Bitcoin and other Cryptocurrencies, Comprehensive guide on first page.

Bitcoin and other Cryptocurrencies, Comprehensive guide on first page.

|

|

Nov 26 2020, 07:58 PM Nov 26 2020, 07:58 PM

Return to original view | Post

#41

|

All Stars

12,573 posts Joined: Nov 2008 |

tanariz and Andrew Lim liked this post

|

|

|

|

|

|

Dec 8 2020, 09:44 AM Dec 8 2020, 09:44 AM

Return to original view | Post

#42

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(laceruffles91 @ Dec 8 2020, 01:02 AM) Wow, in that case their FD 7-8% is not worth it because Bitcoin’s price could go higher in the future! Why would others put in FD then? 🤔 You also used the word "could" go higher. If everyone had a magic crystal ball, everyone would have bought crypto.No different from other investments like stocks, gold, commodities. Prices "could" go up but they "could" go down as well. But one thing for sure, if I put RM1,000 into a savings account or FD in the bank, tomorrow it would still be RM1,000. But bitcoin or Ethereum the price could drop 10% or rise 20% |

|

|

Feb 4 2021, 11:45 PM Feb 4 2021, 11:45 PM

Return to original view | Post

#43

|

All Stars

12,573 posts Joined: Nov 2008 |

|

|

|

Feb 7 2021, 08:34 PM Feb 7 2021, 08:34 PM

Return to original view | Post

#44

|

All Stars

12,573 posts Joined: Nov 2008 |

|

|

|

Apr 8 2021, 10:47 PM Apr 8 2021, 10:47 PM

Return to original view | Post

#45

|

All Stars

12,573 posts Joined: Nov 2008 |

|

|

|

Apr 9 2021, 01:13 PM Apr 9 2021, 01:13 PM

Return to original view | Post

#46

|

All Stars

12,573 posts Joined: Nov 2008 |

|

|

|

|

|

|

Apr 10 2021, 11:44 PM Apr 10 2021, 11:44 PM

Return to original view | Post

#47

|

All Stars

12,573 posts Joined: Nov 2008 |

|

|

|

May 1 2021, 12:17 PM May 1 2021, 12:17 PM

Return to original view | Post

#48

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(andrekua2 @ May 1 2021, 01:19 AM) Well, I'm wondering if one should buy bitcoin. Most likely you stand to gain more from buying alts like defi or even bsc shitcoins. My advice would be very different if bitcoin is currently at $4,000 in March 2020 but now btc is at $58,000 so that's something to think about If you had 1k budget (like me), you can only buy a limited amount of bitcoin. Or you can spent a significantly smaller amount to trade bitcoin future and could stand to gain more from it. I really don't see the purpose for bitcoin other than money laundering or value preservation. Bitcoin I think might hit $100-200k, maybe even 300k during this bull run peak which I think will be end of this year or Jan 2022. And of course the bear market will be equally glorious; 80-90% correction which may very well last 2-3 years like the 2018-2020 bear market due to the involvement of institutions. inb4/institutionsareourfriends Trading on the other hand is a totally different ball game. 99% never became profitable traders even after a number of years This post has been edited by -kytz-: May 1 2021, 12:35 PM |

|

|

Jun 26 2021, 02:45 PM Jun 26 2021, 02:45 PM

Return to original view | Post

#49

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(Moogle Stiltzkin @ Jun 26 2021, 01:30 PM) this? You can try tradingview for the ultimate charting experience https://coin360.com/ i mostly look at this (u can change the time frame e.g. hourly, 4 hour, a week, month). i added lines top and bot so i get an idea when something up or down. then added sound alerts when it makes these movement so i don't have to look all the time  with exodus wallet u can check the price at the time  for example the other day i noticed the price for eth dropped around 5am in morning, then bounced higher in the afternoon. or is there a better way of viewing this? |

|

|

Jun 30 2021, 07:22 PM Jun 30 2021, 07:22 PM

Return to original view | Post

#50

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(Amaru @ Jun 30 2021, 01:15 PM) Made $600 scalping ETH and BTC. Nice one. Not much to a few of you I'm sure, but I'm happy to get any profit during this bear market. Any profits in this bear market and the current choppy range is a bonus. Trade less, preserve $ portfolio and focus on accumulating cheap crypto in the next half/one year or so |

|

|

Jul 25 2021, 08:08 PM Jul 25 2021, 08:08 PM

Return to original view | Post

#51

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(stormseeker92 @ Jul 25 2021, 04:57 PM) Don't take it literally though, have to see at which stage the market is currently at.You don't want to be buying dips during the 1st month of a bear market when there could be 7-8 more bloody months to come just like you don't want to be selling during the 1st month of a bull market. (A full blown bear market usually corrects 80%+ based on past history) But then again, if you're very loaded and can stomach the downside, you can just buy everyday regardless of price. This post has been edited by -kytz-: Jul 25 2021, 08:12 PM |

|

|

Nov 10 2021, 11:38 AM Nov 10 2021, 11:38 AM

Return to original view | Post

#52

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(Win Win Inspiration @ Nov 10 2021, 09:39 AM) Hope to get opinions and insights on the following topics: 1. No one knows for sure but looking back at price history, the major corrections in 2013 and 2018 started in January, however the covid drop was in March 2020.1. In what range of time that the crpyto space will be reaching the ATH of this cycle? End of 2021 or Q1 2022? 2. By the time that the crypto space reaching the ATH in this cycle, will you take profit? If yes, but how much? The entire portfolio, or a portion of it? If profit-taking from a portion of your portfolio, how much is the percentage you planned to? 3. How deep will the correction be after the ATH of this cycle? Will it be like the 2017’s patterns, or, at a bigger/small extent? 4. If we stock-in at this point of time (now), is it a FOMO behavior, or still in time? Thank you all! 2. Thing is, you won't know whether it is ATH until it is all over. It is really anyone's guess. When BTC hits $100k, there will be people calling for $200k, $500k and even $1 million. Personally for me, once BTC hits a certain price like $100k, I'll might be selling a portion of my crypto on the way up to let's say $200-250k if it ever gets there. I won't be holding through the bear market lol. But will certainly re-evaluate when price goes higher and trust my own TA. (Hint: 2013 and 2018 top is when RSI on the daily hit 95 so I'm kinda expecting something similar for this bull market run) 3. I'm expecting 70-90% correction but it could be much less with more institutional interest going on now 4. Depends on where you think BTC is at which phase right now... the beginning of a bull run? The middle of it or at the end of a bull run? No one knows for sure so you need to have your own conviction. Always remember there is a bull market and there is the bear market. |

|

|

Apr 15 2023, 11:07 AM Apr 15 2023, 11:07 AM

Return to original view | IPv6 | Post

#53

|

All Stars

12,573 posts Joined: Nov 2008 |

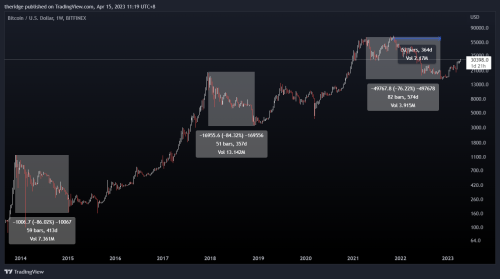

QUOTE(Nutbeater69 @ Mar 28 2023, 05:55 AM) How sure are you that we going back to 10-20k? If this is a repeat of 2019 cycle, u won’t be seeing 10k QUOTE(doraemonkiller @ Apr 1 2023, 08:53 PM) QUOTE(Nutbeater69 @ Apr 2 2023, 03:53 AM) This is my simple take on the current price (advice for the holders): With the last 2 bear markets in 2014/2015 posting a 86% drop and in 2018 a 84% drop from the top, the current bottom of roughly $15k is already a 76% drop, what are the odds that this is the bottom for this market cycle? I would say the odds are high when you also look at the number of days spent in a bear market currently 364-574 days (depending on where you consider the first or 2nd top as the start of the bear market). Other technicals such as daily RSI hitting 90, last 2 bear market bottoms trade below 0.786 fib levels and death/golden cross on the weekly EMAs helped in my conviction to enter the market mid-Jan 2023. It is very risky waiting for much lower like 10-15k when you could miss out on the MUCH BIGGER move totally. Eg: Waiting for 10% lower but miss the 50% upwards move. Been there done that before. Learning how to change bias when new data (eg: price breaking above high time frame resistance) comes in also greatly helps in making better decisions. This post has been edited by -kytz-: Apr 15 2023, 11:19 AM Amaru liked this post

|

|

|

|

|

|

Nov 25 2023, 07:50 PM Nov 25 2023, 07:50 PM

Return to original view | IPv6 | Post

#54

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(ChAOoz @ Nov 25 2023, 12:27 PM) Cannot short crypto lately, all trades going short are losing trade. Even biggest exchange proven to break laws is also a bullish signal. It's not about "betting against cryptoverse" but more of the timing of your trades.Guess I never learn my lesson betting against cryptoverse, should have trade and think like a degen. $BTC price movement currently is clearly on an uptrend on HTF, so you really want to favour longs instead of shorts. Don't fight the trend unless you are very confident. Bear market is probably over already and it is very likely a great time to position to ride this wave up. Also later on, once you see people and celebrities start talking about crypto/NFT again on social media tiktok, youtube, insta, or when WeAreDegens starts posting here again, you know we are in full bulltard mode. WeAreDegens liked this post

|

|

|

Mar 6 2024, 12:52 AM Mar 6 2024, 12:52 AM

Return to original view | IPv6 | Post

#55

|

All Stars

12,573 posts Joined: Nov 2008 |

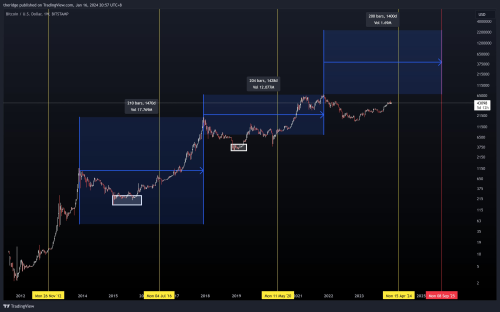

Normal for $BTC to consolidate around/below ATH levels (eg: $60-69k level) before continuing the uptrend.

3Day candles  One thing this cycle did differently is $BTC hitting ATH before halving which is quite swift. I'm thinking this cycle might be shorter than previous ones so might have to revise the target for 2025 top around Aug/Sept 2025, which was based on the duration of 1400-ish days between each cycle's ATHs:  This post has been edited by -kytz-: Mar 6 2024, 12:56 AM |

|

|

Mar 16 2024, 11:31 AM Mar 16 2024, 11:31 AM

Return to original view | IPv6 | Post

#56

|

All Stars

12,573 posts Joined: Nov 2008 |

How to position mentally in a bull market as an investor? Just my 2 cents:

- Dips for buying and pumps are for buying also - Always expect retracements to be shallower than deeper - Trade less, hodl longer - Throw away bear mentality, big green candles show strength in momentum and not an opportunity to sell - (For traders) High RSI levels and high greed index is absolutely normal in a bullish environment. In fact this only shows strong buying momentum - Expect bearish patterns (HNS) or bearish divergences to fail more often than not - Stop looking for bearish patterns and start looking for bullish patterns. - Stop rotating your majors/alts unless you know what you are doing. - Lastly, RESPECT THE PUMP This post has been edited by -kytz-: Mar 16 2024, 11:53 AM |

|

|

Mar 17 2024, 01:00 PM Mar 17 2024, 01:00 PM

Return to original view | IPv6 | Post

#57

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(mois @ Mar 16 2024, 07:39 PM)  Found the cup and handle pattern. Except the handle havent form Oh ya. Before you say bearish divergences often fail, make sure you really understand what is divergence. Price action can be faked by whales, but they cannot hide the momentum they left behind. "Expect bearish patterns (HNS) to fail more often than not or expect bearish divergences to "not play out" in Price Action because indicators can quickly shift trends (like a trend of lower high RSI can stop and then start producing higher highs" I'll give a few examples on RSI below: Hidden bullish divergence on the 4H: Higher Lows on Price but Lower lows on RSI..... but what happens next is price just moving sideways  Bearish divergence on the 4H: Higher highs on Price but lower Highs on RSI but what happens next is price going up  Happy to hear your thoughts on the above and do you feel these divergences translate into "meaningful" price action in lower timeframes such as 4H or in higher time frames like 1D or 1W? This post has been edited by -kytz-: Mar 18 2024, 11:29 AM |

|

|

Mar 17 2024, 04:58 PM Mar 17 2024, 04:58 PM

Return to original view | IPv6 | Post

#58

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(mois @ Mar 17 2024, 02:00 PM) I use MACD, this is the 4H timeframe. I normally only use 4H to spot hidden divergence. Make sure you use cloud & support resistance also. Thanks for sharing bro» Click to show Spoiler - click again to hide... « Btc weekly break above cloud for the first time since 2020. I wouldnt sell that position after btc break above 32k super major resistance. QUOTE(Amaru @ Mar 17 2024, 03:03 PM) Sold half my crypto yesterday for profits. PTSD is strong in you bro but to be fair, it is never a bad thing to take profits and I am glad you made good money ya Just in case this dump ends up like 2021-2022 crash after bullrun and wait another 3 years to recover. BTC ETFs are a huge deal, you can already see the enormous inflows from tradfi and I will definitely not underestimate it. BTC is still adhering to the "4 year cycle" and we are in a bull market until proven otherwise. Amaru liked this post

|

|

|

Mar 21 2024, 03:31 PM Mar 21 2024, 03:31 PM

Return to original view | IPv6 | Post

#59

|

All Stars

12,573 posts Joined: Nov 2008 |

|

|

|

Mar 26 2024, 10:11 AM Mar 26 2024, 10:11 AM

Return to original view | IPv6 | Post

#60

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(-kytz- @ Mar 16 2024, 11:31 AM) How to position mentally in a bull market as an investor? Just my 2 cents: - Dips for buying and pumps are for buying also ✅- Dips for buying and pumps are for buying also - Always expect retracements to be shallower than deeper - Trade less, hodl longer - Throw away bear mentality, big green candles show strength in momentum and not an opportunity to sell - (For traders) High RSI levels and high greed index is absolutely normal in a bullish environment. In fact this only shows strong buying momentum - Expect bearish patterns (HNS) or bearish divergences to fail more often than not - Stop looking for bearish patterns and start looking for bullish patterns. - Stop rotating your majors/alts unless you know what you are doing. - Lastly, RESPECT THE PUMP - Always expect retracements to be shallower than deeper ✅ Think the correction is over... 18% retracement very consistent multiple previous retracements. IMO 68-70k is key level for BTC to reclaim and flip previous resistance to support for higher upside.   |

| Change to: |  0.1106sec 0.1106sec

0.42 0.42

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 05:54 PM |