QUOTE(wild_card_my @ Aug 8 2017, 04:28 AM)

https://www.bloomberg.com/news/videos/2017-...investing-video

In Malaysia unit trust funds are being sold as if they are the final answer to your retirement plans - at least that is the impression that I am getting from unit trust consultants who are paid handsomely as commissions from the investments made by their clients. But are there other types of investments out there which are more passive, or perhaps even more active than unit trusts?

Sure, passive-wise you can look into index-funds, these funds track a particular index; the index is invested in all the stocks that make up an index - like the S&P 500.

More active-wise, you can look into hedge-funds, but I will not talk about them too much since they are not too relevant for the average-joe reading this topic. They are aggressively managed, promises good returns, but comes with very high fees, which are paid regardless of their performances (but they get paid more as they generate higher returns for the investors). Avoid or not, up to you.

or not, up to you.

The arguments against actively-managed investment (in this case, the aforementioned unit trust funds):

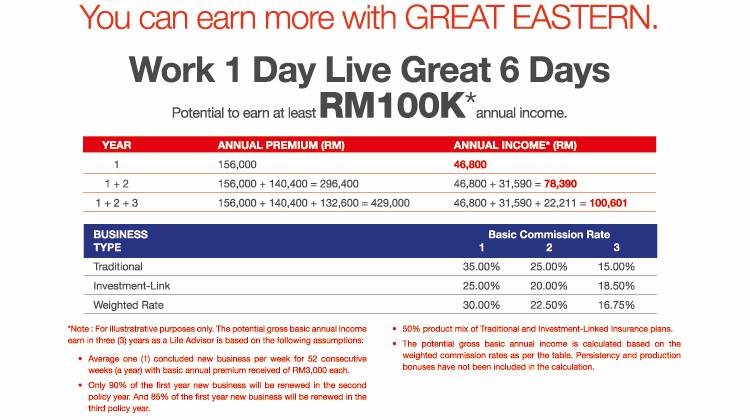

- high management fees (1 to 2.5% per annum) eating up the profits

- high agent fees also eating up your initial investments (between 5.5% to 6.5% for cash investments and 3% for EPF-withdrawal investments).

- majority of funds end up end up not beating the index in 1, 5, and even 10 years periods, as published in several studies, also quoted in the video (the high fees being quoted as a big part of the problem)

In Malaysia there is a limited number of ETFs or index funds that we can buy; you need to look overseas. You can perhaps start looking into Vanguard and other providers. I believe there are services that allow you to buy them while in Malaysia.

Disclaimer: I'm not selling anything nor am I an investment agent, I have no material interests in any of these companies/organizations.

Out of curiosity, how much do you charge for the loan and insurance services you provide to your clients? In Malaysia unit trust funds are being sold as if they are the final answer to your retirement plans - at least that is the impression that I am getting from unit trust consultants who are paid handsomely as commissions from the investments made by their clients. But are there other types of investments out there which are more passive, or perhaps even more active than unit trusts?

Sure, passive-wise you can look into index-funds, these funds track a particular index; the index is invested in all the stocks that make up an index - like the S&P 500.

More active-wise, you can look into hedge-funds, but I will not talk about them too much since they are not too relevant for the average-joe reading this topic. They are aggressively managed, promises good returns, but comes with very high fees, which are paid regardless of their performances (but they get paid more as they generate higher returns for the investors). Avoid

The arguments against actively-managed investment (in this case, the aforementioned unit trust funds):

- high management fees (1 to 2.5% per annum) eating up the profits

- high agent fees also eating up your initial investments (between 5.5% to 6.5% for cash investments and 3% for EPF-withdrawal investments).

- majority of funds end up end up not beating the index in 1, 5, and even 10 years periods, as published in several studies, also quoted in the video (the high fees being quoted as a big part of the problem)

In Malaysia there is a limited number of ETFs or index funds that we can buy; you need to look overseas. You can perhaps start looking into Vanguard and other providers. I believe there are services that allow you to buy them while in Malaysia.

Disclaimer: I'm not selling anything nor am I an investment agent, I have no material interests in any of these companies/organizations.

I am just a regular joe trying to understand the fuss about fees. I doubt the above are charity work. Every thing has a fee to pay, either built in or not. You buy a house, you pay the lawyer fee, the banker's fee, the developer's profit, the supplier's profit and so forth and like wise with everything you buy or use. Tell us who will work for free. Do you work for free?

Investing on your own make sound simple enough, read a few books and good to go, so why isn't everyone a Buffett or a Soros? Why are we still 9 to 5 kuli? In reality, it isn't that easy as you make it to be. I believe a vast majority of people don't understand UT let alone ETF or know what Vanguard is.

And likely if am I taking a loan and buying insurance, I would look for you to advise on the steps and what-to-look-fors, you wouldn't give free advice, would you? Again, what is your fee on say a 5m loan and insurance coverage for that loan?

This post has been edited by lunchtime: Aug 12 2017, 02:35 AM

Aug 12 2017, 02:33 AM

Aug 12 2017, 02:33 AM

Quote

Quote

0.0184sec

0.0184sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled