QUOTE(cmk96 @ Sep 26 2019, 07:22 AM)

Demo period... They dun k... Real live account... U lose 20%... U are out... Thats y better trade on your own.

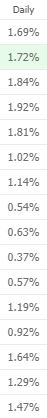

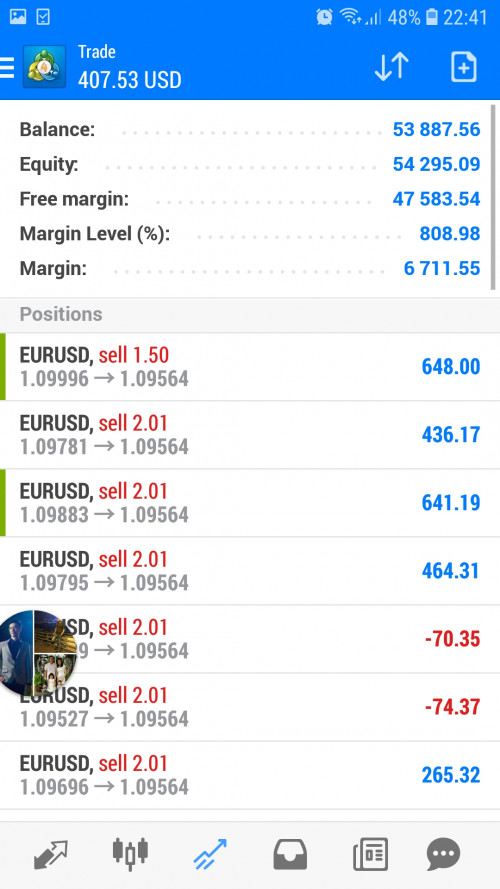

As i said earlier... Its about consistency. U can earn 2% a month... 24% a year.... Next year your account MC. How? Will prop firm still allow you to trade? Some only allow DD less than 10%..... Can you make it? There were times... I hold my positions up to 6 mths.... Prop firm allow that? Thats how i grow my account from 1400 into 6 figures.

There will be many restrictions which you need to stick to.

There is a saying... 95% of traders lose money. Trading is tough job.

Have you join any prop firm by now? Kindly share your exp.

20+% ROI is a logical target for any trader, worst case scenario you will lost 20+% per year and your account never MC if you have a good tight money management. But if that happen your system is not ready for that if keep losing why in the world you wanna trade people money if you have track records like that lol

The drawdown always your one time fees if you notice almost all on their website, if you hit the drawdown it's always the trader money not them, they not stupid enough to lose a single cent on test period or the test can be a simulator.

If you can make any account to 6 figures account, that is good, try to make again and again every year. But in my reality I need sum of money every month to support my daily living cost and I don't have a big capital to begin with. Unless you never withdraw your capital until hit the goals that maybe take time for a year or more.

Say my system on can make 18-20% per year, if I only can afford very small account like USD1000, that's is only like USD200 ROI, can I live on that? Even If I doubled my account it is not enough.

I only on the evaluation on some random remote prop firm out there, if I failed I will try it again and again.

And my point is you don't need a big 6 figures capital or aim with your own capital for that to trade this market for a living. There is plenty of option over there.

Sep 20 2019, 07:42 PM

Sep 20 2019, 07:42 PM

Quote

Quote

0.0993sec

0.0993sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled