Passive funds are not based on value investing principle, so there is a risk of bubble.

![]() Active vs. Passive funds, 2 minute video

Active vs. Passive funds, 2 minute video

![]() Active vs. Passive funds, 2 minute video

Active vs. Passive funds, 2 minute video

|

|

Aug 8 2017, 07:24 AM Aug 8 2017, 07:24 AM

Return to original view | IPv6 | Post

#1

|

Senior Member

3,815 posts Joined: Feb 2012 |

Passive funds are not based on value investing principle, so there is a risk of bubble.

|

|

|

Aug 12 2017, 07:14 AM Aug 12 2017, 07:14 AM

Return to original view | IPv6 | Post

#2

|

Senior Member

3,815 posts Joined: Feb 2012 |

QUOTE(Ask_Yip @ Aug 9 2017, 03:37 PM) ETF of which country?ETF are such that the more people invest in them, the better they perform. (Until the bubbles burst, that is.) In the US, the active/passive split is 70:30. The share of passive funds is much lower in Malaysia. |

|

|

Aug 12 2017, 10:10 PM Aug 12 2017, 10:10 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

3,815 posts Joined: Feb 2012 |

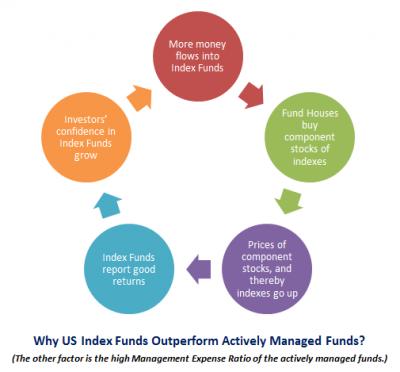

I explained in another thread before why US index funds (passive funds) outperform active funds. See attachment.

Don't expect passive funds in other countries to perform equally. This is because the 'More money flows into index funds' step is missing. And, in the U.S., this kind of loopback is creating a bubble. Attached thumbnail(s)

|

| Bump Topic Add ReplyOptions New Topic |

| Change to: |  0.0219sec 0.0219sec

0.60 0.60

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 11:21 AM |