Anyone one here holding through halving or just HODL?

Bitcoin and other Cryptocurrencies, Comprehensive guide on first page.

Bitcoin and other Cryptocurrencies, Comprehensive guide on first page.

|

|

May 6 2020, 08:24 PM May 6 2020, 08:24 PM

Return to original view | Post

#1

|

Senior Member

1,033 posts Joined: Dec 2009 |

Anyone one here holding through halving or just HODL?

|

|

|

|

|

|

May 7 2020, 08:27 PM May 7 2020, 08:27 PM

Return to original view | Post

#2

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

|

|

Jan 2 2021, 08:28 PM Jan 2 2021, 08:28 PM

Return to original view | Post

#3

|

Senior Member

1,033 posts Joined: Dec 2009 |

30k finally Andrew Lim liked this post

|

|

|

Feb 21 2021, 01:14 AM Feb 21 2021, 01:14 AM

Return to original view | Post

#4

|

Senior Member

1,033 posts Joined: Dec 2009 |

100k in sight finally and will probably be dependent on the ETF market.

https://markets.businessinsider.com/currenc...21-2-1030101400 QUOTE North America's first bitcoin ETF had a strong showing on its first day of trading on Thursday, with $165 million worth of shares trading on Canada's TSX exchange, according to Bloomberg data. The Purpose Bitcoin ETF (BTCC) far outstripped the usual first day performance of an exchange-traded fund. Investors traded almost 10 million shares in the Canadian dollar version of the fund, making it one of the most active securities on the TSX. The ETF above already has close to 0.5 bil. Grayscale Bitcoin Trust (GBTC) has roughly 40bil in AUM and if an ETF is approved in US then the demand is going to be something else if the current market holds. |

|

|

Apr 4 2021, 08:22 PM Apr 4 2021, 08:22 PM

Return to original view | Post

#5

|

Senior Member

1,033 posts Joined: Dec 2009 |

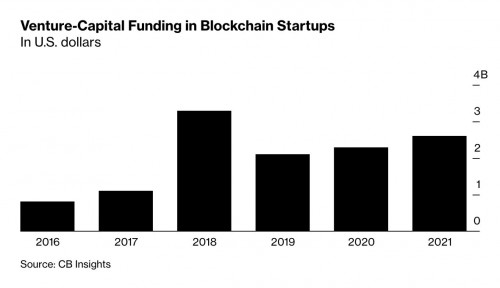

https://www.bloomberg.com/news/articles/202...-in-all-of-2020

QUOTE Venture capitalists are pouring money into cryptocurrency-related companies at the fastest clip in years. In the first quarter, 129 startups focusing on the digital technology known as blockchain raised about $2.6 billion, according to CB Insights. That’s more than in all of 2020, when they attracted $2.3 billion in 341 deals, according to the data analysis company. The increase was fueled by several large rounds for startups including crypto lender BlockFi Inc., game-maker Dapper Labs Inc. and crypto wallet provider Blockchain.com.  |

|

|

May 24 2021, 06:43 PM May 24 2021, 06:43 PM

Return to original view | Post

#6

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

|

|

|

|

|

May 25 2021, 12:35 AM May 25 2021, 12:35 AM

Return to original view | Post

#7

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

|

|

May 27 2021, 10:27 PM May 27 2021, 10:27 PM

Return to original view | Post

#8

|

Senior Member

1,033 posts Joined: Dec 2009 |

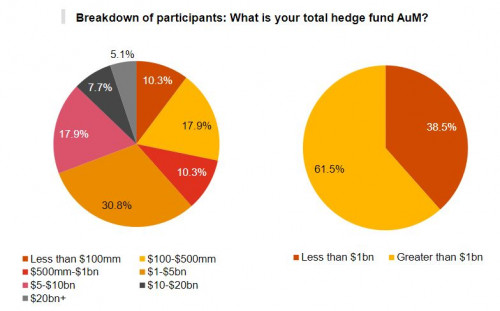

3rd Annual Global Crypto Hedge Fund Report 2021 https://www.pwc.com/gx/en/financial-service...-(may-2021).pdf QUOTE https://www.aima.org/educate/aima-research/third-annual-global-crypto-hedge-fund-report-2021.html  Carpeneer@9782 and oOoproz liked this post

|

|

|

May 31 2021, 11:54 PM May 31 2021, 11:54 PM

Return to original view | Post

#9

|

Senior Member

1,033 posts Joined: Dec 2009 |

QUOTE(xTatsuya @ May 31 2021, 05:44 PM) Sign of winter, no big price movement, no hype stories, it's gna be start of a long consolidation period. Still there but in pockets though.Even this forum is getting more quiet. Plus Bitcoin 2021 conference is this week.... Bitcoin Volatility is also still at elevated levels. Sentiment is also still quite strong as long as takes below still exist  https://twitter.com/APompliano/status/1398402405923016710 |

|

|

Jun 8 2021, 10:30 PM Jun 8 2021, 10:30 PM

Return to original view | Post

#10

|

Senior Member

1,033 posts Joined: Dec 2009 |

QUOTE(Patent @ Jun 8 2021, 10:49 AM) Straight forward if he bought all with cash but MSTR didn't.Second convert is quite OTM and is likely at the distressed levels as the chart below  Those convert bond maturities are still years away so that is a positive but MSTR share price needs to stabilize and if not then there a number unpredictable outcomes that are possible. ChAOoz liked this post

|

|

|

Jun 9 2021, 09:03 PM Jun 9 2021, 09:03 PM

Return to original view | Post

#11

|

Senior Member

1,033 posts Joined: Dec 2009 |

QUOTE(ChAOoz @ Jun 8 2021, 11:45 PM) Well just saw he is doing a third offering and this time its not a convertible note anymore. Well it is free money for him. Also i wonders what are the terms of the 1st and 2nd conversion. No such things as free money in the market i guess. If it works out they will call him a genius and if it doesn't then he can go back to his core business. Third offering is even more senior compared to the two converts so there is that. A lot of eyes are on this right now so games will be played both ways for sure .... Terms for first two notes QUOTE The notes are unsecured, senior obligations of MicroStrategy, and bear interest at a rate of 0.750% per annum, payable semi-annually in arrears on June 15 and December 15 of each year, beginning on June 15, 2021. The notes will mature on December 15, 2025, unless earlier repurchased, redeemed or converted in accordance with their terms. Subject to certain conditions, on or after December 20, 2023, MicroStrategy may redeem for cash all or a portion of the notes at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date, if the last reported sale price of MicroStrategy’s class A common stock has been at least 130% of the conversion price then in effect for a specified period of time ending on the trading day immediately before the date the notice of redemption is sent. Holders of notes may require MicroStrategy to repurchase their notes upon the occurrence of certain events that constitute a fundamental change under the indenture governing the notes at a repurchase price equal to 100% of the principal amount of the notes to be repurchased, plus any accrued and unpaid interest to, but excluding, the date of repurchase. In connection with certain corporate events or if MicroStrategy calls any note for redemption, it will, under certain circumstances, be required to increase the conversion rate for holders who elect to convert their notes in connection with such corporate event or notice of redemption. The conversion rate for the notes is initially 2.5126 shares of MicroStrategy class A common stock per $1,000 principal amount of notes, which is equivalent to an initial conversion price of approximately $397.99 per share. This represents a premium of approximately 37.5% over the last reported sale price of $289.45 per share of MicroStrategy class A common stock on The Nasdaq Global Select Market on December 8, 2020. The conversion rate is subject to adjustment upon the occurrence of certain events. QUOTE The notes are unsecured, senior obligations of MicroStrategy. The notes do not bear regular interest, and the principal amount of the notes does not accrete. The notes will mature on February 15, 2027, unless earlier repurchased, redeemed or converted in accordance with their terms. The notes are convertible into cash, shares of MicroStrategy’s class A common stock, or a combination of cash and shares of MicroStrategy’s class A common stock, at MicroStrategy’s election. Prior to August 15, 2026, the notes are convertible only upon the occurrence of certain events and during certain periods, and thereafter, at any time until the second scheduled trading day immediately preceding the maturity date. The conversion rate for the notes is initially 0.6981 shares of MicroStrategy’s class A common stock per $1,000 principal amount of notes, which is equivalent to an initial conversion price of approximately $1,432.46 per share. This represents a premium of approximately 50% over the last reported sale price of $955.00 per share of MicroStrategy’s class A common stock on The Nasdaq Global Select Market on February 16, 2021. The conversion rate is subject to adjustment upon the occurrence of certain events. Amaru liked this post

|

|

|

Jun 13 2021, 11:09 PM Jun 13 2021, 11:09 PM

Return to original view | Post

#12

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

|

|

Jun 15 2021, 08:20 AM Jun 15 2021, 08:20 AM

Return to original view | Post

#13

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

|

|

|

|

|

Jun 23 2021, 09:12 PM Jun 23 2021, 09:12 PM

Return to original view | Post

#14

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

|

|

Jun 27 2021, 11:14 PM Jun 27 2021, 11:14 PM

Return to original view | Post

#15

|

Senior Member

1,033 posts Joined: Dec 2009 |

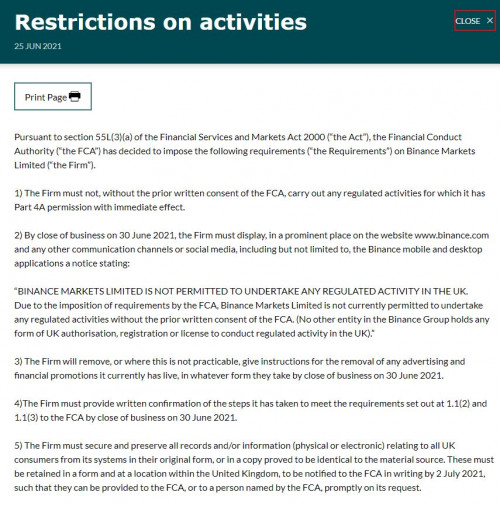

https://register.fca.org.uk/s/firm?id=001b0...do-restrictions

U.K. Financial Regulator Bars Crypto Exchange Binance https://www.bloomberg.com/news/articles/202...xchange-binance QUOTE Britain’s Financial Conduct Authority issued a consumer warning against Binance Markets Ltd., banning the cryptocurrency exchange from undertaking any regulated activity in the country. Binance has until Wednesday evening to confirm that it has removed all advertising and financial promotions, according to the FCA’s register. The exchange must also make clear on its website, social media channels and all other communications that it is no longer permitted to operate in the U.K. Binance, which announced the acquisition of an FCA-regulated entity last June along with plans for the launch of Binance.UK, won’t be able to resume U.K. operations without prior written consent. A Binance representative didn’t immediately have comment when reached on Sunday. The Financial Times reported the news earlier. The move extends a regulatory crackdown on the cryptocurrency sector amid concerns about its potential involvement in money laundering and fraud. Binance withdrew an application related to the 5MLD -- an anti-laundering directive -- on May 17 following “intensive engagement from the FCA,” according to the watchdog, which said the action had been in train for some time. “A significantly high number of cryptoasset businesses are not meeting the required standards under the money laundering regulations, which has resulted in an unprecedented number of businesses withdrawing their applications,” an FCA spokesperson said. Of the firms assessed, more than 90% have withdrawn applications following the FCA’s intervention. Binance is being probed by several agencies in the U.S., Bloomberg News reported in recent months. And Japan’s Financial Services Agency issued a warning against Binance recently, saying it offered crypto services without registration. |

|

|

Jun 29 2021, 08:55 PM Jun 29 2021, 08:55 PM

Return to original view | Post

#16

|

Senior Member

1,033 posts Joined: Dec 2009 |

Announcing Compound Treasury, for Businesses & Institutions

https://medium.com/compound-finance/announc...ns-83d4484fb82e QUOTE Today, we’re proud to announce Compound Treasury, designed for non-crypto native businesses and financial institutions to access the benefits of the Compound protocol. High-Yield Interest Powered by USDC Working with Fireblocks and Circle, Compound Treasury has built a product and flow-of-funds that enables Neobanks, Fintech startups, and other large holders of U.S. Dollars to access the interest rates available in the USDC market of the Compound protocol, while abstracting away protocol-related complexity including private key management, crypto-to-fiat conversion, and interest rate volatility. The customer experience is simple: Wire U.S. Dollars to your Compound Treasury Account, and begin earning a guaranteed, fixed interest rate of 4% per year — orders of magnitude higher than the average U.S. Dollar Savings Account. Fund and withdraw from your account anytime, with a 24-hour turnaround. Low minimums, no maximums, and no fixed terms or durations. Detailed, auditable balance statements available monthly and on-demand. Compound Treasury has been built to the needs of financial institutions, following many months of customer and regulatory compliance research. We’ve begun onboarding customers, and plan to expand access to Treasury Accounts significantly over the coming months. Our vision is that Compound Treasury becomes the bridge for non-crypto financial institutions to deliver the core benefits of DeFi to the next billion users, and we are extremely excited to work with our customers to navigate this enormous opportunity. |

|

|

Jul 6 2021, 11:24 PM Jul 6 2021, 11:24 PM

Return to original view | Post

#17

|

Senior Member

1,033 posts Joined: Dec 2009 |

Aave price hits 3-week high as ‘Aave Pro’ debuts for institutional lending

https://cointelegraph.com/news/aave-price-h...utional-lending QUOTE Dubbed as Aave Pro, the platform expects to become a “permissioned liquidity protocol” by offering institutions, corporates and fintech clients access to decentralized finance (DeFi). That said, it would follow strict regulations while onboarding participants, ensuring that their Ethereum addresses are safe-listed following a thorough Know Your Customer process. “We will have different kinds of permissioned markets so that DeFi will be more layered and tailored to specific needs,” Stani Kulechov, founder and CEO of Aave, said during the online discussion event “Next Steps for Institutional DeFi.” Aave Pro will go live in July with liquidity pools of Bitcoin (BTC), Ether (ETH), USD Coin (USDC) and its own token, Aave. |

|

|

Jul 30 2021, 05:46 PM Jul 30 2021, 05:46 PM

Return to original view | Post

#18

|

Senior Member

1,033 posts Joined: Dec 2009 |

QUOTE(jack2 @ Jul 30 2021, 05:30 PM) https://twitter.com/binance/status/1421033047886123008QUOTE We're continually evaluating our products and working with our partners to meet our users’ needs. Today we’re announcing that we plan to wind down our derivatives products offerings across the European region, commencing with the Netherlands, Germany, and Italy. QUOTE(andrekua2 @ Jul 30 2021, 05:34 PM) How would they do that? LoL... You guys just love to blurt out nonsense. They can only control the money flow but can't do anything against binance since it's not registered here. At most block IP. They can do what they do to US users.Force close and ask them to move to Binance US. Remains to be seen what they do though. This post has been edited by zacknistelrooy: Jul 30 2021, 05:47 PM |

|

|

Aug 5 2021, 11:12 PM Aug 5 2021, 11:12 PM

Return to original view | Post

#19

|

Senior Member

1,033 posts Joined: Dec 2009 |

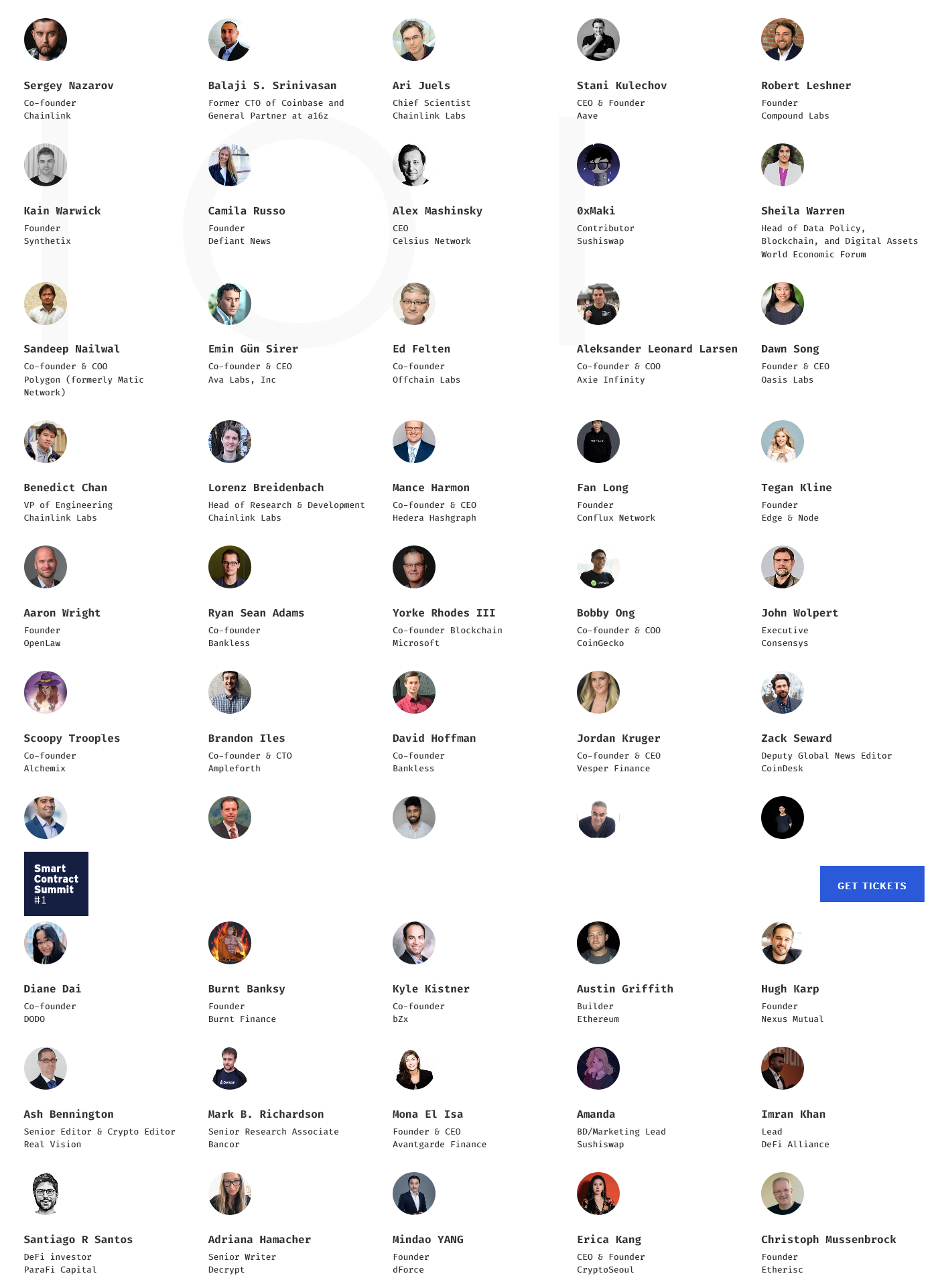

For those interested in Smart Contract Summit Hosted by Chainlink QUOTE https://hopin.com/events/smart-contract-summit-1#top https://www.smartcontractsummit.io/  Amaru liked this post

|

|

|

Aug 14 2021, 10:16 PM Aug 14 2021, 10:16 PM

Return to original view | Post

#20

|

Senior Member

1,033 posts Joined: Dec 2009 |

|

| Change to: |  0.0750sec 0.0750sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 01:45 PM |