate will be rounded down to the nearest ringgit. Which mean if you earn RM1.23 CB , you will only get RM1 CB. (they round it down to nearest ringgit) Some more attached a chart.  Did you guys facing this issue ? I try to search first page on this forum , nothing mention about it. Also been to CIMB website --> Credit Card products --> CIMB CRCC , also never mention this. Their Original Email Reply as below : Dear Mr XXX Thank you for your message. Kindly be informed that effective 3rd December 2018, cash rebate will be rounded down to the nearest ringgit. The amount will be rounded down from all categories and subsequently added up to form the total cash rebate. Please refer to table enclosed for example. Thank you for banking with CIMB Bank. |

|

|

Feb 9 2019, 01:58 PM Feb 9 2019, 01:58 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(dragonteoh @ Feb 9 2019, 01:23 PM) I keep this card in da drawer until my other card quota out only use it. Quite long never use it, now only know the new T&C. Wow is it because of cny, your quota burn. Hmmm. Ya the change in features quite long d. The latest round down is a turn off to users. I liked the card alot last time for the online rebate. |

|

|

Apr 21 2019, 12:12 PM Apr 21 2019, 12:12 PM

Return to original view | Post

#18

|

Senior Member

1,683 posts Joined: Sep 2018 |

I can't believe upto today, still got ppl use Cimb products. Cimb whole database has been compromised last year. I was one of the victim. They basically have all your details. Upto today still haven't solved. It's because of my company using it as payroll, that I can't leave Cimb. Now I just set my bank auto transfer the whole salary out every month. Cimb is jibby's brother eh bank. What do u expect.

|

|

|

Apr 21 2019, 01:05 PM Apr 21 2019, 01:05 PM

Return to original view | Post

#19

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(PJng @ Apr 21 2019, 12:43 PM) U have a choice. Open another bank's account. Set auto transfer every month to that bank. Don't leave any cent in Cimb every month. Sometimes a little work can save a lot of your time. To some ppl this is troublesome stuffs. But wait till u kena hack (speaking from experience), then u will do it. Run to bank, run to balai, run to bank, run to balai again. I ended up wasting my one day's leave just to lari here and there. |

|

|

May 30 2019, 09:20 AM May 30 2019, 09:20 AM

Return to original view | Post

#20

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(se800i @ May 29 2019, 09:32 AM) MBB Amex target for RM 50 CB monthly hmm do you get rm50 Max CB monthly from amex? if not, why not topup to boost on weekends. got CB for it.Standard Chartered Just One target for RM 85 CB monthly with RM 2.5K spending Amex cant accept utilities from June 2019 onwards for CB, so use the Petrol and other groceries to hit RM 1K in order to get RM 50 CB Standard Chartered can accept utilities, so all bills give to them and boost top up as well calculated. |

| Change to: |  0.0910sec 0.0910sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 01:51 PM |