QUOTE(bbjslee @ Jul 9 2008, 03:24 PM)

hi guys, can you please help me understand how exactly Malaysian Customs charge us on importing tobacco (cigars). Last week I was charged RM395.94 for the cigars that I bought from overseas.Here's the details:

I was charged under the 2402.10.000 (tariff code) which says:

Import Rate (RM200/KG) + Sales Tax 5% + Excise Duty 20% and 150 p.u. (per unit)

How do they calculate the unit? Mine was 1526.46.. I wonder where did they dig the figure from..

The total weight was 0.45 kg (which is 450g) - it was 45 sticks of cigars.

I bought the cigars for RM686.91 (it was 2 boxes of cigars and 2 sample packs of 5 cigars).

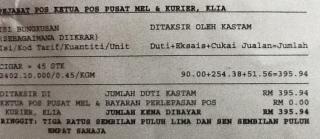

In the form, they said this:

Duti+Eksais+Cukai Jualan = Jumlah

RM90 + 254.38 +51.56 = RM395.94

by right, the excise duty is RM 137.39 (coz, 686.91 x 0.2 (which means 20%) = 137.39).. why is it 254.38??

and sales tax.. by right it should be just RM686.91 x 0.05 (which means 5%) = RM34.35, but they charge me RM51.56..

I am perplexed la.. BTW I attach the photo of the document here..

Can you guys please help?

Thanks a gee!

Attached thumbnail(s)

Mar 14 2012, 11:31 PM

Mar 14 2012, 11:31 PM

Quote

Quote 0.0528sec

0.0528sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled