QUOTE(EA MT4 @ Mar 20 2018, 09:52 PM)

» Click to show Spoiler - click again to hide... «

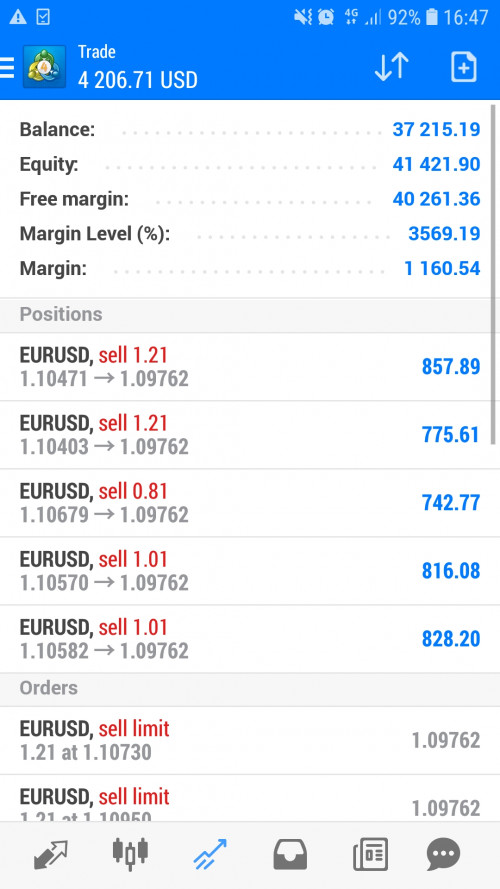

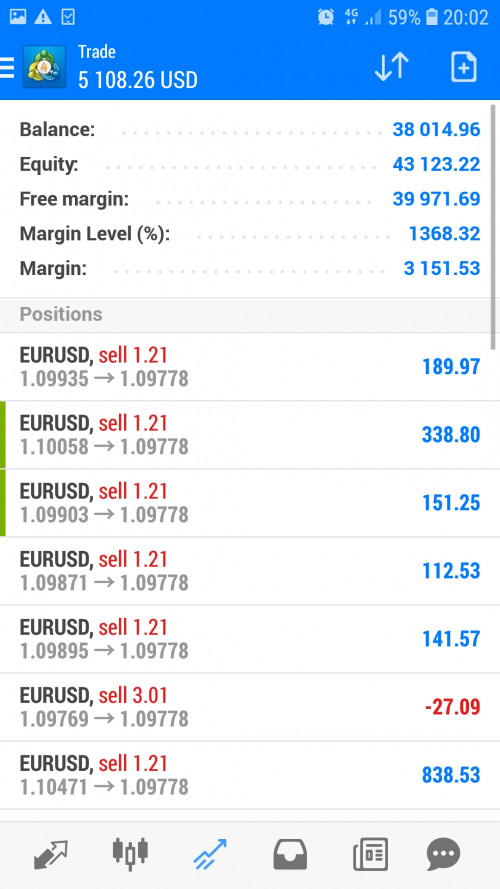

There is actually one that trades only the EUR/USD on H1.

A pair that is quite a slow mover in comparison, but offers great stability.

Not too spiky in its movement with a small daily range.

Maybe that's why its so successful trading this pair.

Its success rate is only about

75% as you can see from the long & short trades won.

But the biggest SL is only

22 pips. And max draw down was only

7%. That's pretty stable.

Not bad,considering

1245 trades executed over a period of 5 months with conservative compounding.

LIVE trading was done through Alpari.

For some reason, the forum doesn't allow Excel sheet attchments here.

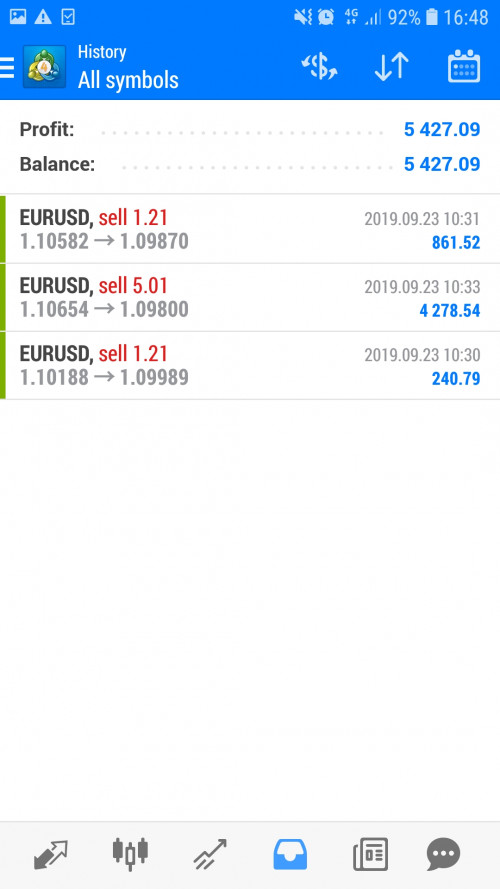

Impossible to post the full 63 pages of the statement here

, so just posting the 1st page & the final page (read from bottom to up) :

1st page

last page

QUOTE(EA MT4 @ Mar 21 2018, 12:00 AM)

The EA i posted is forward-tested.

edit : 'was'

Before I start, let me assure you I'm not trying to pour cold water. I'm just giving constructive feedback. I myself have done a lot of research on EAs and even coded a few myself when I was younger. But because of that experience, I have a lot of doubt on the validity of EAs because there are inherent problems which I will discuss some of them below.

There are a few questions:

1)You mention the robot is based on 1h. But clearly the data indicates trades are entered and exited based on 1min or tick charts. So which is it?

2)You said that this robot has been forward tested live. Do you have the actual statement? Or is this a robot you found on a website and just linking their pictures? If you have the excel file, just zip it up and post here on lowyat. Or provide a link.

3)You never mention what are the spreads on your broker. Live trading has slippage and spread. When your profits are counted in single digit pips, spread and slippage plays a huge role. It could probably eat up as much as 50% of your net profit. If your average pips are around 40pips, then slippage and spread is not so impactful. Also, requotes happen way more than you think which again, is not impactful to swing traders, but absolutely devastating to high frequency traders.

4)Assuming 2 pips spread on average for eurusd, it means that per entry and exit you have to eat up 2 pips (total 4 pips per trade). Meaning your average wins could be 4 pips less and your avg loss could be 4 pips more. If so, then the positive expectancy of this strategy not very high.

5)You didn't indicate the entry rules or exit rules, so a lot of guesswork is needed. Your biggest recorded drawdown is -22 pips,

-but we don't know if price moved -55pip first then came back to -22 or

-the exit strategy signaled an exit at 22 pips.

-But based on the timestamps, the strategy is an "always in" robot, which means that if it exits a trade, it will reverse the position. And since there are no "whipsaws" as indicated in your records, that means there is no hard stop loss. Again this means that it is possible that although your recorded drawdown is -22 pips, it could have went all the way to -100pips floating loss before coming back to -22. Obviously this is a problem because it becomes possible to ruin the account in a single black swan event. You can be profitable for 1 year and suddenly wipe the account in 1 brexit move.

-So if the strategy doesn't use a mechanical stoploss, then it is susceptible to black swan events - which by the way is usually what kills all robots eventually.

-If the strategy uses mechanical stop losses, you would see way more whipsaws on the statement - but it is not seen in the statement.

-Which of the above 2 is it?

And finally, the only way to accept that the robot is working well is to have it run for 2 years. Just like a manual trader.

6)Estimated calculation of your compounding rate from Aug17-jan18 (180 days), I came up with the figure 1.84% per day.

-If you compound $1000 for 2 years (730days), with a compounding rate of 1.84% a day, by the end of 2 years, you would be worth $603million.

So now you can see why I'm so critical and doubtful. There are a lot of gaps that needs explaining.

This post has been edited by Emily Ratajkowski: Mar 21 2018, 02:14 PM

Mar 20 2018, 07:29 PM

Mar 20 2018, 07:29 PM

Quote

Quote

0.0411sec

0.0411sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled