Here's some reasoning on why I don't reinvest.

BackgroundBeen holding 325MH/s for past ~1 month.

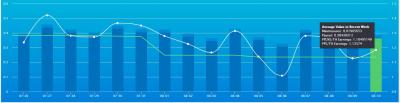

All the roi calculation are based on the

average payout over the week (the rightmost green bar in your HashNest dashboard) divided by no. of MH/s.

Effectively I get amount of LTC I get per MH/s per day.

Now the figures itself:

20th Jul: 0.001760

10th Aug: 0.001183

With the formula

FV = PV x (1 + C%) ^ D where:

FV = future value (0.001183)

PV = present value (0.001760)

C% = value change expressed in %

D = duration (20 days)

The value of C% is -1.97%.

That means I should expect my payout to decrease by 1.97% everyday over time. (this is obviously optimistic, with more miners coming in, the drop will be more pronounced)

With that I extrapolated my future payout amount:

Days = n days from now

Payout = expected payout at after n days

Value = how much value it dropped compared to 10th Aug's payout.

From here I can tell that, in about 3 months my payout will lose -83.32% of its payout amount compared to 10th August payout.

Which is frankly, good as none.

----------------------------

Ok now the logical part.

If I re-invest my payouts, my hunch tells me that I will never

break-even before the contract becomes $0/void.

I can probably build some math models to compare both but I'm lazy.

Hence my view towards this investment is, the day I determine that the payout is no longer worth it, I will liquidate all my contracts, likely with loss, unless LTC skyrockets.

And with the LTC I accumulated, I will do active trading when opportunity presents and hopefully be able to profit from that.

If you know what's a call warrant in traditional securities, imagine it's a dividend paying warrant where both the contract value and payout diminishes over time.

All these are my personal views and by no means recommendations.

Pretty sure there are plenty of things that I missed out, but let's have a healthy discussion.

Jul 11 2017, 02:16 PM

Jul 11 2017, 02:16 PM

Quote

Quote

0.1399sec

0.1399sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled