QUOTE(naith @ Feb 23 2012, 07:15 AM)

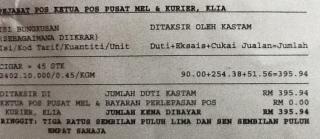

You may get tax, but note that the way to calculate whether you exceed RM 500 is slightly different. The way customs calculates whether you exceed RM 500 is as below:

value of item + freight charges + insurance

value of item = converted to RM

freight charges = based on their table, not what you paid

insurance = 1% of the converted value of the item

In my case, I ordered something from the states, which I paid RM 270 for (including shipping). But based on customs calculations, the total value came up to RM 570+, so I already exceeded the limit.

To add salt to wound, the shipper declared the item as plastic materials instead of toys, so I am being taxed RM 180+ (30% instead of 10%) for the shipment.

thats last part you could have negotiate with the officer.. 30% ouchvalue of item + freight charges + insurance

value of item = converted to RM

freight charges = based on their table, not what you paid

insurance = 1% of the converted value of the item

In my case, I ordered something from the states, which I paid RM 270 for (including shipping). But based on customs calculations, the total value came up to RM 570+, so I already exceeded the limit.

To add salt to wound, the shipper declared the item as plastic materials instead of toys, so I am being taxed RM 180+ (30% instead of 10%) for the shipment.

Added on February 23, 2012, 5:58 pm

QUOTE(DallasToler-Wade @ Feb 21 2012, 12:04 AM)

yesAdded on February 23, 2012, 5:59 pm

QUOTE(nycdist @ Feb 22 2012, 02:00 PM)

what items can or cannot import from other countries? i am looking to importing container of broken electronics like lcd, computers, handphones to malaysia to repair. will Malaysia allow Clearance and tax free? if charge tax, how much? what should avoid and do first? need your professional help.

you declare under electronic parts you'll get taxed...you declare under computer used parts you dont get taxed...

phone is a different story...i donno that story

This post has been edited by Sham903n: Feb 23 2012, 05:59 PM

Feb 23 2012, 05:56 PM

Feb 23 2012, 05:56 PM

Quote

Quote

0.0245sec

0.0245sec

0.29

0.29

6 queries

6 queries

GZIP Disabled

GZIP Disabled